Upward pressure on deposit rates

Many finance analysts expected deposit rates to rise higher despite the slowdown in credit growth.

Vietcombank announced an increase in deposit rates in July 2022.

>> Vietnam’s monetary policy will remain accommodative

The State Bank of Vietnam (SBV) is likely to stick to its own pace with a balance of attention to "domestic recovery" and "macro-economic stability".

Credit quotas to be extended

The SBV will focus on controlling inflation and stabilizing the macroeconomy while paying attention to the goal of low lending rates to support businesses and the economy to recover. "We see an increasing likelihood that the commodity price decline provides the headroom for SBV to maintain an extended pause in policy rate hikes this year.""In addition, the Government has plenty of room through reducing taxes and fees to curb inflation, and the SBV does not need to rush to raise the policy interest rates this year", said Mr. Dinh Quang Hinh, analyst at VNDirect.

According to the SBV, until July 26, 2022 credit growth increased by 9.42% ytd (16.3% yoy). Vietnam’s credit growth is kept at 14% yoy in 2022F. Mr. Dinh Xuan Hinh expects the SBV to raise credit quotas for some commercial banks from the end of 3Q22. Credit capital flows will be prioritized for manufacturing and services, especially in priority businesses such as industry, export-import activity, agriculture, forestry, and the fishery sector. In addition, the SBV will carefully control credit flows into high-risk areas such as real estate, securities, and BOT projects.

Regarding lending interest rates, the SBV is implementing an interest rate compensation package with a scale of VND43,000bn. It provides lending rates of only 3-4% per year for businesses severely impacted by the COVID-19 pandemic, such as (1) small and medium-sized enterprises, (2) businesses involved in a number of key national projects, and (3) businesses in specific industries (tourism, aviation, transportation).

However, the implementation of the interest compensation package is slower than expected, so this policy has little impact on the loan interest rate in 2022.

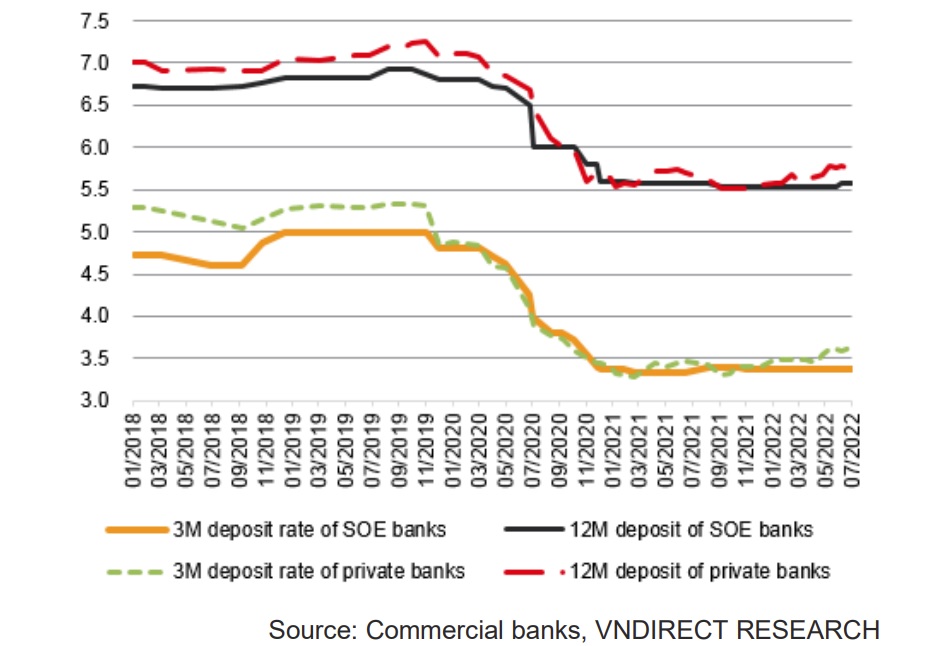

Deposit interest rates rose higher despite the slowdown of credit growth in July 2022 (%)

Deposit rates burden

We witnessed a sharp increase in interbank interest rates in July 2022. Specifically, the overnight interest rate increased to 5% on July 29, plus 423 basis points from the end of June. Interbank interest rates for longer terms (from 1-week to 12-month terms) also increased by 45–403 basis points in July 2022. Interbank interest rates rose sharply in July after the State Bank boosted net withdrawals through bills and foreign currency sales. This caused a large amount of VND to be net withdrawn from the banking system in July.

>> The pressure to increase deposit interest rates will happen at the end of the year

We also saw an increase in deposit interest rates in July. As of 27 July, 2022, the 3-month term deposit rates and the 12-month term deposit rates of private banks edged up by 9bps and 16bps, respectively, compared to the level at the end of last month. Thus, since the beginning of 2022, the 3-month term deposit rates and the 12-month term deposit rates of private banks have increased significantly by 38 and 44 basis points, respectively.

Meanwhile, the 3-month term deposit rates and the 12-month term deposit rates of state-owned banks also increased by 3 basis points, as Vietcombank announced an increase in deposit rates in July. Since the beginning of this year, the 3-month term deposit rates and the 12-month term deposit rates of private banks have inched up by 3 and 7 basis points, respectively.

Mr. Dinh Xuan Hinh expects deposit rates to increase further in the coming months due to (1) high credit demand amid economic recovery, (2) deposit growth was slow in 7M22 (4.2% ytd, 9.9% yoy) due to less attractive deposit rates compared to other investment channels, (3) FED is expected to raise policy rates by 100-125 basis points until the end of 2022, (4) strong USD put pressure on Vietnam’s exchange rates and interest rates.

"Deposit rates would increase by 30-50 basis points in 2H22F. We see the 12-month deposit rates of commercial banks climbing to 6.0-6.2%/year (on average) at the year-end of 2022, which is still lower compared to the pre-pandemic level of 7.0%/year", said Mr. Dinh Xuan Hinh.