Uncertain prospects for SCS

The outlook for Saigon Cargo Service Corporation (HOSE: SCS) appears to be wavering between concerns and expectations regarding its business opportunities and corporate advantages.

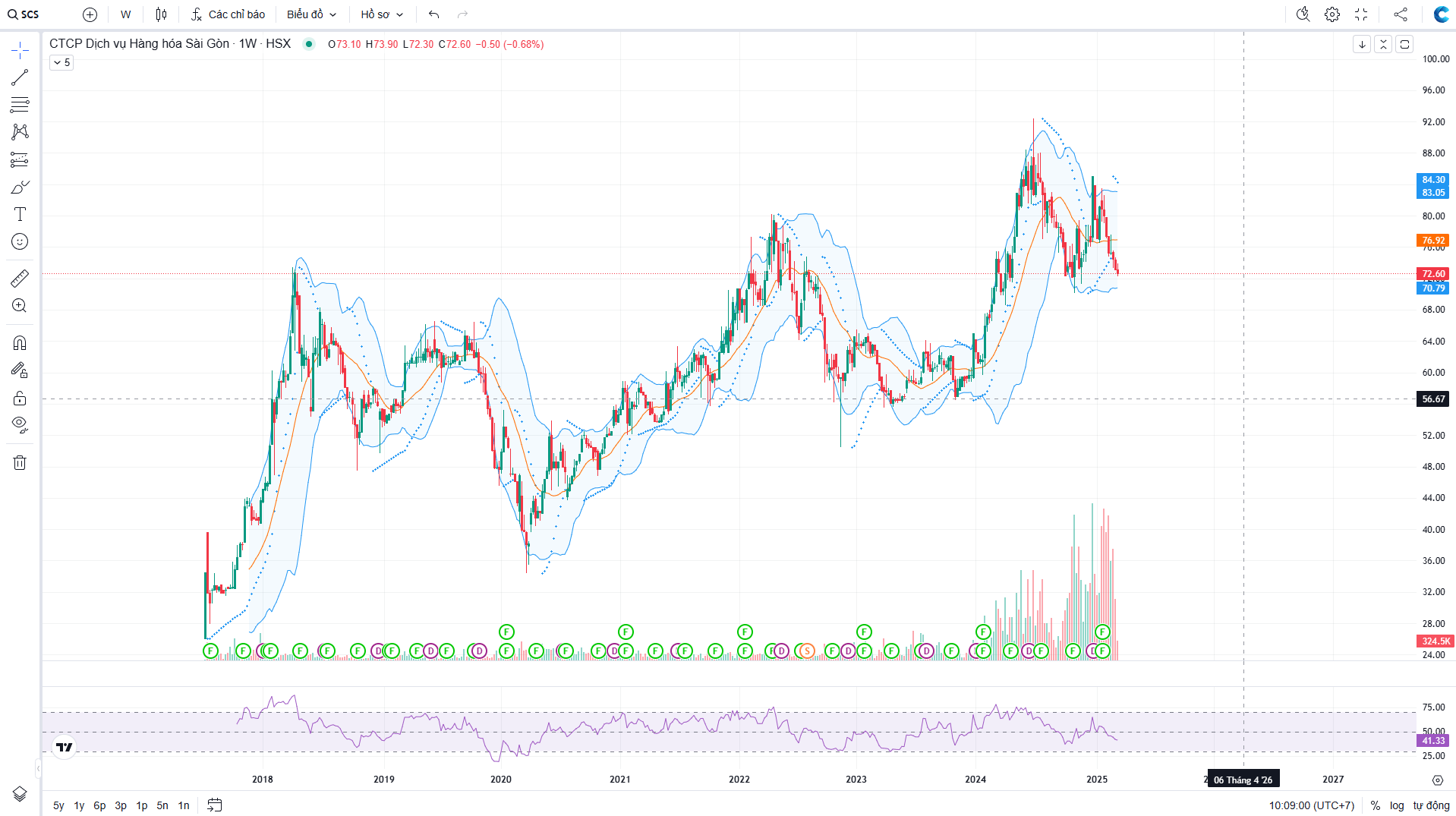

SCS shares have been on a continuous decline from their peak of over VND 82,000 per share at the beginning of the year to below VND 60,000 per share as of April 21, 2025.

