US dollar at risk of declining over the medium term

In our view the US dollar is trading poorly and this makes us feel that it is more likely to decline over the medium term.

What do we mean when we say that the US dollar is trading poorly? One thing we don’t necessarily mean is that the dollar is crashing. Sure, the US dollar has been slow out of the blocks this year. But the fall against other G10 currencies, using the DXY index, is less than 2% so far. That’s hardly catastrophic. So, what do we mean when we say it is trading poorly?

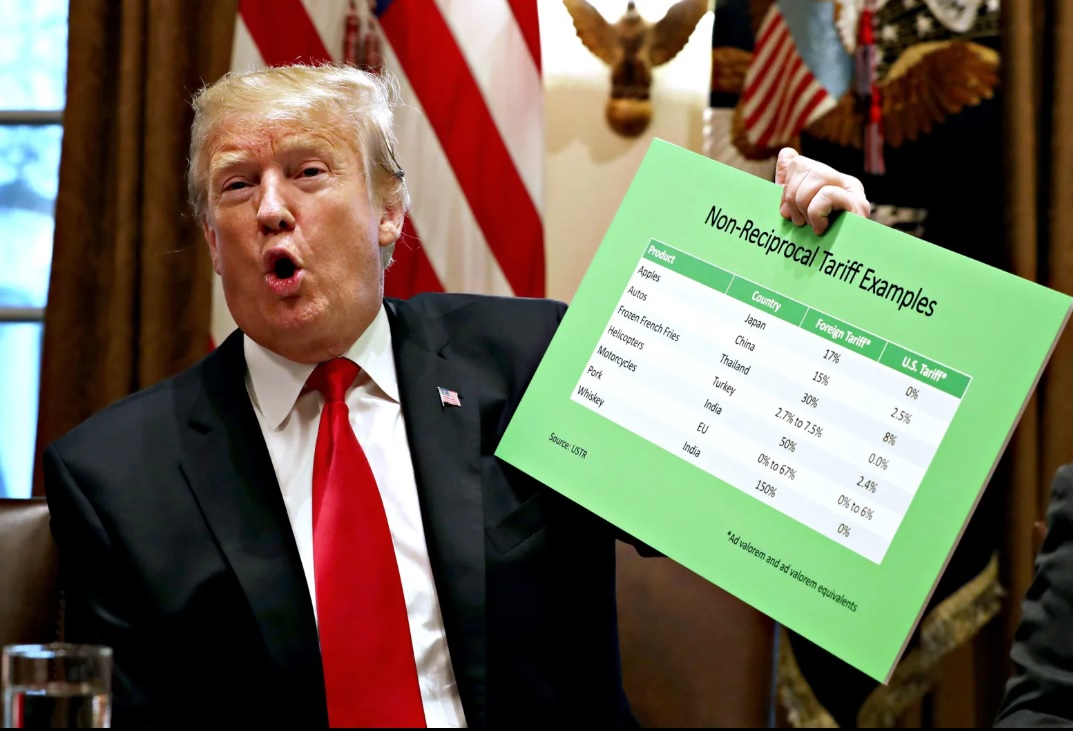

In short, we feel that the US dollar is trading poorly relative to what the news surrounding the US dollar might suggest. Put it this way. If we were told a few months ago that the coming period would see the Fed go into pause mode on rates, while others still cut. And if we knew that President Trump would start to impose tariffs (on China) and threaten them elsewhere (Canada, Mexico and global reciprocal tariffs) we would have probably predicted a stronger US dollar today than the one that we’re currently seeing.

We don’t know why the market has not responded more to the shift in relative monetary policy or Trump’s tariff threats and actions. It might be that these things have been anticipated in advance with traders and investors so heavily invested in a bullish US dollar view that there’s no one left to open up new long positions.

In the same vein, traders and investors might have been so bearish for other currencies, particularly the euro and the pound, that it has only taken the merest hint of better economic outlooks in the euro zone and the UK to lift these currencies against the US dollar. Perhaps another, rather more insidious possibility is that, while there has been a lot of positive talk of how Trump’s policies will lift the US dollar, there’s a nagging concern in the market that it might all end in tears.

That tariffs either won’t generate much in the way of revenues if they go ahead, or just show Trump up as someone who makes threats but falls short when it comes to actions if they do not. There could be concern that taking a chainsaw to government departments, as the new Department for Government Efficiency (DOGE) has done will create fallibilities that we don’t yet know about, in areas such as consumer protection for instance. It might be that the market fears tariffs more for their growth-sapping properties in the US than their inflation-lifting capabilities.

For while a relative tightening of US monetary policy borne of robust growth might be good for the US dollar, a panicked rate hike in response to out-of-control inflation is not. A clue to this can be found in the stock market. For the US dollar’s outperformance in recent years may simply be a reflection of the stock markets outperformance (US exceptionalism). Data certainly shows that foreign investors have ploughed cash into the US equity market. The Fed’s flow of funds data puts foreign equity holding at USD16tr in Q3. That’s almost double the level seen just before the pandemic.

In contrast, foreign holding of treasuries is up by around a quarter. Of course, a chunk of this rise in equity assets reflects valuation effects but, even so, the stock and dollar story do seem intertwined and hence the relative weakness of US stocks so far this year might explain the slide in the dollar.

But does the poor performance of the US dollar so far this year necessarily imply that further declines lie ahead? Or should we just assume that the fall is temporary and the greenback will bounce back? We think it is a bit of a mixture. On one level we are a bit disconcerted that the market has not lifted the dollar in response to what’s happened with monetary policy and tariffs. Hence we are aware that the US dollar could rebound, and that’s why we have a 3-month view for euro/US dollar to reach the 0.95-1.0 range. But, at the same time, we do have significant concerns about the way in which US policy is heading that, even if not initially, will ultimately prove detrimental to the economy, stock market outperformance and hence the US dollar. And it is this that informs our call for the euro to rise to the 1.10-1.20 range over the next year, or two.