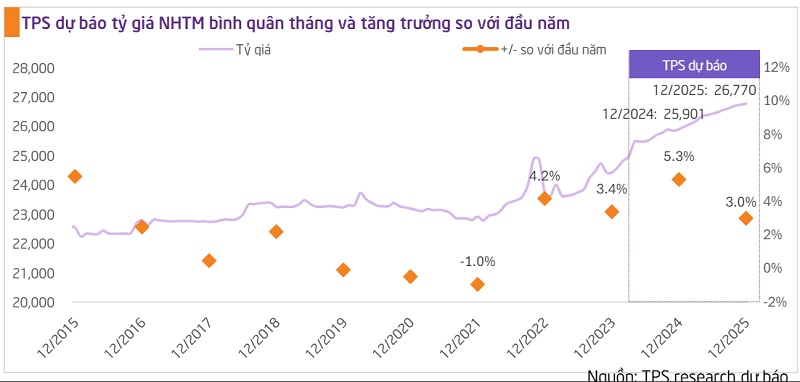

USD/VND rate might rise by 5.3% by the end of 2024

Recently, the USD/VND rate in the free market unexpectedly increased, possibly reigning short-term exchange rate pressures.

Over the last ten days, the USD/VND rate on the free market has risen by roughly 100 VND, trading at around 25,950, extremely close to the previously traded figure of 26,000 VND per USD.

The trading exchange rates at commercial banks are listed close to the slight increase of the central exchange rate. (Illustration: Quốc Tuấn)

On June 25, the free market USD fell slightly, trading between 25,820 and 25,920 VND/USD.

The State Bank of Vietnam (SBV) did, however, make only minor adjustments to the official exchange rate.

From June 17 to June 21, the SBV raised the central exchange rate by 7 VND from the previous weekend, bringing it to 24,256 VND/USD. The USD selling price at banks followed the increase in the central exchange rate, remaining close to the cap of 25,468 VND/USD. Last week, the interbank currency rate ended at 25,455 VND/USD, which remains higher than the SBV's intervention selling price of 25,450 VND/USD.

On June 25 this week, the central exchange rate was announced at 24,253 VND/USD, slightly lower than the rate listed at the end of last week.

Previously, on June 24, the SBV changed its T-bill issuance operations, with 10,150 billion VND drawn through the T-bill channel and 8/8 members winning the bid. The duration of the T-bills was lowered from 20 days in the previous session to 14 days, however, the winning interest rate stayed at 4.25% annually. Following this, on June 25, the SBV withdrew 25,000 billion VND. The T-bill auction had 13 members with a 14-day period and an annual interest rate of 4.3%. Compared to the previous day, the winning bid volume grew by about 15,000 billion VND, while the interest rate increased by 0.05%. However, the T-bill's duration was lowered from 18 to 14 days.

The T-bill term adjustment, with unchanged winning interest rates and a slight subsequent increase, is seen as aiming to increase the attractiveness of this tool, thereby raising VND interbank interest rates in the face of ongoing exchange rate pressures and a significant drop in interbank rates at terms less than one month in recent sessions.

On June 24, the overnight interbank interest rate was at 3.54%. Short-term rates, such as one week and two weeks, also reached 4.07% and 4.42%. As a result, as indicated by the SBV in the last two weeks, average interbank interest rates are falling, putting pressure on the USD price to fluctuate quickly on the market.

Overall, exchange rate pressures are less severe than they were previously, however, the US Dollar Index (DXY) continues to approach danger zone of 105 - 106, influencing global FII flows and financial asset prices.

According to FIDT Research, various short-term variables are heavily impacting the DXY: (1) monetary policy differences, with the US Federal Reserve (Fed) maintaining interest rates while the European Central Bank (ECB), the Bank of Canada (BoC), and the Swiss National Bank (SNB) have cut rates in recent meetings; (2) European regional political risks, putting pressure on the Euro; (3) global risks related to the Russia-Ukraine and Israel-Lebanon (Hezbollah) conflicts; and and (4) risks related to the "trade war" between the US-China and Europe-China.

In the short term, the strength of the USD is outperforming other major currencies in the basket, such as the EUR, JPY, and CHF. Particularly, the exchange rate pressure in the global foreign exchange market is worsening as the JPY continues to weaken to its lowest historical levels (159 – 160, approaching the monetary intervention zone of the Japanese Ministry of Finance).

This pressure has a short-term influence on the USD/VND rate (particularly given the greenback's recent market response). However, the SBV has been implementing a variety of steps on a constant basis.

Among them is the continuing execution of gold sales through state-owned banks and SJC to maintain low gold prices; the shortage of gold and market demand must "balance" between transparent trading requirements and gold prices being extremely near to international pricing. Furthermore, the SBV has begun selling USD to "mitigate exchange rate pressures," with an expected value of around 500 million USD during the week of June 17 - June 21.

Monthly average exchange rate

"The USD/VND exchange rate pressure is worsening in the short term, primarily due to the strong upward trend of the USD. Exchange rate pressures significantly impact factors such as: (1) SBV's exchange rate pressure mitigation activities like: selling USD, increasing OMO interest rates, and regulating tighter liquidity; (2) short-term FII flows in the stock market; (3) impacts on medium- to long-term exchange rate expectations," FIDT Research comments.

According to TPS Securities, as of June 21, 2024, the commercial bank exchange rate has increased by 4.3% from the beginning of the year to date. Although the exchange rate has cooled compared to a few days earlier, it still remains relatively high. Compared to the beginning of 2024, the commercial bank exchange rate exceeded 3%, starting from mid-April 2024 when a series of positive US economic news was announced - reducing expectations of the Fed accelerating interest rate cuts. Additionally, due to strong new export orders and an increase in the import of raw materials for production, as well as a sudden increase in gold imports with rising gold prices and complex geopolitical risks, the confluence of many factors has put significant pressure on inflation and the exchange rate.

According to TPS's ARIMA univariate forecasting model findings, assuming present conditions hold, the exchange rate might rise by 5.3% from the start of the year to the end of 2024. However, the analysis team of this securities firm believes that more favorable factors for the exchange rate will emerge by the end of the year, such as: (1) the trade balance returning to a surplus with strong export growth, (2) the US cutting interest rates, and many countries joining BRICS, causing the USD to fall. As a result, the commercial bank exchange rate is predicted to rise by around 3% to 4% in 2024.