Three key export sectors urgently need credit support

Domestic enterprises, particularly in the textiles, seafood, and wood industries, are vulnerable to tariff impacts and therefore require timely support through preferential credit packages and other policy solutions.

Changes in tariff policies may lead to adjustments in export industries and markets or even shifts in manufacturing investment flows by FDI enterprises.

In the report "Vietnam’s Export Structure to the U.S. – Responding to Tariffs and Long-Term Vision" by FiinGroup and FiinRatings, credit rating experts note that the risk of high U.S. tariffs is placing significant pressure on the export activities of Vietnamese enterprises, including foreign direct investment (FDI) firms, which dominate trade with the U.S.

The Government has tasked the State Bank of Vietnam with implementing a credit program for agriculture, forestry, and fisheries, totaling VND 100 trillion, with preferential interest rates 1–2% lower than commercial lending rates. Banks such as Agribank, BIDV, VietinBank, Vietcombank, LPBank, Sacombank, MB, ACB, Nam Á, OCB, Eximbank, BVBank, SHB, VietBank, and HDBank have registered to disburse under this program.

Meanwhile, domestic exporters in sectors like textiles, seafood, and wood may face significant challenges in financial resilience, making them more susceptible to disruptions from changing tariff environments.

The report analyzes the export distribution between FDI and domestic enterprises, delves into the product structures of each group, and evaluates the financial health and risk tolerance of domestic companies in response to international tariff fluctuations.

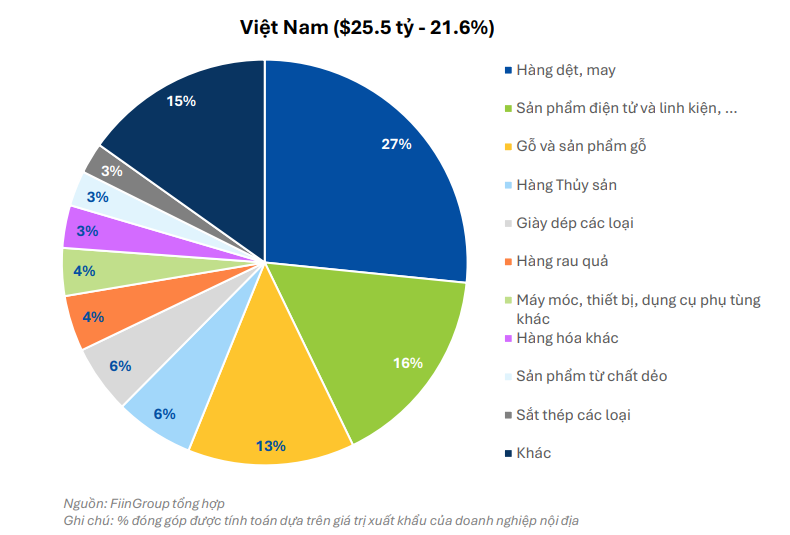

According to bilateral trade data with the U.S., Vietnam ranked among the top three countries with the largest trade surplus with the U.S. in 2024, behind only China and Mexico. Export value breakdowns by enterprise group show a long-standing disparity: in 2024, domestic firms accounted for just under 22% of Vietnam's total exports to the U.S.

Notably, with the exception of the seafood sector, FDI firms contributed over 50% of export value to the U.S. In other words, domestic firms only held a dominant share in seafood exports.

Low-tech industries like textiles, bags, wood, and footwear still have a large presence of FDI firms. In contrast, high-tech sectors requiring major investments in technology and production capacity—such as electronics and machinery—are largely dominated by FDI enterprises.

FDI businesses focus heavily on high-tech products, with electronics and machinery being top priorities.

Looking deeper into domestic export products to the U.S. in 2024, according to FiinGroup and FiinRatings, the textiles, wood, and seafood sectors were the core industries, accounting for approximately 46% of total U.S. export value by domestic firms.

Export Structure of Vietnamese Enterprises to the U.S.

Despite this, these businesses face high risks from U.S. tariffs, directly affecting their ability to export and maintain operations.

Given their limited financial strength and significant socioeconomic impact, this group of enterprises requires timely government support.

According to FiinGroup data:

Textile sector: 1,525 domestic exporters, employing 1.4 million workers, with outstanding loans of around VND 60 trillion.

Gross profit margins ranged from 0.59% to 34.84% (average 13.37%), but net profit margins ranged from –30.96% to 4.81% (average –3.06%). The average risk rating is FG-7 (out of 18 levels), with a 2.64% risk probability.

Seafood sector: 323 domestic exporters, employing 322,000 workers, with outstanding loans of around VND 49 trillion. Gross profit margins ranged from 3.81% to 27.49% (average 10.9%), but net profit margins ranged from –9.16% to 4.34% (average –0.14%). The average risk rating is FG-6, corresponding to a 1.90% risk probability.

Wood sector: 1,736 domestic exporters, employing 416,000 workers, with outstanding loans of around VND 59 trillion. Gross profit margins ranged from 2.78% to 26% (average 11.86%), but net profit margins ranged from –14.63% to 3.37% (average –1.10%). The average risk rating is FG-8, with a 3.68% risk probability.

"FDI companies from countries such as South Korea, Taiwan, and the U.S. have long held a dominant share in Vietnam’s exports and should work together with domestic businesses in negotiations, risk-sharing, and maintaining production to ensure social security and economic growth," FiinGroup recommends.

Furthermore, domestic enterprises—particularly in labor-intensive sectors like textiles, seafood, and wood—are facing significant impacts and should be prioritized by the government for timely assistance through preferential credit programs, international trade initiatives, and labor welfare policies.

Credit institutions, in turn, need to revise lending policies, strengthen portfolio risk supervision, and apply deep-dive analytical tools to promptly manage sector-specific risks, experts suggest.

In addition to government policies supporting risk mitigation, businesses are advised to proactively adapt to tariff changes. In fact, expanding and exploring new export markets beyond the U.S.—particularly those with bilateral or multilateral trade agreements with Vietnam—has long been recommended by experts, even prior to President Trump’s second term.

According to FiinGroup, in the long run, Vietnam needs to focus on developing domestic production capacity, aiming to make local businesses the core drivers of multi-sector exports. The government should prioritize resources and implement long-term strategies to support domestic enterprises, foster innovation, and promote high-tech export industries to enhance global competitiveness.

Vietnam should also push ahead with export market diversification strategies and better leverage existing free trade agreements (FTAs) to mitigate the impact should tariff adjustments turn unfavorable in the medium and long term.