How to seize the chance for buying bank stocks

While the Vietnam banking sector may continue to confront NIM and asset quality issues in 2025, its overall operating environment is projected to improve.

Deposit interest rates to raise up

Vietnam banks have been under pressure to raise deposit interest rates in order to meet the following financial requirements.

First, the gap between deposit and credit growth in 2024 has brought banks' loan-to-deposit ratios (LDRs) closer to the SBV's statutory maximum of 85%.

Second, the credit growth objective for 2025 remains high (about 16 percent).

Third, interbank interest rates are unlikely to fall in the near future, especially given projected exchange rate pressures in 1H2025, making it more difficult for banks to get funds through interbank borrowing.

Deposit rates are likely to rise until 2025 to fulfill the increasing demand for funding. However, the size of this increase will differ amongst banks. State-owned banks are projected to see more mild deposit rate rises (30-50 bps) due to their access to secure funding sources such as Treasury deposits, which alleviates some of their liquidity concerns. Small-scale JCBs with weaker CASA franchises, on the other hand, may experience increased pressure to raise deposit rates by 50-100 basis points in order to attract and maintain customers.

Lending rates, on the other hand, are likely to stay constant in the first half of 2025, in line with the government's strategy of stimulating economic growth and supporting recovery efforts following Typhoon Yagi. Pham Phuong Linh, an analyst at KBSV, predicted that loan interest rates will rise modestly in the second half of 2025, allowing banks to offset the impact of rising funding costs while maintaining profitability.

Positie credit growth

Deposit rates often lag 6–12 months behind increases in COF. Given the 10-120bps rate hike in 2024 and the likelihood of continued moderate increases in deposit rates throughout 2025, Linh predicted that CoF would not improve in 2025, and NIM would remain under pressure in the first half of the year. In the second half, a gradual recovery in lending rates along with a resurgence in retail banking would push IEA yields. Overall, she anticipates a 10-20bps YoY improvement in NIM for banks in 2025.

Linh estimated that a more favorable position in the last two years enables credit growth within the banking sector to reach 15% in 2025, as: (1) the real estate market, after overcoming legal challenges, is expected to strongly recover and further contribute to credit growth; (2) low interest rates will boost credit demand, particularly within the retail banking segment; (3) the trend of FDI enterprises relocating to Vietnam under President-elect Donald Trump's new term Furthermore, the corporate bond market will need more time to fully recover, particularly with substantial maturities scheduled between 2025 and 2026. In this environment, the bank loan channel will remain critical to the economy in the future years.

However, credit growth is expected to be differentiated across banks. Linh expects that retail banks, such as ACB, VIB, VPB, CTG, and STB, will experience robust growth, driven by the expected recovery in the retail banking segment. Banks involved in the restructuring of weak financial institutions, including MBB, VPB, and HDB, will likely continue to receive higher-than-average credit growth limits.

Improvement in asset quality

While asset quality did not improve significantly in the first nine months of 2024, encouraging signs are developing. A progressive drop in NPLs and restructured loans was noted across the quarters, implying that the NPL ratio peaked in 3Q or 4Q 2024. Linh predicts that asset quality would increase throughout the business by 2025. The pressure from rising NPLs is likely to reduce by the end of the year, aided by (i) preferential interest rate loan packages and loan restructuring efforts, and (ii) improved consumer financial conditions as the economy recovers. KBSV anticipates that the NPL ratio will fall by 10-30 bps by 2025.

Following huge write-offs over the previous year, banks' current provisioning buffers have shrunk dramatically. This needs a large rise in provisioning efforts throughout the 2025-2026 timeframe, which is likely to put pressure on earnings growth. Due to the residual risks linked with maturing bonds, private banks would most certainly experience increased provisioning issues. In comparison, SoBs have significantly larger provisioning buffers. Linh believes that the comeback of the real estate sector will boost market liquidity, making it easier to handle NPLs and improving banks' chances of recovering bad debts.

What stocks to pick?

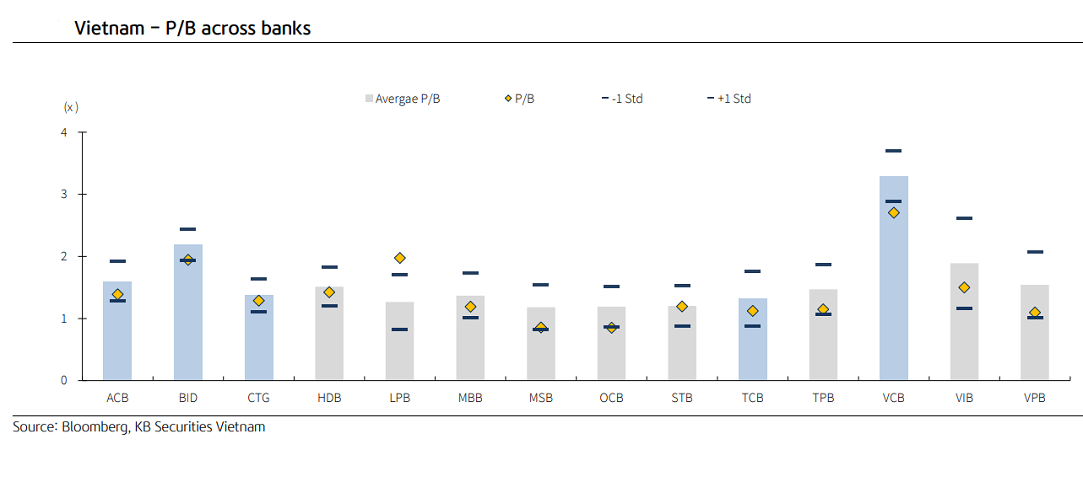

The banking sector is currently trading at a P/B ratio of 1.53x, which is significantly higher than the 5-year average by -1 standard deviation. While the industry may continue to confront NIM and asset quality problems in 2025, the overall operating environment is likely to improve, aided by the ongoing economic recovery and resurrection of the housing market.

"Our top recommendations for 2025 are based on both development potential and risk management. We chose ACB (for its long-term growth and conservative risk-taking), TCB (for its significant growth potential, fueled by the real estate market recovery), VCB and BID (for their stock offering tales), and CTG (for its comparatively low valuation and continuous asset quality improvements). These banks are projected to successfully handle changing market conditions and generate good financial performance by 2025," Linh said.