Unveiling BCM’s ambitions

Becamex IDC Corporation (HOSE: BCM) – the industrial real estate 'giant' in Southern Vietnam – is set to auction and offer 300 million shares.

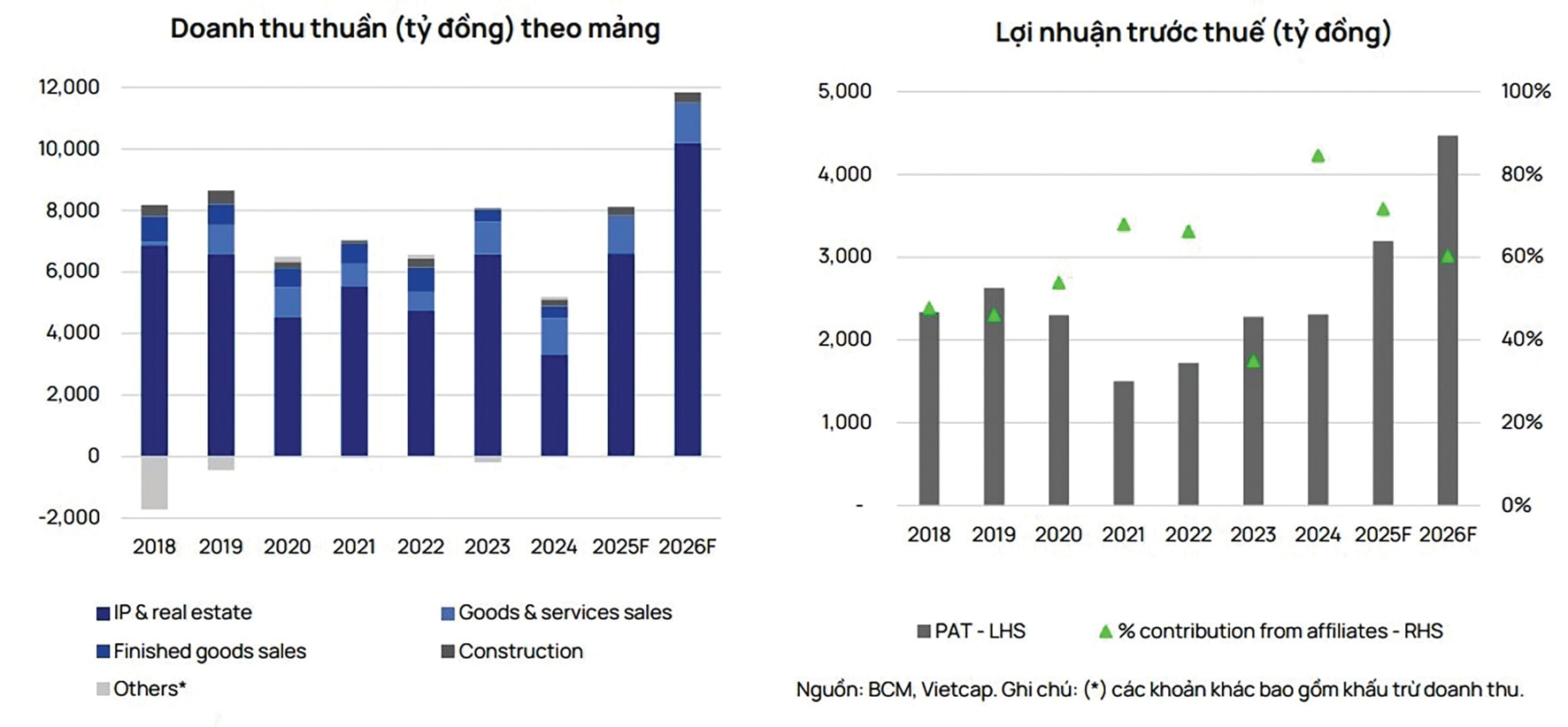

BCM’s Net Revenue and Profit Before Tax

BCM plans to raise at least USD 882.6 million through an issuance. The funds raised through this issuance will be allocated to develop new industrial real estate zones and decrease state ownership. This strategy aims to enhance long-term stock liquidity.

