Typical FDI Enterprises: Sustained Commitment to Vietnam’s Development

Typical FDI Enterprises: Sustained Commitment to Vietnam’s Development 8:24:57 AM | 9/8/2025 Over the past 30 years, foreign direct investment (FDI) has been a pillar of Vietnam's economic growth. Despite many fluctuations, this capital flow has remained strong, enabling the economy to expand steadily at an average of nearly 7% per year.

Major corporations such as Samsung, Intel, Toyota, Unilever, Nestlé, and AEON not only provide capital and technology but also generate jobs, advance sustainable development, and serve as symbols of international cooperation in Vietnam.

Workers on the production line at Toyoda Gosei Haiphong Co., Ltd in the Japan-Haiphong Industrial Park

Four waves of FDI

The journey of attracting FDI in Vietnam can be divided into four distinct waves, reflecting the process of deep economic integration and development. The first wave started on January 9, 1988, when the Foreign Investment Law officially took effect, and capital inflows grew rapidly after the U.S. lifted its embargo in 1994. This was a cautious but dynamic period, marked by the arrival of U.S. technology corporations such as IBM, HP, Microsoft, and Oracle with large investments and modern management models. As a result, Vietnam’s GDP grew by an average of 7.56% per year, doubling in 2000 compared with 1990.

The second wave (2001-2010) saw a sharp surge as both registered capital and implemented capital grew many times compared with the previous decade. This was also the period when Vietnam attracted its first billion-dollar projects from Intel (U.S.) and Posco (Korea). In particular, 2008 marked a historic milestone with nearly US$72 billion in registered capital and the arrival of Samsung in Bac Ninh, paving the way for a large-scale wave of Korean investment.

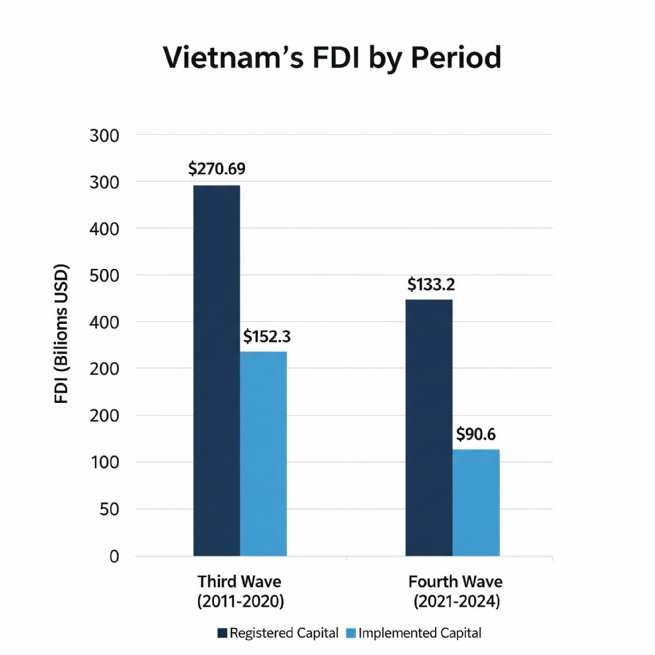

The third wave (2011-2020) did not create a breakthrough but sustained steady growth, with US$270.69 billion in registered capital and US$152.3 billion in realized capital. Since 2014, the merger and acquisition (M&A) trend became the main investment channel, helping to diversify the FDI market. This was also the time when major corporations such as Apple, Dell, Foxconn, Pegatron, and Nike shifted supply chains to Vietnam, while semiconductor and electronics companies including Samsung, Qualcomm, Infineon, Amkor, and Nvidia expanded their investments, laying the foundation for the new wave.

The fourth wave (from 2021 to the present) is reaching its peak, with 2024 registering over US$38.2 billion in capital and US$25.3 billion in disbursed capital, the highest level ever. The FDI structure has also changed significantly: from a focus on low value-added textiles and footwear, nearly 50% of capital is now directed to processing and manufacturing. The FDI sector currently accounts for more than 70% of the country’s export turnover.

Foreign capital flooding into Vietnam in 2025

2025 is witnessing a surge in FDI in Vietnam driven by institutional reform, administrative boundary mergers, and new investment attraction policies. According to the National Statistics Office (Ministry of Finance), by the end of July the total registered capital, including new capital, adjustments, and M&A, reached US$24.09 billion, up 27.3% compared with last year.

