Can VN-Index surpass 1,300 points?

According to analysts from Dragon Capital, the effectiveness of policy implementation in practice is a key factor for investors to assess the Vietnam stock market outlook.

Analyzing the stock market based on Q4/2024 and the past year’s results, Ms. Dang Nguyet Minh, Head of Research at Dragon Capital, noted that corporate earnings within the VN-Index saw significant growth in Q4/2024, exceeding initial forecasts. Revenue increased by 19.7% year-over-year (YoY), while net profit after tax (NPAT) surged by 32.8% YoY, both reaching record-high quarterly levels.

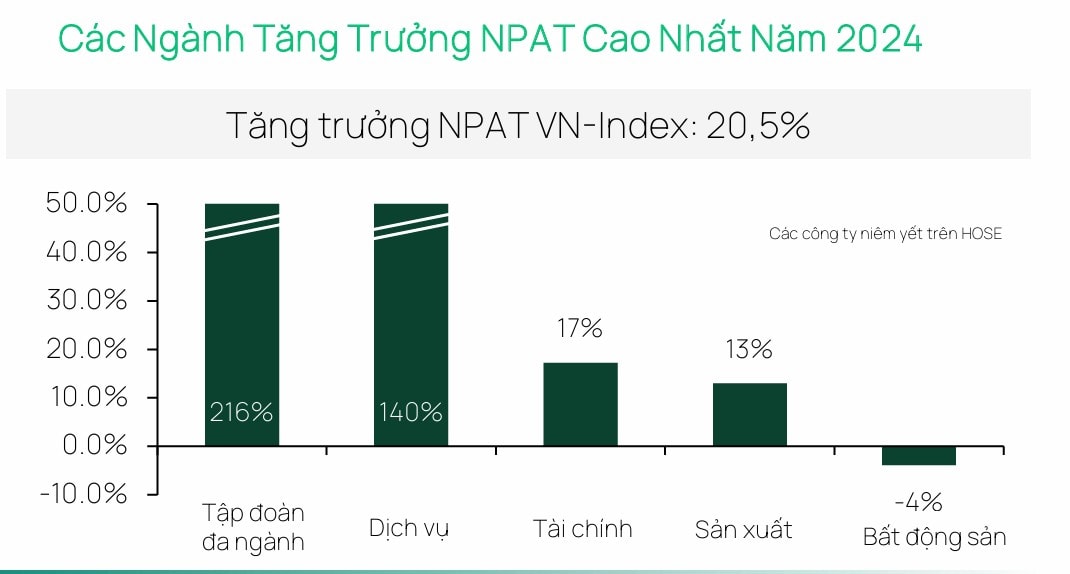

Sectors with the Highest NPAT Growth in 2024. Source: Dragon Capital

As a result, VN-Index in 2024 grew by 10.7%, while NPAT increased by 20.5%. Notably, Dragon Capital’s Top-80 portfolio outperformed the broader market, with revenue rising by 13.9% YoY and NPAT increasing by 23.6% YoY, according to Dragon Capital experts.

This trend is also a major feature of January 2025, according to Ms. Minh, because corporate profit recovery occurred more quickly than anticipated. A recovery in economic activity that bolstered revenue growth was one of the main growth drivers from a macroeconomic standpoint. Vietnam's GDP expanded by 7.1%, which is among the fastest growth rates in the last 15 years. The GDP per capita rose by USD 337 to USD 4,700, while imports and exports expanded by 16.1% and 15.5% year over year, respectively. In addition to increasing revenue, companies' gross profit margins grew as their cycles of inventory reduction were finished. In addition to lowering financial expenses, lower interest rates also aided in the expansion of profits.

From an industry perspective, the financial sector remained the primary growth driver in 2024, contributing 58.7% of total VN-Index profits and accounting for 48.1% of the total YoY profit growth.

Although the services sector represented only 8.2% of total profits, it was the second-largest growth driver, with NPAT surging 2.4 times YoY, contributing 27% of total profit growth. Similarly, conglomerates, despite accounting for just 4.3% of total profits, contributed 16.5% of the total growth.

