The hard liquidity, increasing credit, interest rates are under upward pressure

Deposit interest rates in Vietnam are under increasing pressure in the last months of the year, but the interest rate compensation package can help reduce the lending interest rate.

According to a survey, since the beginning of May, banks are continuing to increase deposit rates for many terms with an increase of about 0.1-0.5%.

The macroeconomic update report of VNDirect Securities Company stated that the decision of the US Federal Reserve (FED) to raise the operating interest rate has had a multifaceted impact on the Vietnamese economy. In which, rising USD interest rates and inflationary pressure are putting pressure on domestic interest rates, VND deposit interest rates are expected to increase by 20-40 basis points in the last months of the year.

But VnDirect believes that the twelfth-month term deposit interest rate of commercial banks can increase to 5.9-6.1%/year by the end of 2022 (currently at 5.5-5.7%/year), which is still lower than the pre-pandemic level of 7.0%/year.

|

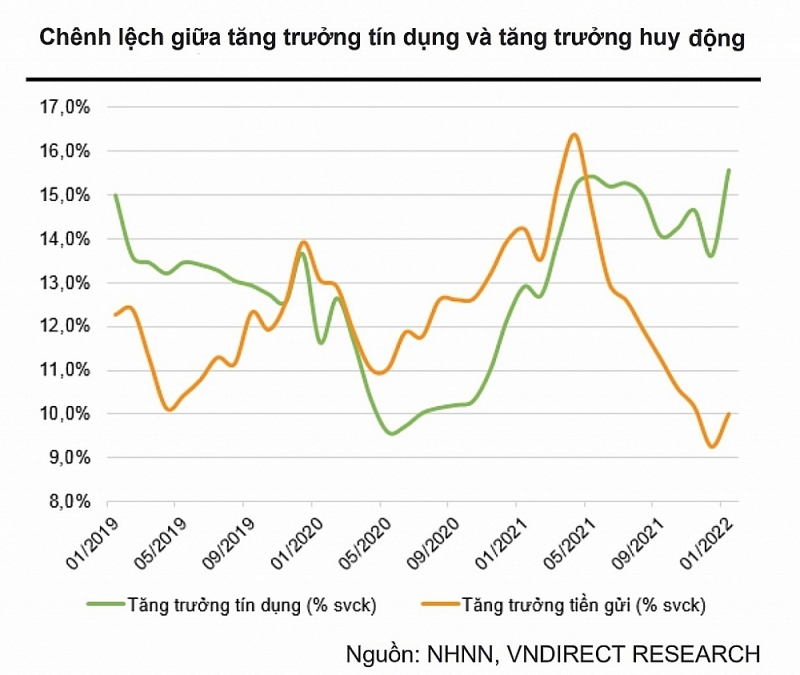

| The gap between credit growth and deposit growth is widening. |

In addition, according to experts, the reason for the increase in interest rates is that many banks have a liquidity shortage to supplement when credit growth is very positive. This is reflected in the difference between credit and deposit, which has fallen to the lowest level in eight years.

Data from the State Bank of Vietnam (SBV) shows that credit as of April 25 has increased by 6.75% compared to the end of 2021 (equivalent to 16.4% over the same period) while capital mobilization only increased by 3.55% (equivalent to 10.7% over the same period).

In Ho Chi Minh City, by the end of April 2022, the credit balance in the area reached over VND3 quadrillion, an increase of about 7% compared to the end of last year. However, the total capital mobilization of credit institutions in the area is estimated to increase by 2.74% compared to the end of 2021, much lower than the credit growth rate.

Since March, the State Bank has continuously injecting money to banks through the open market channel, and lending interest rates in the interbank market have remained at a high level of over 2%/year due to the shortage of liquidity.

Regarding this issue, economic expert Dr. Le Xuan Nghia said that interest rates are under increasing pressure from the bad debt situation. Currently, bad debts are hidden by regulations on debt extension and postponement. Since June this year, the extension and postponement regulations expire, the number of bad debts increases, and the provisioning for risks also increases. Banks will need liquidity to lend, so deposit rates will be pulled up.

With these developments, experts of SSI Research believe that monetary policy is managed "softly" in the first months of the year, although the operating pressure on the State Bank is increasing. The lending interest rate level is still stable, while the improved credit leads to an increase in the deposit and interbank interest rates. In the short term, SSI believes that the risk of monetary policy changes from the State Bank is not much when the Government is still focusing on recovering the economy after Covid-19.

Sharing the same opinion, VnDirect experts expect that the State Bank will maintain an "appropriate" monetary policy with a priority on supporting the economy's recovery, at least until the end of the second quarter of 2022. The reason is that inflationary pressure is expected to increase in the coming months, domestic demand is weak and has not fully recovered to pre-pandemic levels and the SBV prioritizes the goal of maintaining low lending rates to support business and economic recovery.

Regarding the impact on lending interest rates, the State Bank is preparing to deploy an interest rate compensation package, so experts and businesses believe that this can help reduce the average lending interest rate by 20-40 points in 2022. However, the actual impact of the interest rate subsidy package on businesses and the economy could be lower if commercial banks raise lending rates for other conventional loans to offset the increase in deposit interest rates.