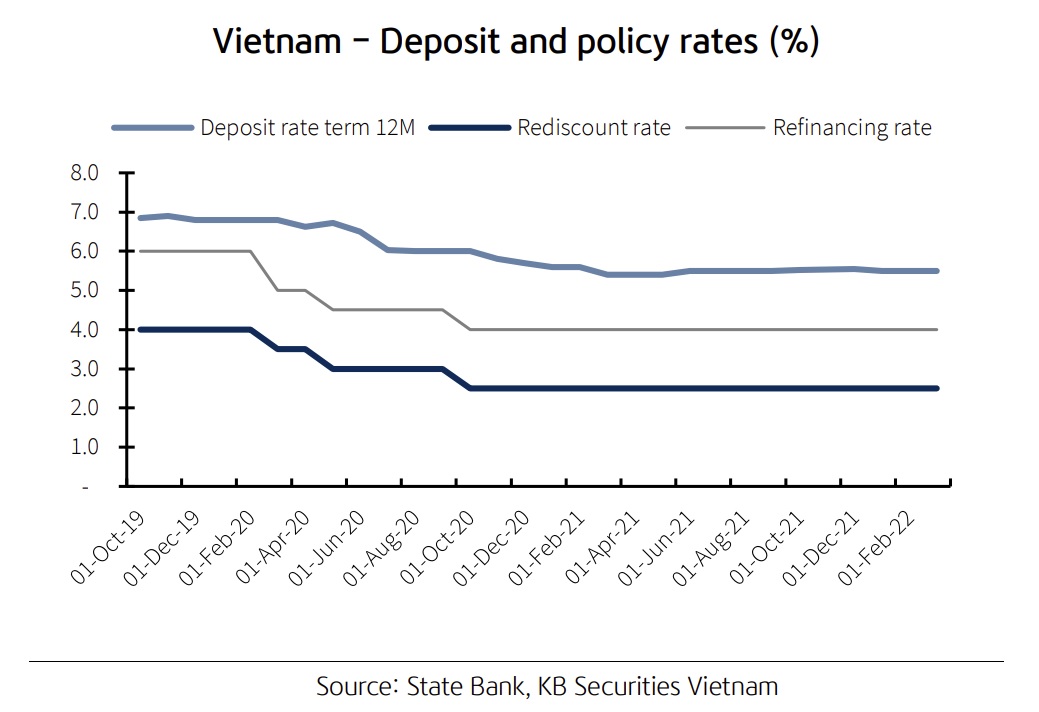

Upward pressure on deposit and lending rates

Deposit rates may inch up by 0.5% in 2022, while lending rates will likely increase slightly, according to KB Securities.

In the first quarter of 2022, deposit rates, especially in small-sized commercial banks, inched up for terms less than 12 months of maturity.

In the first quarter of 2022, the State Bank of Vietnam (SBV) continued to keep policy rates unchanged and maintain a low cost of funds so that credit institutions could continue cutting lending rates to support pandemic-hit businesses, accelerating the economic recovery. According to the SBV, credit growth hit 5.04% year-to-date in 1Q22 compared to 2.16% year-to-date in 1Q21, reflecting a significant increase in capital absorption in the new normal.

In 1Q22, interbank rates rose to a new base, with overnight, one-week, and one-month interest rates increasing by 67 bps, 62 bps, and 43 bps compared to the end-2021, respectively. Notably, interbank rates increased sharply by 135bps in February 2022 from the end of the year. It reflects liquidity shortages across banks during the peak season of the Tet holiday.

In the first quarter of 2022, deposit rates, especially in small-sized commercial banks, inched up for terms less than 12 months of maturity. However, the fluctuation was relatively small (0.5%), indicating that deposit rates remained stable at low levels.

Rising pressure on Vietnam’s inflation is attributable to the growing demand for raw materials for production amid disrupted supply chains, which causes commodity prices to surge across the globe. In addition, the conflict between Russia and Ukraine and the sanctions against Russia, the leading natural gas exporter and the second-largest crude oil exporter in the world, pushed global energy prices to fresh record highs. Rising inflation has also put pressure on interest rates in Vietnam.

Mr. Tran Duc Anh, Head of Macro and Strategy of KB Securities, expects the monetary policy to remain supportive until the end of 2022. The SBV will likely keep the policy rates unchanged and target credit growth at 14%, an increase equivalent to the increase in 2021, given elevated inflation pressures with inflation projected at 3.8% in the base case scenario.

However, Mr. Tran Duc Anh said deposit rates would hit rock bottom and increase in the second half of 2022 due to: (1) banks’ raising deposit rates to keep real interest rates positive and attractive enough to maintain the competitive advantage given rising inflation; and (2) growing credit demand in the wake of the economic recovery. Deposit rates will likely increase marginally by 0.5%, corresponding to the base case scenario where inflation rises by 3.8%.

"Lending rates tend to increase in line with deposit rates. However, it may increase by only 0.2 - 0.3% as the Government asks banks to maintain lending rates at low levels to aid pandemic-hit businesses", Mr. Tran Duc Anh forecasted.