The new investment wave covers many sectors. Techtronic Industries (TTI) is expanding production in Saigon High-Tech Park; Gamuda Land (Malaysia) has proposed building a metro line to connect Long Thanh airport; PowerChina (China) are jointly investing in metro line 2; and Smart Tech Group (U.S.) has invested US$340-850 million in a storage battery factory.

Ho Chi Minh City has emerged as the “locomotive” after merging with Binh Duong and Ba Ria-Vung Tau, attracting nearly US$6.2 billion in seven months, up 45.67% year-on-year. Export processing zones and industrial parks alone contributed US$2.43 billion, including 133 new projects worth US$1.1 billion and 106 adjusted projects worth US$1.33 billion. The high-tech sector notably attracted more than US$1 billion, with projects such as BE Semiconductor Industries N.V.'s US$42 million microchip equipment manufacturing plant, Amazon Data Services (additional US$48 million), and GSK Vietnam (additional US$133 million).

In the financial sector, following the National Assembly’s approval in early August 2025 to establish the Ho Chi Minh City International Financial Center, groups such as Milcon Gulf and the Trump Organization have expressed interest in the project. The combination of Binh Duong’s industry and Ba Ria-Vung Tau’s port infrastructure is expected to make Ho Chi Minh City a financial and trade gateway for ASEAN, with GRDP comparable to many major cities in the region.

The real estate M&A market has also become active. CapitaLand spent US$553 million to acquire Becamex IDC’s project in Binh Duong; Sumitomo Forestry, Kumagai Gumi, and NTT Urban Development partnered with Kim Oanh Group to develop The One World project; and Nishi Nippon Railroad acquired 25% of the Paragon Dai Phuoc project from Nam Long.

Among the partners, Korea continues to play a leading role with more than 10,250 projects and total registered capital of US$94.9 billion, accounting for nearly 24% of the number of projects and 18.2% of FDI capital. In the first seven months of the year alone, Korean enterprises carried out 241 new projects, 179 adjusted projects, and 513 capital contribution deals, with total additional capital of US$3.9 billion. Korean investment capital is concentrated in high technology, electronics, manufacturing, energy, automobiles, and real estate, with Samsung and LG in the North remaining the key players. Samsung is currently the largest investor in Vietnam with registered capital of US$23.2 billion and more than 300 domestic suppliers.

Commitment to a sustainable Vietnam

Over three decades of presence, leading FDI enterprises have affirmed their long-term commitment to Vietnam not only through capital flows but also through sustainable development strategies.

Ms. Pham Thi Truc Thanh, Director of Sustainability, HEINEKEN Vietnam, said: “Heineken, with more than 30 years of partnership, demonstrates its sustainable commitment through the strategy ‘For a better Vietnam’.” This strategy focuses on achieving net zero emissions, maximizing the circular economy, conserving water and natural resources, building a fair, equal, diverse, and inclusive world, and promoting a culture of responsible drinking.

At Unilever Vietnam, the sustainable development strategy is expressed through efforts to promote a green supply chain. Ms. Nguyen Thi Bich Van, Chairwoman of Unilever Vietnam, emphasized the focus on the circular economy, plastic waste management, and cooperation with Duy Tan Recycling to collect 30,000 tons of plastic waste in the 2025-2027 period.

In the field of regenerative agriculture, Mr. Binu Jacob, CEO of Nestlé Vietnam, affirmed: “The NESCAFÉ Plan brings sustainable value to farmers, communities, and the planet.” Nestlé Vietnam invested an additional US$75 million to expand the Tri An factory while implementing the NESCAFÉ Plan to support 21,000 farming households in reducing irrigation water by 40-60%, cutting chemical fertilizers by 20%, increasing income by 30-150%, and lowering carbon emissions.

In the retail sector, AEON Mall (Japan) is expanding rapidly, with AEON Mall Long An opening in August 2025 and AEON Mall Can Tho (8.5ha) under construction, while targeting to triple its scale in Vietnam by 2030. Mr. Tezuka Daisuke, General Director of AEON Vietnam, emphasized: “Vietnam is our highest growth market outside of Japan.” Mr. Matthew Powell, Director of Savills Hanoi, said: “Despite global uncertainties and trade tensions, Vietnam remains determined to advance structural reforms and attract investment. Although challenges persist, stable FDI inflows combined with infrastructure development momentum reflect cautious optimism for long-term growth.”