The manufacturing sector was the second-largest profit contributor, accounting for 17% of total profits, but only 12% of total growth due to weaker performance in energy, chemicals, and utilities.

Real estate was the only sector to record a decline, accounting for 11.8% of total profits, with NPAT falling by 4% YoY. However, Dragon Capital experts noted that mid-cap real estate companies showed quarter-on-quarter improvement, signaling a market recovery led by the retail segment.

Experts believe that as the government accelerates reforms to boost economic growth, profit growth expectations remain strong at 15-17% for 2025.

"In our meetings with businesses in January 2025, we observed a significant increase in business confidence. Companies are not only optimistic but are actively preparing for large-scale projects over the next 3-5 years. The government is closely collaborating with leading enterprises, implementing incentive policies to develop human resources, provide tariff support, and facilitate data sharing, creating a strong foundation to enhance Vietnam’s competitive edge in manufacturing and technology," Ms. Nguyet Minh shared.

The real estate sector, a crucial pillar of the economy, is showing significant improvement. Real estate developers are seeing legal bottlenecks being resolved at a faster pace, while market absorption rates remain stable. Companies with clear legal frameworks are accelerating infrastructure development and bringing projects to market. Confidence in the banking sector is also rebounding, as financial institutions enter 2025 with positive growth expectations.

Credit growth, which had been tight for several years, is gradually loosening. Wholesale credit is gaining momentum, and stable asset quality is allowing banks to be more proactive in capital deployment.

With improved business confidence and investment-supportive policies in place, the investment environment is turning more positive, helping to boost market sentiment. However, alongside domestic tailwinds, external factors could still influence the broader outlook. "Investors should closely monitor the actual effectiveness of policies to gain a clearer understanding of the market recovery prospects," Dragon Capital experts advised.

Looking at the broader macroeconomic and stock market outlook for 2025, Mr. Tran Hoang Son, Chief Market Strategist at VPBank Securities (VPBankS), compared the market’s trajectory to the transformation of a snake: "Last year, the market fluctuated like a dragon, but this year, it will be a story of a snake stretching and growing strongly."

.jpg)

Vietnam’s Stock Market Expected to Attract Foreign Investors Amid Regulatory Improvements for Market Upgrades. Illustration.

Mr. Son highlighted several positive developments. First, from a macroeconomic perspective, the government has set a growth target of 8%. Historically, when GDP growth is strong, supportive policies such as increased public investment and credit expansion accompany it, providing liquidity and aiding industry recovery.

"As per our previous forecasts, in addition to strong economic growth, we are also expecting positive catalysts such as Vietnam’s potential stock market upgrade. In March, FTSE Russell is expected to release an updated report on Vietnam. I personally anticipate that Vietnam's stock market will be upgraded by September," Mr. Son predicted, reiterating prior expectations shared during VPBankS’ economic outlook seminar. Sectors such as banking, securities, and particularly real estate are expected to benefit significantly, with the potential for price increases and strong recoveries. If credit growth reaches 16-18%, banks will have ample room to continue expanding their profits.

Secondly, the public investment sector will benefit from the government’s efforts to accelerate infrastructure spending from the beginning of the year. Many publicly listed infrastructure-related stocks have already responded positively to this news.

Many stocks in the real estate industry are still trading close to two-year lows. Real estate equities should see a significant recovery in 2025 if credit expansion quickens and industry issues are fixed.

In terms of market movements, Mr. Son said that the VN-Index may continue to rise in early 2025 and might even surpass the 1,300-point barrier, hitting 1,310 or a little higher. Nevertheless, the index can experience a correction following this first increase. Liquidity levels are still too low to support a robust rally, even in the face of several favorable catalysts and robust sector growth.

From an information perspective, Mr. Son advised investors to wait for updates on credit growth and market upgrades. As a result, the most favorable period could be after Q2, from July to September, when the market upgrade narrative gains traction and helps the VN-Index break through the 1,300-point barrier more decisively.