Textile & garment sector to pass through headwinds

Although Vietnam's textile and garment sector faced many difficulties and challenges, it would pass through headwinds in the coming time, said VNDirect.

For 9M21, aggregated revenue of listed textile and garment companies increased slightly 1.4% YoY. Photo: Quoc Tuan

Covid-19 lockdown shadow

Based on VNDirect’s estimate, 3Q21 aggregated revenue of listed textile and garment companies decreased 4.8% YoY under the impact of Covid-19 stricter lockdown during July- September. Due to the implementation of directive 16 of the Government, most of the Southern garment companies ran at 50%-60% capacity in 3Q21. Thus, sector net profit grew 1.8% YoY in 3Q21, lower than that of 141.1% YoY in 2Q21.

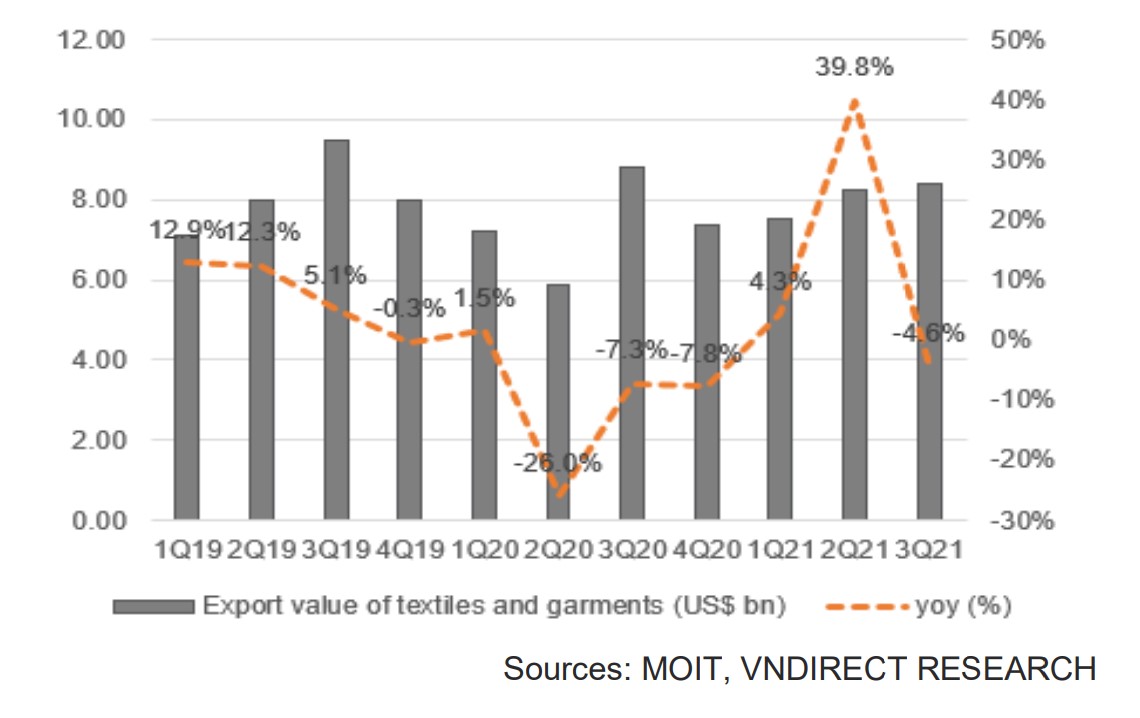

For 9M21, aggregated revenue of listed textile and garment companies increased slightly 1.4% YoY. Yarn manufacturers such as STK, ADS posted strong revenue growths in 9M21 with 29.2% YoY and 17.4% YoY, respectively, thanks to the low base in 3Q20 and taking advantage of soaring in yarn price in 3Q21 (20.8% YoY) by the depletion of yarn inventories in China. 9M21 net profit accelerated 63.2% YoY and even 12.1% higher than that of 9M19.

VNDirect sees gross margin improvement across the textile and garment sector in 9M21. To be specified, STK's gross margin inched up 6.4% pts YoY to 19.4% in 9M21 thanks to a larger contribution with higher-margin recycled yarn (56% of 9M21 revenue vs 38% of 9M20). VGT's GPM in 9M21 widened 4.5% pts YoY on the back of the larger contribution from yarn which delivered a higher margin. Whereas MSH's GPM in 9M21 increased 1.4% pts YoY as FOB orders are shifted from Myanmar and Southern companies.

On the other hand, the GPM of TCM and MNB softened 3.0% pts YoY in 9M21 due to 1) increasing "3-on-site" and Covid-19 test cost for labor and 2) lack of gauze mask and anti-virus fabric order.

Demand surge in U.S and E.U

The U.S. and E.U. consumers have shown a strong pent-up demand after lockdown. According to the Bureau of Labor Statistics (BLS), CPI for apparel advanced 3.4% YoY and 4.3% YoY in Sep-21 and Oct-21, respectively. Nearly half of the U.S. population has been vaccinated against COVID-19, allowing Americans to buy personal goods directly in the shop, travel, and attend sporting events. As a result, the U.S.'s T&G import turnover in 9M21 increased by 26.9% YoY to US$82.2bn, in which import turnover for apparel reached US$58.5bn (24.5% YoY).

Whereas, E.U.'s CPI for clothing and accessories also rose 3.6% and 1.7% YoY in Aug-21 and Sep-21. VNDirect expects the outlook of the Vietnam T&G industry in 2022 is followed by the recovery of the U.S. and. E.U. T&G industry. The International Monetary Fund (IMF) and the World Bank (W.B.) forecast global GDP growth to achieve 4.9% in 2022F, and world textile demand in 2022F will return to 2019 levels, reaching about US$740bn. Moreover, VITAS forecast Vietnam T&G export turnover to achieve US$38bn (8,5% YoY) and US$43bn (13.1% YoY).

Impacts from the anti-dumping tax

In 3Q21, local yarn manufacturers cooperated with a consulting company and worked with the Vietnam Trade Remedies Administration about the antidumping case for polyester filament yarn products made from Vietnam, China, India, Indonesia, and Malaysia. Initially, the Ministry of Industry and Trade of Vietnam (MOIT) has applied the preliminary anti-dumping tax that has been applied since Sep-21, then the official tax rate was announced on 13 Oct 21. According to the decision of the MOIT, most Chinese manufacturers will face an anti-dumping duty of 17.45%. While India, Indonesia, and Malaysia yarn manufacturers will be subjected to 54.9%, 21.9%, and 21.3%, respectively.

VNDirect thinks that the main target of the anti-dumping tax was China, Vietnam’s main recycled yarn import country. In 1H21, the amount of polyester yarn imported from China reached 156,500 tons, accounting for 60% of the total imported polyester yarn, of which 20,000 tons are recycled yarn.

“Investors should keep eyes on yarn polyester manufacturers such as STK. According to STK’s management, imported yarns ASP from China in 1H21 was 10-12% lower than ASP of STK, respectively. We expect the anti-dumping tax to support STK to increase market share in the domestic market and improve the GPM in FY22-23F”, VNDirect said.