Vietnam Banks: Indirect Impacts Under "Trump 2.0" Era

Following the outcome of the United States presidential election, Vietnam's banking industry is expected to see indirect consequences in the near future.

Proposals to increase trade tariffs and perspectives on the U.S. Federal Reserve's (Fed) policy interventions are issues being closely monitored by analysts and investors as Donald Trump gradually assembles his administrative team for his next term.

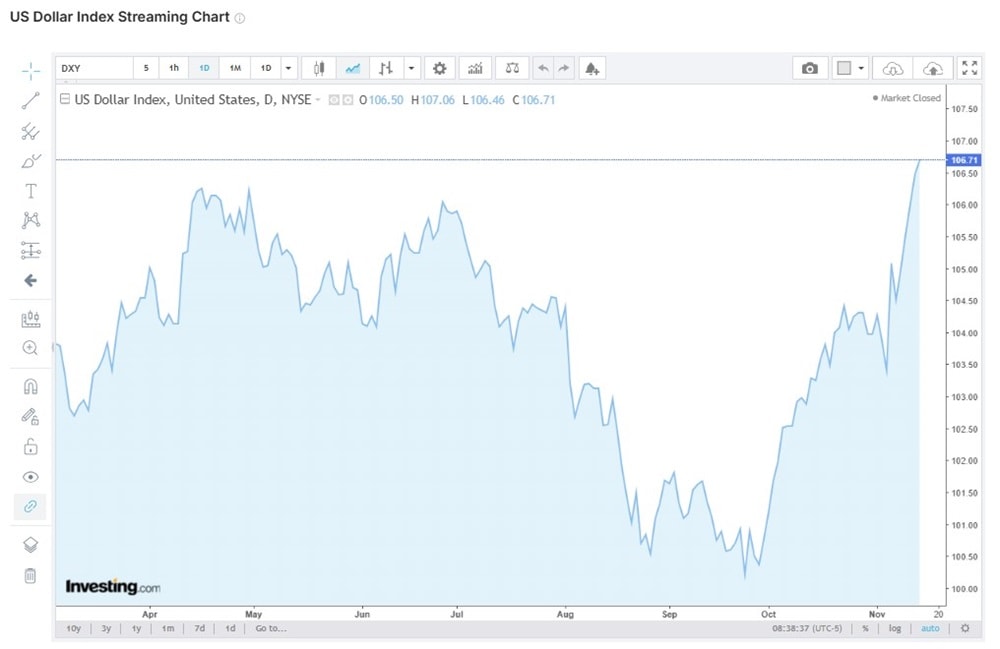

DXY pressure has brought exchange rate risks back globally. Photo: I.T

Among these, the proposal to raise trade tariffs could significantly affect export-driven economies like Vietnam, indirectly impacting the banking sector, according to Vietcap Securities.

Credit Growth Impact

Regarding credit growth, Vietcap experts believe increased tariffs could disrupt trade activities between Vietnam and the U.S., potentially encouraging FDI companies to shift from "friendshoring" to "onshoring."

In this scenario, credit growth could be negatively affected due to a decline in export volumes, impacting not only exporting enterprises but also suppliers of raw materials to exporters. Another potential consequence could be reduced labor income, leading to a drop in domestic consumption and borrowing demand.

However, Vietcap observes that during Donald Trump's first term, greater taxes on Chinese imports helped to grow Vietnam's exports to the United States via a "nearshoring" approach. A similar result may occur if the United States slaps larger tariffs on China than on other nations, thereby cushioning some negative effects on Vietnam's credit growth. The experts warn, however, that it is unclear if these advantages would sufficiently balance the credit demand pressures generated by tariff rises.

Michael Kokalari, CFA, Chief Economist and Head of Macroeconomic and Market Research at VinaCapital, argued in a rapid report after Trump’s re-election that fears of tariffs might be overstated. According to him, despite concerns over tariff weapons in the U.S.-China trade war, Vietnam would maintain its competitive advantage in attracting FDI compared to other countries. The factors making Vietnam appealing to manufacturers, which have already attracted billions of dollars in FDI, are expected to persist. However, he also suggested that Vietnam would benefit from proactively addressing its trade surplus with the U.S. before it becomes a significant concern for the new administration.

Interest Rates Impact

Trump's administration might strengthen the US currency because higher tariffs could generate inflation in the US, demanding tougher monetary policies from the Fed than the present expectation for rate decreases in the coming years. According to Vietcap specialists, a rising USD/VND exchange rate might cause capital outflows from Vietnam, encourage exporters to hoard USD, and put pressure on the VND currency. This would hinder Vietnam's ability to sustain its accommodating monetary policy.

Since Trump’s victory, the U.S. Dollar Index (DXY) and digital currencies like Bitcoin have strengthened. Concerns over a stronger dollar under "Trump 2.0" create immediate and future exchange rate pressures. The USD/VND exchange rate has surged close to the upper limit set by the State Bank of Vietnam (SBV) from a depreciation of around 1% during the cooling period. However, in the short term, the exchange rate is forecast to decline by year-end, supported by factors such as FDI inflows, trade surpluses, remittances, macroeconomic stability, and SBV's flexible policies.

Non-Performing Loan (NPL) Ratio

The potential negative impacts on credit growth and interest rates could lead to an increase in NPL ratios. Export-oriented industries and supply chains could be adversely affected by shifts in demand and exchange rate pressures, according to Vietcap experts. This forecast is concerning given the banking system's need to improve asset quality, with diverse NPL ratios reported across banks.

For example, in Q3 2024, Vietcap observed that the overall NPL ratio remained flat compared to the previous quarter, while Group 2 loan ratios improved, declining for two consecutive quarters (-10 basis points QoQ and -60 basis points YoY). However, there were variations across banks, with some (BID, MBB, STB, TCB, TPB, LPB) experiencing higher NPL ratios. Annual credit costs slightly decreased QoQ but remained elevated at 1.2% (-20 basis points QoQ), while the loan loss reserve (LLR) ratio remained stable. On a positive note, the declining Group 2 loan ratio indicates reduced pressure for future NPL formation.

Net Profit

In a worst-case scenario for each of the above factors, banks’ net profits could face challenges due to declining credit growth and rising NPL ratios. Experts believe that domestic economic growth could alleviate some pressures, partially offsetting the decline in export demand.