Increased cash inflows into the stock market: Will the VN-Index skyrocket?

The first trading session of this week recorded the highest influx of capital into the Vietnam stock market in the past five months.

In the March 3 trading session, domestic investors disbursed strongly, pushing liquidity on the Ho Chi Minh City exchange to VND 21,130 billion. Including HNX and UPCoM, total market liquidity approximated VND 23,500 billion. Illustrative photo.

It can be said that after many months of relatively flat liquidity, this session truly marked a positive cash flow.

According to Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities Joint Stock Company (VPBankS), in terms of trading signals, previously, the market’s average liquidity in the morning session was typically only around VND 4,000 – 5,000 billion. However, up to now, even the lowest session has reached about VND 8,000 billion on HoSE alone. In the session on March 3 (provisionally counting the morning session), liquidity reached about VND 10,000 billion, which is a very good improvement compared to the same period or December 2024, despite the fact that foreign investor flows have not improved significantly. The cash flow from domestic investors is showing a positive element.

Regarding the stock components driving the VN-Index, previously, there were many upward waves from 1,230 to 1,300 points primarily driven by VN-30, with large-cap stocks such as BVH and GVR being the main contributors. These large-cap, moderately liquid stocks had a significant influence on the index. However, in this current wave, bank stocks were the first to rise (in the last week of January), followed by other sectors. Up to now, there has been an interweaving of money flows across various industries without exiting the market, Mr. Duong noted.

According to statistics, around 52 stocks across the exchange have recorded higher growth than the VN-Index. This indicates that capital flows may continue to stay, and market breadth will improve in the future, even if the index has yet to see a strong breakout.

Mr. Dao Hong Duong also stated that he does not anticipate the VN-Index reaching 1,400, 1,450, or 1,500 points. The index could surpass any forecast if certain favorable factors emerge. Looking at current market conditions, from a technical standpoint, it is quite positive: prices have increased for six consecutive weeks, trading volume has risen, and the 1,300-point resistance has been surpassed. The market will fluctuate within the resistance zone of 1,280 to 1,305 points, similar to 2023 when all waves peaked in this range.

The market is still maintaining its strength, as evidenced by indicators such as RSI and MSI in the 14- to 20-day range. There are no current signs of a correction, and the market remains in an accumulation phase after the six-week-long upward wave, Mr. Duong added.

According to VPBankS's technical specialist, two support levels are quite reasonable. Over the past six weeks, the index has effectively surpassed the first resistance zone, which is located between 1,280 and 1,300 points. Investors who want to be more cautious can use the 200-day MA to find the resistance at 1,265 points.

