Unlocking bank loans for real estate

Because banks were unable to track cash flow, they did not dare to offer real estate loans while this market was in turmoil.

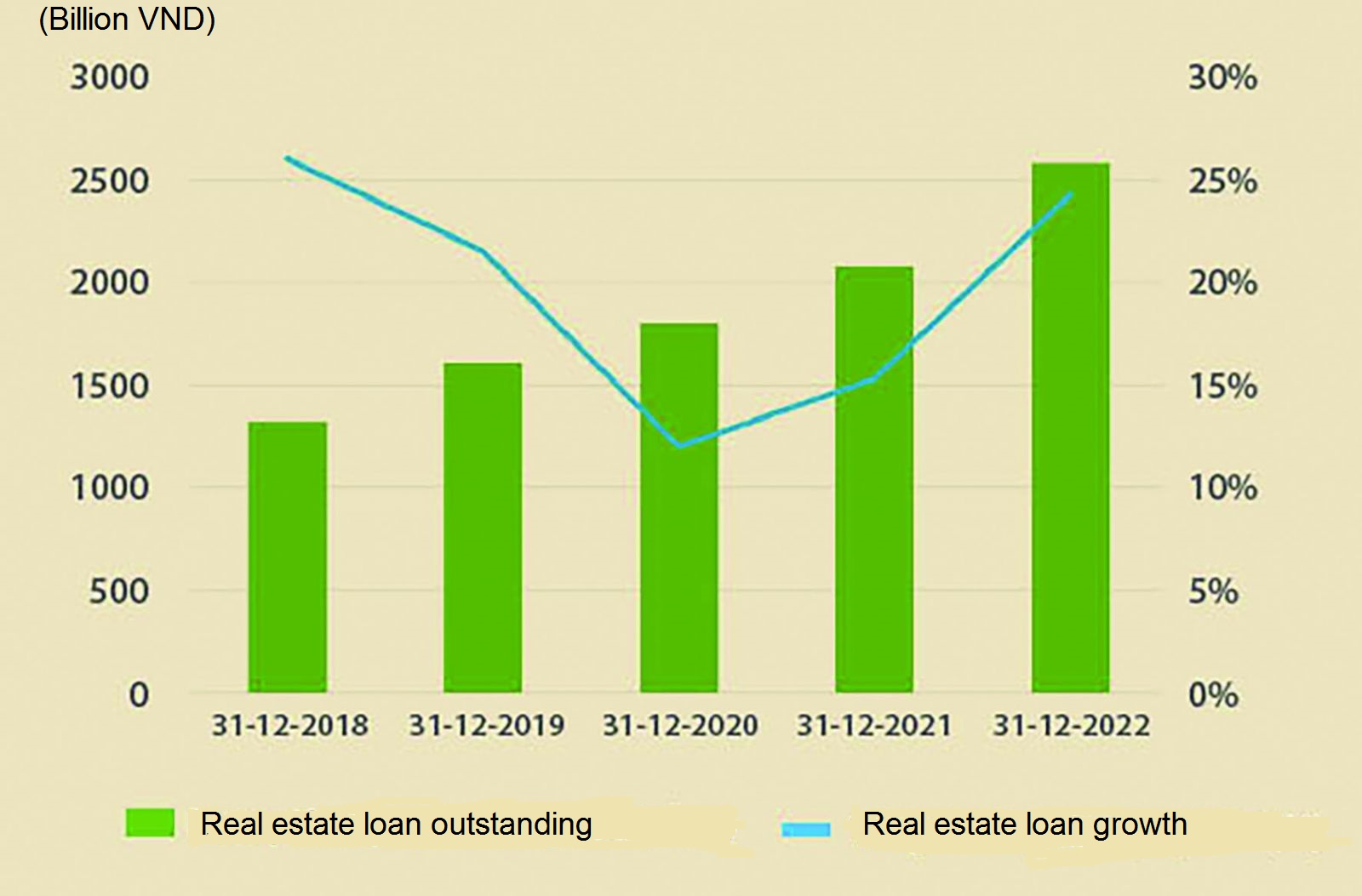

The outstanding loans for the real estate industry were more than VND 2.67 million billion as of April 25, 2023, a 3.51% increase from the end of 2022.

>> Removing obstacles to commercial housing construction

Recently, it was proposed that real estate loans be displayed in the form of a "closed circle."

The risk of "catching fish with two hands"

According to the State Bank of Vietnam (SBV), outstanding loans for the real estate industry were more than VND 2.67 million billion as of April 25, 2023, a 3.51% increase from the end of 2022. Thus, the size of real estate outstanding loans climbed by more than 90,000 billion VND in the first four months of the year (in the first four months of 2022, the scale of real estate outstanding loans expanded by more than 200,000 billion VND).

Ms. Nguyen Thi Hong, Governor of the SBV, stated that real estate loans are experiencing challenges, mostly owing to project legal difficulties, and that loan growth is not as strong as in the past. As a result, legal issues must be resolved before measures to restructure the payback term and maintain the debt group intact are promoted, and the firm can demonstrate that there is sufficient cash flow to repay the loans under the new terms are implemented.

Recently, it was suggested that real estate loans be offered in the form of a "closed circle." As a result, commercial banks might launch real estate lending packages for specific industry segments ranging from the mid-end to the low-end. This loan package will be distributed in a closed circle, with the banks controlling 100% of the cash flow, i.e. bank - house buyer - investor - bank.

However, Dr. Hieu stated that we will reconsider the realities of the Vietnam real estate market, as well as the relationships of three parties, including banks, project developers, and house purchasers. Banks, like in the United States, only lend to homebuyers once the project is done. It is more creative in Vietnam, yet that creativity is rather risky. That is, developers frequently borrow from banks to develop future-sharpened projects while also collecting money from house buyers based on the progress of the project. When there is a large amount of money, the project developers will fund other projects. And the risk arises when they "catch a fish with two hands," the project is not completed, the house buyer has paid money but has not yet received possession...

>> Matching land prices to market values

Cash flow control

It is important to realize how to manage cash flow so that the homeowner receives a house, the bank gets the money, and the developers finish the project and earn a profit.

In truth, there is still no mechanism in place in Vietnam for a closed bank loan circle, because numerous issues emerge when working on projects, and the key is whether the project developers desire to do so.

"The simple solution is that when developers borrow from a bank to construct a future project, the two parties must commit to each other." Specifically, when home buyers pay money, they will have to pay directly to the bank to deduct the project developers' loan outstanding," Mr. Hieu explained.

Although the project developers have a future project as collateral, the price of this collateral will progressively fall as the apartments are sold to house buyers and deducted from the banks' initial assets. As a result, the bank will only accept a fall in collateral price if the loan due lowers proportionally.

The "congestion" of real estate loans in Vietnam right now is clearly owing to banks' incapacity to govern cash flow, therefore they are unwilling to lend in the context of a frozen real estate market. As a result, according to Mr. Hieu, the following remedies must be implemented:

First, do not decrease commercial banks' present real estate loan requirements. Businesses must still assess and maintain cash flow, profitability, and financial leverage.

Second, in order to repay their bank loans, project developers must rearrange their financial system and cash flow.

Third, a special credit program, similar to the 30,000 billion VND package, should be developed to assist enterprises in providing products that meet the demands of the majority of house purchasers in Vietnam.