The basic chemical sector could look brighter

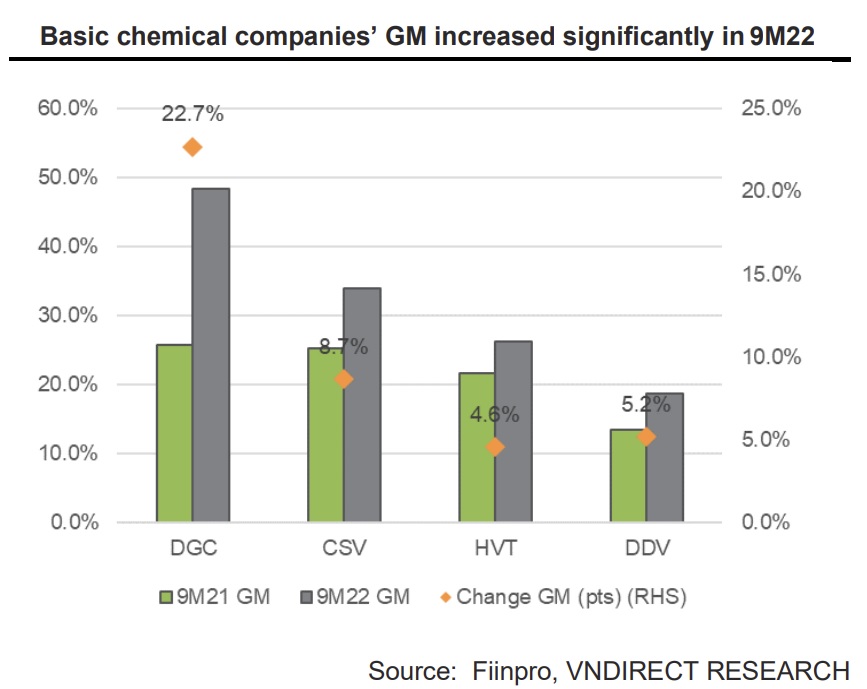

Vietnam’s basic chemical companies’ net profit growth slowed down in 3Q22 as commodity prices peaked in 2Q22. However, their net profit outlook could be better.

DGC’s gross margin slumped 8.6% pts qoq in 3Q22 due to a lower average selling price, and DGC conducted maintenance on its phosphorus equipment.

>> Sectoral applications of IoT: Optimizing processes for chemicals

Net profit growth slowed down

Following a peak in 2Q22, the cost of various common chemicals, including phosphate, DAP fertilizer, and caustic soda, has decreased in 3Q22. Prices for phosphorus, DAP, and caustic soda all fell from their peaks by 30%, 21%, and 20%, respectively, which caused basic chemical businesses to perform worse in the third quarter of 2012.

Vietnam's largest manufacturer of phosphorus and phosphorus-based goods, Duc Giang Chemicals Group JSC (HoSE: DGC), reported net sales of VND 3,696 billion (75% yoy and -8% qoq). Due to a lower average selling price and maintenance on its phosphorus equipment, DGC's gross margin declined 8.6% points quarterly in 3Q22. Thus, DGC's NP in 3Q22, which was VND 1,414 billion, increased 196% year over year but declined 21% qoq.

A major producer of caustic soda in Vietnam, South Basic Chemicals JSC (HoSE: CSV), reported net sales of VND574 billion in the third quarter of 2018 (61% year over year and 2% quarter over quarter). The lower ASP caused CSV's gross margin to increase to 31.8% in 3Q22 (8.9% points year over year and -2.3% points quarter over quarter). CSV's 3Q22 net profit consequently totaled VND101 billion (59.% yoy and -11.2% qoq).

Prices of yellow phosphorus have increased

Yellow phosphorus has been subject to energy consumption regulation limit ations in China since September 2022. One of China's four provinces producing the most yellow phosphorus, Yunnan, has launched a "Energy Efficiency Management Plan" for the energy consumption sector that will run from September 2022 to May 2023. Therefore, the Yunnan Province's yellow phosphorus producing facilities will scale back and eventually cease output.

The operating ratio of yellow phosphorus businesses in Yunnan has decreased to around 41% as of October 2022, down 28% from mid-September. However, daily production was only 805 t (down 41.8% from mid-September). As a result, the price of phosphorus rose by 15.5% in September 2022 to reach USD 5,200/tonne.

>> How has the Russia-Ukraine crisis impacted Vietnam’s key sectors?

As Yunnan will restrict phosphorus output until the end of May 2023, Mr. Nguyen Duc Hao, analyst at VNDirect, anticipates that phosphorus prices will continue to rise and maintain high prices (USD 5,200–5,500/tonne) until 1H23F. Lithium iron phosphate battery development is also promoted in China. Therefore, the major producers of phosphorus, like DGC, are profiting from the increase in phosphorus prices.

Caustic soda is more expensive than ever

As China meets roughly 40% of the demand for caustic soda in Vietnam through exports, China has a significant influence on caustic soda prices domestically. Caustic soda prices in China would increase again in September 2022, reaching USD 850/tonne (13.2% mom) due to the energy deficit and the country's high demand for aluminum.

"We anticipate that caustic soda prices will stay high until 2Q23F because China was unable to eliminate the zero-covid and restrict aluminum output in 2023F. The price of caustic soda may vary between USD 800-900/tonne in 4Q22–1H23F before steadily declining in 2H23F. Vietnamese producers of caustic soda, like CSV, could retain a sizable net profit in 4Q22-1H23F," Mr. Nguyen Duc Hao said.