Will electricity stocks be more positive?

According to Mr. Nguyen Anh Minh – Head of the F319 Investment Team, the ever-increasing demand for electricity, viewed as a “lever” for power stocks, is expected to keep rising.

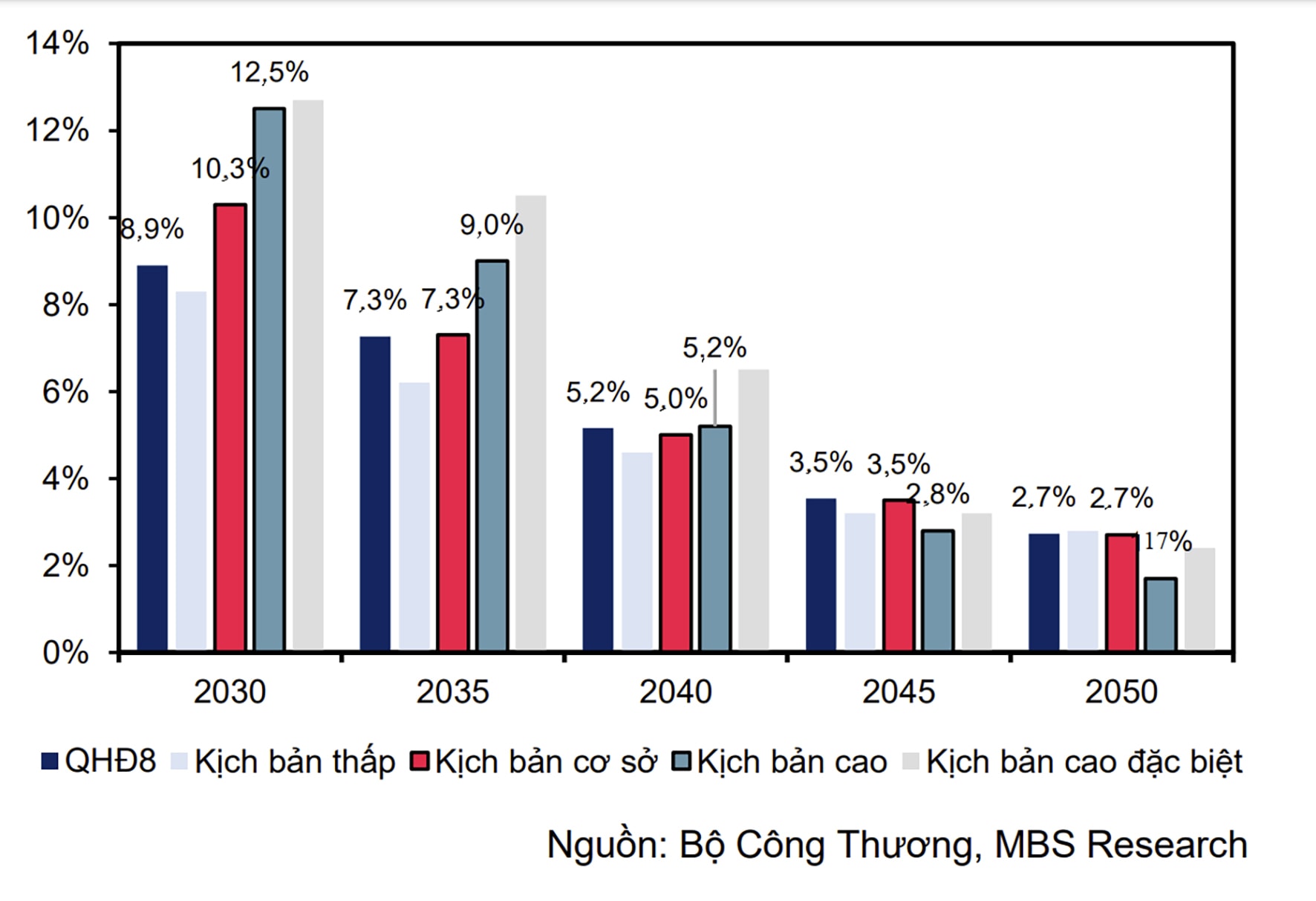

The scenarios for electricity consumption are constructed to match Vietnam’s economic growth scenarios. Of these, two major ones—base-case and high-case—both project growth of over 10% in the 2025-2030 period.

The Ministry of Industry and Trade (MOIT) anticipates strong growth in electricity demand this year, as the Government sets an 8% GDP growth target and has approved the proposal to adjust Power Development Plan 8 (PDP8).