Capital Utilization Plan

In the market, BCM is a prominent domestic industrial zone (IZ) developer in Vietnam, with its land bank primarily located in Binh Duong province – dubbed the nation’s “IZ capital.” By the end of 2024, BCM held a large land reserve, including 950 hectares of commercial industrial land and 1,200 hectares of commercial urban land. In Binh Duong, BCM commands a 30% market share. Nationwide, BCM ranks third with a 3.6% market share.

According to BCM’s plan for 2025–2026, the company aims to fully utilize remaining space and attract large corporations applying advanced manufacturing technologies to the expanded Bau Bang and Cay Truong industrial zones in Binh Duong.

If the major share auction is successful, BCM will use over VND 8,400 billion to invest in developing the Cay Truong and expanded Bau Bang IZs, while also injecting more capital into the VSIP joint venture (in which BCM holds a 49% stake).

Additionally, BCM plans to use nearly VND 4,300 billion of the raised capital to repay principal loans from BIDV and VietinBank, mainly short-term debts, according to BCM’s financial statements.

By the end of 2024, BCM’s total liabilities reached nearly VND 38,298 billion, up 13% from the start of the year. Short- and long-term borrowings totaled over VND 23,600 billion, accounting for 62% of total liabilities and increasing by 20%. By late 2024, BCM’s net debt-to-equity ratio stood at 1.0x, higher than peers in the same industry. Looking ahead, BCM plans to continue issuing bonds in 2025 (with 3–5 year terms) to finance project development. A successful auction is expected to help reduce this net debt-to-equity ratio.

Opportunities and Challenges

Currently, BCM’s shareholder structure is quite concentrated, with the Binh Duong Provincial People’s Committee remaining the controlling shareholder, holding over 95.4%. If all 300 million shares are successfully allocated, the State’s ownership ratio will decrease but still retain controlling power in the company.

This factor, along with the appeal of a market-leading company in a sector projected to continue thriving due to Vietnam’s attractive FDI policies, makes investment in BCM theoretically appealing to many investors – especially long-term institutional investors and even potential FDI players looking to “set the nest” for future “eagles.” Proven joint ventures such as BCM–VSIP are also expected to expand their influence in the IZ sector through this share sale.

On the flip side, with a minority stake (29%) still far from having control over State-dominated governance, and the large capital required making it impractical for individuals or institutions not specifically targeting the IZ or financial investment market, this “playground” naturally favors “big players.” An expert remarked that entering a company under State shareholder control is both an advantage and a hurdle in this share sale.

Moreover, as assessed by SSI – the lead arranger of BCM’s auction deal – in BCM’s total operating profit, financial income from joint ventures and associates contributes the most (ranging from 40% to 80%). A large portion of this financial income comes from the Vietnam-Singapore Industrial Park (VSIP) joint venture, in which BCM holds a 49% stake. In contrast, BWID continues to report losses, mainly due to persistently low occupancy rates in ready-built factories. This income structure may prompt investors to scrutinize BCM’s core operating profit growth prospects more closely, particularly in residential real estate and anticipated new launches.

Despite the challenges, most securities firms believe this major share sale by BCM will mark a new era for State divestment (potentially boosted by a “double lever”: industrial real estate’s FDI attraction prospects and Vietnam’s stock market upgrade potential in drawing future FII).

SSI forecasts that BCM’s 2025 revenue will reach VND 7.2 trillion, up 40% year-on-year, and post-tax profit will hit VND 3.64 trillion, up 57.5% year-on-year. SSI values BCM at VND 89,900 per share but notes key risks: (1) low liquidity in Binh Duong New City; (2) delays in IZ development due to legal procedures and high compensation costs; and (3) elevated interest expenses. SSI estimates a 1% interest rate hike would increase BCM’s interest costs by VND 151 billion (USD 6.3 million), equivalent to 5% of its post-tax profit.

Vietcap estimates BCM’s fair value at VND 91,000 per share and believes that proceeds from the planned 300 million share offering (equal to 29% of total outstanding shares, expected in April 2025) could boost BCM’s valuation, as the capital would accelerate IZ project development and contribute to joint ventures.