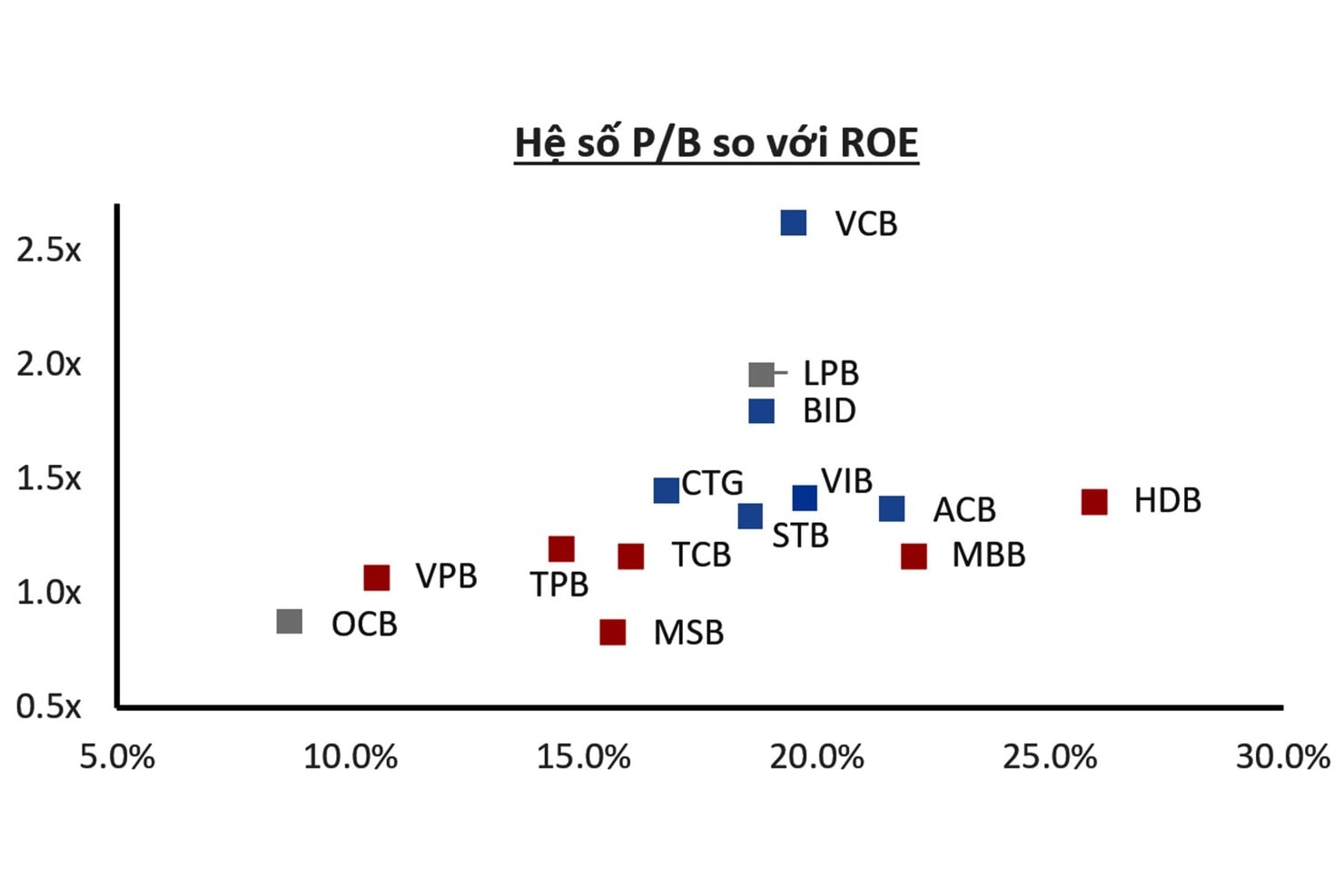

The expert pointed out that, in terms of the attractiveness of capital flows across different stock market sectors, the banking industry has the greatest E/P ratio—higher than the VN-Index—based on after-tax profit. Currently, banks' annual E/P ratio hovers around 10%. Bank stocks continue to be particularly appealing when compared to bank deposits or other investment assets, with a P/B ratio of roughly 1.55.

Banks are attractive with low valuations. According to VinaCapital, ACB, VCB, CTG, BID, and STB together with TCB, VPB, MBB, and HDB represent two groups of bank stocks with growth prospects based on their fundamentals and policy benefits.

Second, the household goods sector has an E/P ratio of about 7.7%, a P/E of 13 times, and a P/B of 1.56 times. The travel and entertainment sector currently has a relatively high P/B, but its E/P ratio is now around 7%, reflecting a very positive EPS recovery after three consecutive quarters of profit growth.

Next, the real estate sector has a positive factor of low valuation. With a P/E of around 6.4 times, a P/B of 1.23 times (slightly higher if excluding Vin stocks), this is a very good investment opportunity.

There will also be unique chances in other industries. For instance, with recent changes, the basic resources sector—particularly the anti-dumping duties roadmap—is exhibiting very positive prospects, notably for steel. Furthermore, the chemicals group's profits have already dropped as a result of the challenges of 2024. Because commodity prices are cyclical, this sector's profits may increase once more in 2025.

The food and beverage sector still holds some opportunities. SAB and VNM are enterprises with moderate growth, but there will be stocks with different stories, such as MSN, tied to mining. The recovery of retail and consumer goods has helped MCH’s profit and EBITDA grow by double digits in 2024. Additionally, MSR has certain advantages, with a large copper inventory of around 10,000 tons, and copper prices are moving positively; there is also an agreement to sell.

The retail sector’s valuation already reflects the recovery of 2024, but its prospects for further recovery in 2025 remain intact. In particular, retail businesses outside the ICT and CE segments are anticipated to see a stronger rebound in profit growth.

Finally, according to Mr. Dao Hong Duong, the securities sector should not be overlooked in 2025.