Two factors to drive gold prices next week

Gold prices will be driven by global uncertainties and Fed rate decreases next week.

In the Vietnamese gold market, the price of an SJC gold bar increased dramatically, rising from VND 74 million to VND 77.45 million.

>> Next week's gold price: Impacts from US inflation

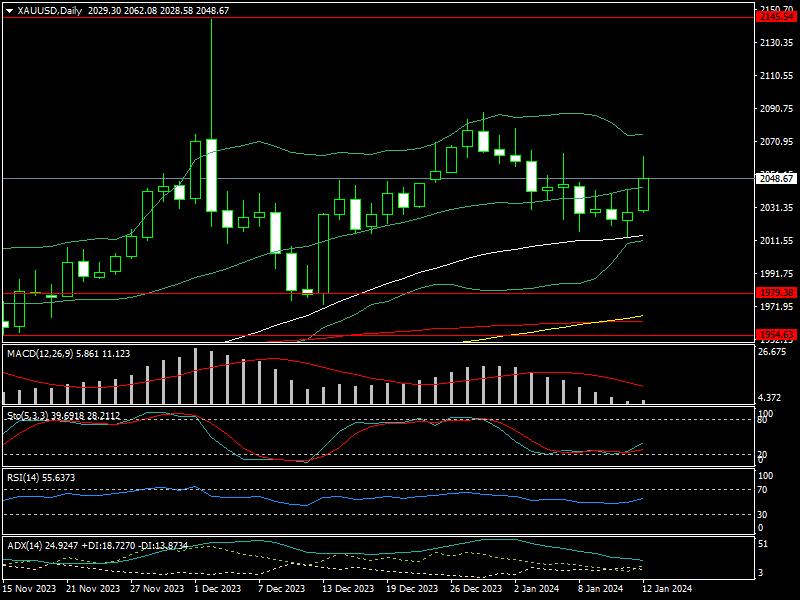

This week, the worldwide gold price fell to $2,016/oz after beginning at $2,044, but then steadily rebounded to $1,062/oz before closing at $2.048/oz.

In the Vietnamese gold market, the price of an SJC gold bar increased dramatically, rising from VND 74 million to VND 77.45 million.

Due to the rising unrest in the Middle East, gold is experiencing increased interest from safe-haven demand as investors seek some portfolio protection ahead of the weekend. Gold rose as the US and British airplanes, ships, and submarines launched dozens of air strikes throughout Yemen overnight in retribution for months of attacks on cargo ships in the Red Sea by Houthi troops.

Furthermore, gold is benefiting from increased predictions that the Federal Reserve may decrease interest rates as soon as March. Markets continue to price in dramatic rate reduction, despite the Federal Reserve of the United States signaling three rate cuts this year.

According to the CME FedWatch Tool, markets expect the Fed to ease in March by about 80%. Markets were factoring in a 64% possibility this time last week.

Expectations rose Friday when the US Labor Department reported that the Producer Price Index declined 0.1% in December. Although inflation remains relatively high, experts believe that weak producer prices will lead to lower consumer prices.

>> Will the gold price surpass its all-time high in 2024?

Craig Erlam, Senior market analyst at OANDA, said it would be obvious that disinflationary forces remain in the pipeline, giving the Fed confidence that inflation will return to target in the coming months. "Not only are markets nearly completely pricing in 150 basis point cuts this year, but they're also pricing in a greater-than-50 percent possibility of 175, with the first highly supported to arrive in March." "And to think, many people felt markets finished last year overly optimistic about rate reduction," Craig Erlam remarked.

Gold prices may go higher next week

According to Erlam, rising market expectations have reduced the yield on 10-year US Treasury notes below 4%, while two-year rates have plummeted to an eight-month low. Bond rates are falling, which is helping gold.

Overall, the price of gold next week may continue to benefit from the Fed's projections of interest-rate decreases and the Middle East war. However, investors should keep an eye on the crucial US barometer, retail sales, which will be released next week.

According to technical analysis, the gold price will find support at $2,014/oz next week, with the first resistance level at $2,064, above which the gold price will continue to test $2,088, and higher in the $2,100/oz zone.