Textile and garment sector: More challenges ahead

Although the value of textile and apparel exports rose 17.8% year over year in 2Q22, this industry still has additional obstacles to overcome.

The combined revenue of publicly traded textile and apparel companies increased by 22.4% yoy in 2Q22, a slower rate than the 10.2% witnessed in 1Q22.

>> Textile and garment sector: Gross margin is expected to recover in 4Q22

Thanks to robust demand from both the US and EU markets, the value of textile and apparel exports climbed 17.8% yoy in 2Q22, bringing the pace for the first half of the year to 21.6% yoy. Following this pattern, the combined revenue of publicly traded textile and apparel companies increased by 22.4% yoy in 2Q22, a slower rate than the 10.2% witnessed in 1Q22. As a result of rising input material prices, gross margin in 2Q22 decreased overall by 1.1% points year over year (cotton, polyester). Sector net profit increased by 32.0% yoy for 6M22 and by 19.5% yoy in 2Q22.

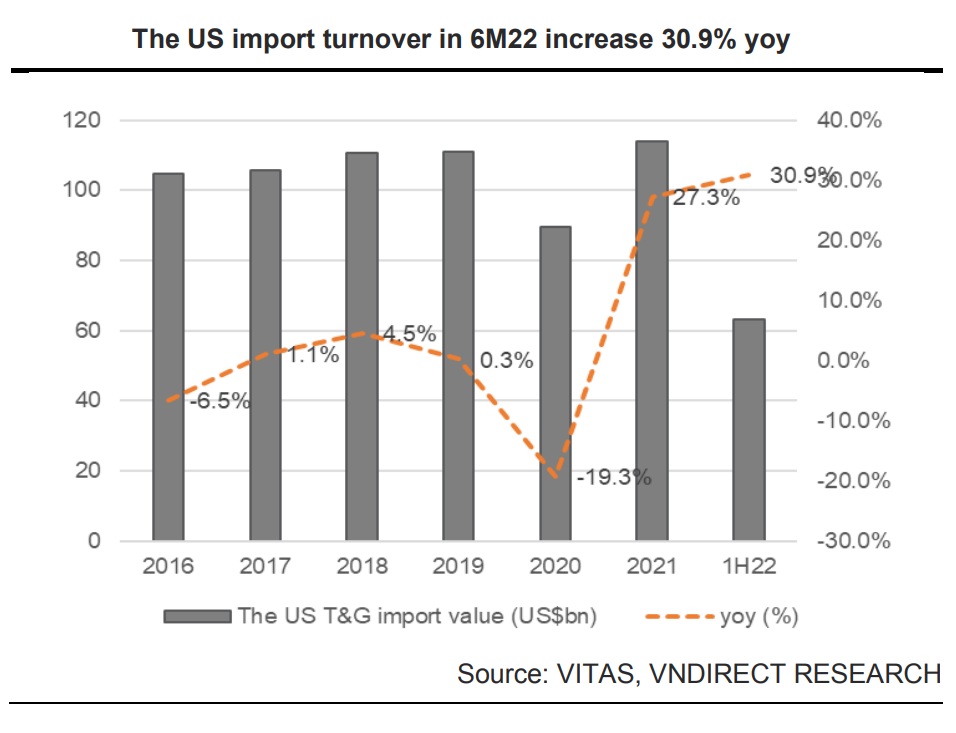

After lockdown, the US has demonstrated a significant pent-up demand. Due to Americans going back to work, demand for office supplies like shirts and vests is increasing. As a result, the value of US textile and apparel imports in 1H22 increased 30.9% year over year to US$66.3 billion.

However, Mr. Nguyen Duc Hao, an analyst at VNDirect, believes that high inflation may cause the US demand for textiles and apparel to decline in the second half of 22. Despite dropping from 9.1% in June to 8.5% in July, consumer inflation in the US is still high compared to previous years.

"We anticipate a decline in demand for premium clothing in the second half of 22 for items like vests, shirts, and T-shirts produced from cotton and recycled yarn (which cost more). The management of clothing companies claims that due to high inventory levels and pressure from inflation, US clients have reduced the pre-order period from six months to three months. Large textile and apparel companies like TCM, STK, and ADS had full orders for the third quarter of this year, but 4th quarter orders have stalled due to inflationary fears”, said Mr. Nguyen Duc Hao.

Additionally, the net profit growth of textile and apparel companies exporting to the EU in 2H22 may be hampered by FX pressure. On July 7, 2022, the euro fell below $1.00, continuing its decline to new 20-year lows and potential parity with the dollar. The euro has been steadily losing value as worries about a recession there grow in response to growing uncertainty about the bloc's energy supply, with Russia threatening to further cut off gas supplies to Germany and the rest of the continent.

>> Textiles and garments face many challenges in major import markets

According to Mr. Nguyen Duc Hao, currency rate losses will cause the net profits of clothing companies including MSH, TNG, and TCM to fall 5–10% from 2Q22 levels.

However, as a result of the decline in oil prices, the prices of cotton and PET chips have fallen by 15.9% and 40.3%, respectively, from their high in Mar-22. Therefore, Mr. Nguyen Duc Hao anticipated that the prices of yarn and fabric will decline in 4Q22, behind the prices of other raw materials.

“The average price of PE chips is predicted to be VND28,309/kg in 2022 (10.8% yoy) and VND27,459/kg (-3% yoy) in 2023. However, according to Trading Economic, cotton will cost 117.7 US dollars a pound in 2022F. Due to the gradual decline in cotton prices in 2H22 before they move sideways in 2023, we predict that the gross margin of the cotton yarn company will edge down by 1.0% to 1.5% points in 2H22 compared to 1H22. However, we anticipate that the gross margin of clothing manufacturers like TCM, GIL, and MSH would increase in 2023F as a result of falling input material costs and a rebound in demand for high-end goods”, said Mr. Nguyen Duc Hao.