Unsecured loans should be promoted

Many firms lack collateral; if banks refuse to endorse unsecured and cash flow-based loans, it will be difficult to stimulate credit growth.

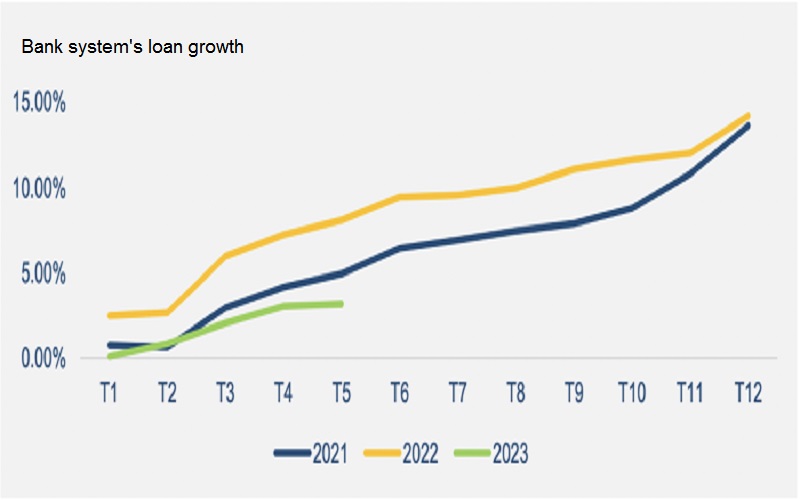

By the end of June, credit growth had only reached roughly 4.73%, which was about half of the growth rate seen during the same period previous year.

>> Credit growth still low in first half of 2023: SBV

However, promoting unsecured loans requires both bank and company efforts.

Difficulties to access bank loans

Lending interest rates have fallen by roughly 1-1.2% since the end of 2022 and are likely to decline further following four policy rate reduction by the State Bank of Vietnam (SBV).

The Vietnam Banks Association (VNBA) announced that it has just delivered a document to financial institutions requesting that they share difficulties with individuals and companies. As a result, the VNBA proposed, on the basis of balancing financial resources, lowering lending rates for existing outstanding loans and new loans, with a minimum interest rate cut of 1.5-2%, as well as lowering fees, charges, and other services for enterprises.

The lending rate drop is intended to assist firms and individuals in restoring production and business, while fostering economic growth in compliance with the National Assembly, Government, and SBV rules.

The liquidity of Vietnam's banking system is also relatively abundant, as evidenced by the fact that the interbank market interest rate is now at a very low level: the overnight lending rate is currently just 0.34%/year; the one-week lending rate is 0.68%/year; and the two-week lending rate is 0.93%/year.

However, by the end of June, credit growth had only reached roughly 4.73%, which was about half of the growth rate seen during the same period previous year. The fundamental reason is that businesses lack manufacturing orders and huge inventory, therefore bank loans are unnecessary. However, many firms desire to borrow but are unable to fulfill bank standards, particularly those for collateral assets, and hence are unable to obtain bank loans.

>> A boost needed for credit growth

"Many businesses require bank loans but lack collateral." As such, banks must promote unsecured loans to boost firms' capacity to access capital," said Dr. Nguyen Huu Huan of the Banking University of Ho Chi Minh City.

How to limit the risks?

Unsecured loans, according to banking experts, are a very sophisticated and modern kind of lending. Banks, on the other hand, are wary of unsecured loans unless their customers are huge corporations or have both unsecured and mortgage loans. The amount of unsecured loans also relies on each bank's risk appetite and management ability, as well as the enterprise's brand reputation, payback history, business strategy, and so on.

As a result, in order to get unsecured loans from banks, firms must strengthen their governance capability, have a clear business strategy, and demonstrate financial transparency. Furthermore, companies must strive to become loyal clients by continuing to employ the bank's service package.

Banks must also encourage the use of modern technology or exploit information from multiple sources to score credit for customers, based on credit history or payment of electricity, water, and tax bills...; the reputation of businesses or the contracts that the business has signed with their partners, their future cash flow, or even their inventory to decide on a loan...

In the present financial trend, the diversification of funding channels for businesses to fulfill business demands, particularly through the stock and bond markets, is an urgent issue to assist firms in not relying solely on bank loans.