Growing Concerns

In 2024, SCS reported strong business results with its highest profit since inception. For the first time in its history, the company recorded revenue exceeding VND 1,000 billion, up 47% compared to 2023. Pre-tax profit and net profit reached VND 783 billion and VND 693 billion respectively, marking increases of 38% and 39% year-over-year. SCS currently holds around 49% market share at Tan Son Nhat Airport. These results reflect the strong recovery of the aviation industry, a surge in cargo volume, and notably, the rising demand for transit through this airport.

However, concerns are emerging as Long Thanh International Airport (LTIA) is scheduled to begin operations in early 2026. The long-term growth potential of SCS will heavily depend on the outcome of the selection process for the operating unit. If SCS is chosen, it could become a springboard for the company. On the contrary, if it is not selected, and as international cargo is increasingly routed through Long Thanh to relieve pressure on Tan Son Nhat, SCS will inevitably face a decline in revenue.

SCS will have to participate in a bidding process once ACV completes its review, expected to include service pricing frameworks and rate plans at LTIA, to be submitted to the Civil Aviation Authority and then to the Ministry of Construction. According to VDSC, if not selected, SCS could lose 10% of its market share by 2027, focusing solely on budget airlines at Tan Son Nhat. Revenue is forecast to decline with a compound annual growth rate (CAGR) of -7% during 2025–2029. If selected, SCS could retain its international customers and cargo volumes, maintaining a 19% market share from 2025 to 2029. Projected revenue in this case would grow with a CAGR of 12% over the same period.

Additionally, in 2025, SCS’s tax incentives—0% tax rate for income from new investment projects (Tan Son Nhat Cargo Terminal) for 15 years starting in 2010, with tax exemptions from 2010 to 2013 and a 50% tax reduction for the next 9 years (2014–2022)—will expire. It is estimated that the company will lose tens of billions of dong annually as it transitions to new tax obligations.

Global trade fluctuations and U.S. tariff policies from the Trump era also raise concerns about reduced investment in electronics components and cross-border purchases, potentially lowering cargo volume and affecting SCS operations from this year. However, as with the initial concern, there is still no clear signal that this scenario will materialize.

But There’s Still Hope

Returning to the keyword “Terminal T3,” a project recently inaugurated under the direction of Prime Minister Pham Minh Chinh, featuring advanced technologies such as full biometric integration. Passengers will be able to book tickets, check-in, and board using facial recognition through the VNeID app, integrated with airline systems like Vietnam Airlines and Vietjet. This will directly benefit aviation service providers like SCS and AST, by increasing cargo traffic and improving logistics efficiency at the airport, according to KBSV.

For international cargo (which has historically accounted for 85%–90% of SCS’s total revenue), the company is awaiting its opportunity to win the bid at LTIA. Aside from its strong competitive edge, SCS’s proactive involvement in cargo terminal planning adds to its favorable position. SCS is currently the only company working directly with ACV and Incheon (South Korea) consultants, discussing key aspects such as architectural design, functionality, technological applications, and operations. VDSC believes this increases the likelihood that Terminal 1 will be operated by a single entity. Meanwhile, Terminal 2 has drawn interest from Vietnam Airlines (HSX: HVN) and Viettel Post (HSX: VTP). With fewer competitors, SCS has a high chance of winning the bid and expanding its market share through LTIA – Terminal 1.

For domestic cargo, SCS’s clients include Vietjet Air, Bamboo Airways, and Vietravel Airlines. Before COVID-19, SCS grew its domestic market share thanks to the expansion of low-cost carriers. However, since 2022, two of its domestic clients have scaled back their fleets and restructured routes/frequencies. As a result, SCS’s domestic market share has declined by an average of 111 basis points per year over the past three years, according to VDSC. With the aviation sector recovering and airlines expected to add aircraft this year through pre-scheduled deliveries (Vietjet) and new purchases under Vietnam–U.S. commercial cooperation, SCS’s domestic cargo volume is projected to grow at a double-digit CAGR from 2025–2029.

Although the expectations are well-founded, short-term impacts remain inevitable. According to many analysts, the market's adjustment of expectations for SCS may make it a more attractive dividend investment at a lower price. VDSC’s valuation shows that while SCS’s 2025 outlook remains positive, its stock has declined 14.2% so far, equating to a forward P/E of 10.4x (28% lower than the industry median). This suggests that the market remains focused on SCS’s long-term prospects but is still “uncertain” about whether it will be selected to operate Terminal 1 at LTIA.

SCS could also seek ways to offset the loss of tax incentives through revenue improvements, such as higher office rental rates when the real estate market recovers (this segment currently contributes about 7% to SCS). In parallel, adopting technology and optimizing labor costs could help reduce operational expenses.