USD/VND exchange rate could remain stable

Kis Vietnam expected that the USD/VND exchange rate would maintain stability in the near future.

From June 17 to June 21, USDVND witnessed a fall of 0.04% compared to the previous week

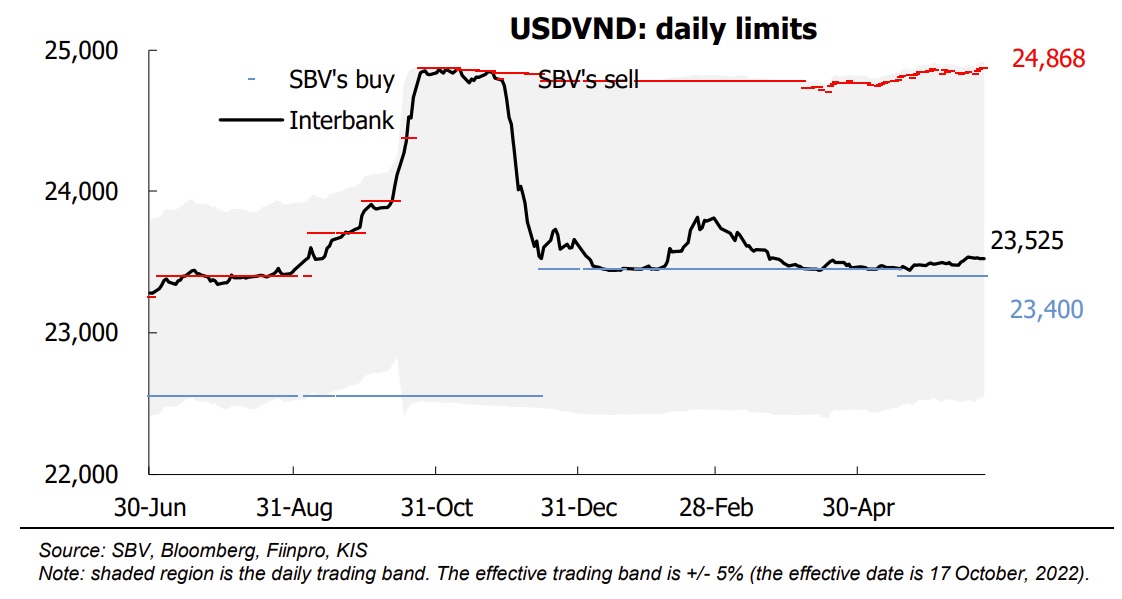

From June 17 to June 21, USDVND witnessed a fall of 0.04% compared to the previous week, posting at VND23,525 on June 21. On the contrary, the U.S. Dollar index (DXY), which measures the value of the greenback relative to a basket of foreign currencies, jumped 0.65% from 102.12 to 102.9, attributed to the hawkish outlook for two additional interest rate hikes this year following Powell's testimony.

Conspicuously, VCB's bid/ask veers into the same downward trend while the shadow market's bid/ask observes a significant increase. Specifically, VCB's bid/ask declined by 20 basis points (bps) and anchored at VND 23,320/23,690, while the shadow market's bid/ask rose significantly by 60 bps, anchoring at VND 23,574/23,5625.

The State Bank of Vietnam (SBV) has decided to increase the selling price of the greenback to VND24,868. This decision is regarded as a cautious measure to safeguard the value of the Vietnamese dong following a hawkish stance from the Federal Reserve (FED). However, the USD buying price remained unchanged at VND 23,400. It is anticipated that the USD selling price will continue to increase in the coming weeks as a preventive measure against the USD outflow.

As a result, the exchange rate for USD/VND is 125 bps higher than the buying price, resulting in no enrichment in USD from the SBV. Based on KIS’s estimates, the SBV has raised its foreign exchange reserves to approximately USD 6 billion.

The sluggish lending activities during the first half of 2023 have resulted in the funding costs, such as the overnight (ON) rate, plummeting into the sub-1% range this week. As mentioned earlier, the ON rate dropped to 0.9%, significantly below the current Fed fund rate of 5.25%. This has increased the appeal of investing in U.S. assets, potentially causing capital to flow out of Vietnam and into the U.S. Consequently, this could exert downward pressure on the value of the Vietnamese dong (VND). Additionally, the anticipated two additional interest rate hikes by the Federal Reserve later this year, potentially bringing the target Fed fund rate to 5.6%, could further negatively impact the VND.

However, Kis Vietnam expected that the USD/VND exchange rate would maintain stability in the near future. First, the State Bank of Vietnam (SBV) has adopted flexible monetary policies aimed at stabilizing the exchange rate. Second, as aforementioned from previous reports, Vietnam this year received a significant USD inflow from three channels, such as M&A activities, trade surplus, and remittance inflow. Thus, Vietnam’s government possesses sufficient resources to prevent the devaluation of the domestic currency.

Among the currencies tracked by Kis Vietnam, the Vietnamese Dong (VND) remains resilient, maintaining its strength relative to the greenback. In fact, it has appreciated by 0.52% year-to-date (YTD). Besides, the Eurodollar (EUR) continued to exhibit strength amid a hawkish view from the ECB, with a YTD appreciation of 2.71% against the USD, double from last week. Following a jump in the DXY index during the previous week, the devaluation of currencies against the U.S. dollar has been extended in several countries. Notably, China, Korea, and Thailand have extended their price drops to 3.93%, 2.20%, and 1.18%, respectively. Furthermore, Japan continued to extend the depreciation level to 7.67% YTD against the greenback.