Textile and garment sector: Leverage from EVFTA

Despite some difficulties, Vietnam's textile and apparel sector may see improvement in 2Q23 as a result of the EVFTA.

Construction and expansion projects of textile and garment firms have increased the manufacturing capacity of textile and apparel companies' plants by 15% to 30%.

Brighter outlook

Mr. Nguyen Duc Hao, analyst at VNDirect thinks that textile firms are increasing their capacity in order to meet the demand in the US and European markets, which is anticipated to increase in 2Q23F. Construction and expansion projects have increased the manufacturing capacity of textile and apparel companies' plants by 15% to 30%.

"When new factories are finished and placed into operation at 80-85% capacity, we anticipate that 2023 will see substantial profit growth for large firms like STK, MSH, and HSM. When the Unitex project is finished and marketed in 4Q23F, STK and MSH are anticipated to record good growth in FY23F, and the SH10 factory is anticipated to operate at 80% capacity in FY23F, according to Mr. Nguyen Duc Hao.

Meanwhile, "quick fashion" is under attack by European regulators. By 2030, all textiles sold in the EU are expected to be long-lasting, recyclable, largely made of recycled polyester yarn, free of dangerous chemicals, and produced with consideration for human rights and the environment. According to Textile Exchange, the market for recycled yarn was estimated to be worth US$5.9 billion in 2025F, or 45% of the world's demand for yarn. Mr. Nguyen Duc Hao emphasized, "We believe that the huge recycled yarn like STK will benefit from this trend”, said Mr. Hao.

According to Mr. Nguyen Duc Hao, the outlook for the textile and apparel sector would be better in 2Q23 because, as a result of the EVFTA, the export duty on textile and apparel items to the EU market will be cut in 2023. As a result, in 2023, the export tax on clothing categories B3, B5, and B7 will be reduced by 2% to 4%. Additionally, according to projections from the European Commission, inflation in the Eurozone would peak at 8.3% in 2022 before declining to 4.3% in 2023.

"We consider lower inflation to represent the anticipated 2023 shopping demand for fashion items. We therefore anticipate that some textile and apparel companies, like MSH, M10, VGG, and TNG, who export suits, shirts, pants, and skirts to Europe, will gain from the EVFTA”, said Mr. Nguyen Duc Hao.

Is this time for bottom-fishing?

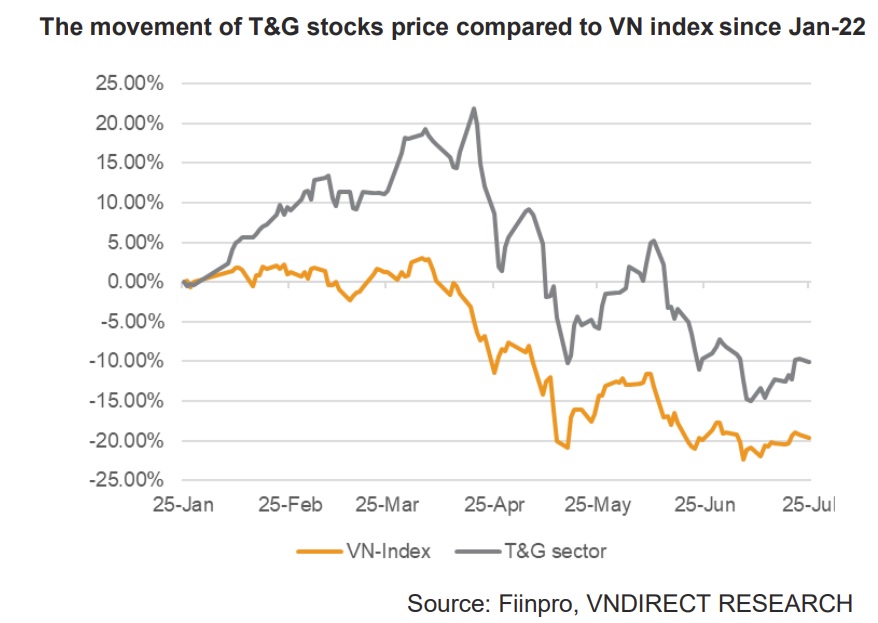

Following the market downturn, shares of textile and apparel companies have fallen by around 30.5% year to date and are currently trading at an average TTM PE of 11x. According to Mr. Nguyen Duc Hao, the future of the textile and apparel industries depends on the ability to keep inflation under control in significant export markets like the US and EU. Currently, export markets account for 85% of textile and apparel industries' income, with the US and EU accounting for 61% of those markets.

Although the value of companies in the textile and apparel industries appears to be cheaper presently, VNDirect believes that it is still not favorable. As a result, it advises neutral for stocks of textile and apparel.

The price of shipping 40-foot containers has climbed from US$1,500 in July 19 to roughly US$8,850 in March 2022, a six-fold increase in just four years. Mr. Nguyen Duc Hao predicted that logistics costs will stay high (US$7000/40ft containers) in 2022 despite the fact that shipping costs have shown symptoms of cooling off in April 2022 (-10% vs. Mar-22). This is because of the current high level of oil price spike. Greater than anticipated logistic costs could negatively impact the gross margin of clothing manufacturers with many free employees (FOB). The demand for textile items will also decline due to longer-than-expected inflation in Vietnam's primary export markets.