Increasing electricity demand

The MOIT projects electricity consumption growth of 10.3%, rising to 12.5% by 2030. Notably, the adjusted PDP8 adds another scenario for economic growth, which could lead to electricity consumption growth of 12.8%. This points to a bright outlook for the power sector in the medium term—especially given that the expansion of generating capacity has been lagging behind the original PDP8 timeline.

The modified PDP8 suggests raising wind power by 3,949–5,321 MW and solar power sources by 25,867–52,825 MW in order to make up for capacity shortages. Vietnam's renewable energy (RE) market is anticipated to become more active beginning in 2025, along with a number of other encouraging policy signals for RE, such as draft circulars for provisional pricing regimes and draft policies on bidding on energy projects. Interestingly, PDP8 also resurrects nuclear power development, adding 6,400 MW with 2030–2031 as the anticipated completion date.

Hence, under the changes in PDP8, renewable energy businesses will benefit the most clearly. Companies in the RE construction and design consulting segment—such as PC1, TV1, and TV2—stand to gain early on from the increase in project volume. Meanwhile, top renewable power developers such as REE, HDG, and GEG continue to advance ambitions to expand plant capacity, spurred by fast-moving policies scheduled for implementation in 2025.

Which companies will benefit?

Under the latest changes in PDP8, major listed wind power companies are poised to benefit from getting their projects added to the plan. Given the extensive wind power development target from now until 2030, there is hope for suitable mechanisms and an attractive investment environment to spur further market participation.

In 2025, a few measures are expected, including pricing frameworks for wind power and bidding mechanisms for energy projects, providing the foundation for investors to roll out new projects. Some companies, such as REE, HDG, and GEG, would benefit. In the earlier phase, the push to develop wind power also creates opportunities for construction contractors and design consultancies like PC1, TV2, and TV1.

The growth of solar power also offers a strategic opportunity given current tendencies toward "clean energy," especially as investment prices continue to drop. Currently, TV2 and REE, two publicly traded firms, stand to benefit. While REE, which has a sizable hydropower portfolio, has suggested including a number of solar power projects in the proposal, TV2 has already inked contracts with several clients as a power supplier.

Given that PVN (PetroVietnam) and EVN (Vietnam Electricity) have been tasked with spearheading the Ninh Thuận 1 and 2 nuclear power projects, these two businesses—which already have nuclear energy-trained people resources—are anticipated to play important roles in the nuclear energy sector.

Investors may consider opportunities in a few electricity sector stocks. Illustration: ITN

Which stocks to consider?

PC1 (PC1 Group JSC)

This is Vietnam’s leading electrical construction contractor, with grid construction projects worth an average of USD 1.6 billion per year, as outlined in PDP8.

PC1 has already shown early success by winning an EPC contract for a 58MW wind farm in the Philippines (valued at nearly VND 1.2 trillion), affirming the company’s capability to secure additional high-value contracts.

PC1 plans to raise its total electricity generation capacity, focusing on hydropower and wind power. It aims to commission two small hydropower plants—Bảo Lạc A (30MW) and Thượng Hà (13MW)—in 2026–2027 and is exploring opportunities to invest in a wind project in Quảng Trị. Given this outlook, investors may consider PC1 when the stock is around VND 20,000 per share.

NT2 (Nhơn Trạch 2 Power JSC)

Starting in 2025, NT2 will have priority access to gas supply, as it still has a gas supply contract with GAS, while competitors such as Phú Mỹ 2.2 and Phú Mỹ 3 will see their BOT contracts expire in 2025 and thus lose priority access to gas.

NT2 is expected to record a profit milestone from 2025 onward, with a forecast compound annual growth rate of about 35% during 2025–2026—supported by a recovery in its core business. Investors can look at NT2 around VND 20,000 per share.

REE (Refrigeration Electrical Engineering Corporation)

With strategic investment plans that include two hydropower projects (Trà Khúc 2 at 30MW) and a wind power project (Duyên Hải at 48MW) slated for commercial operation in 2026, REE is projected to maintain long-term growth.

To further demonstrate its dedication to growing renewable energy, REE is working to create three more wind farms near Trà Vinh, totaling 344MW in capacity.

Because of its sound financial standing, high profitability, and steady growth prospects, REE is a good choice for a defensive investing strategy in the power industry. Investors could think about purchasing REE at a price of about VND 70,000 per share.