Vietnam economy still faces challenges in 2Q23

Vietnam continues to face challenges in 2Q23 after a tough 1Q23 economic performance, said HSBC.

Despite an annual credit growth target of 14-15% and the SBV’s two moves to cut its key interest rates in March, loans only grew around 2% by mid-April.

>> Headwinds for Vietnam economy

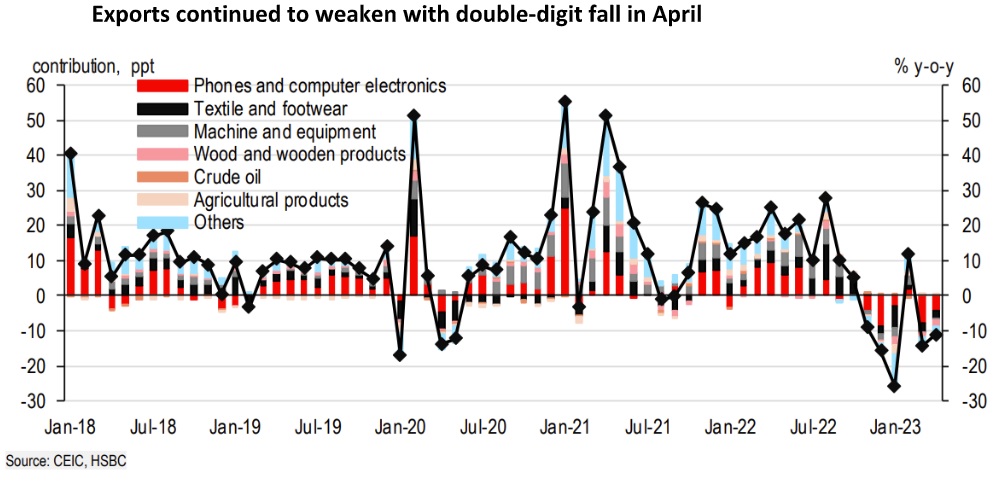

After a sluggish GDP performance in 1Q23, Vietnam is still not out of the woods yet. In particular, we have not seen the light at the end of the tunnel on the trade front. As a country particularly exposed to the global trade cycle, external weakness has dampened Vietnam’s growth. After falling 12% y-o-y in 1Q23, exports continued its double-digit decline, falling 11.7% y-o-y in April. The weakness continued to be broad-based, with key shipments such as textile/footwear, smartphone and wooden furniture saw notable slumps.

However, HSBC said the only bright spot in April’s data is computer electronics, rising 5.4% y-o-y. That said, this was rather an one-off surprise due to base effects, rather than a reflection of the tech cycle bottoming out. While leading indicators such as PMIs showed some initial signs of stabilisation, it will still take some time until we see a meaningful rebound in the global electronics cycle. Indeed, Vietnam is clearly not alone in this: peers such as Taiwan and Korea also continue to struggle in the current electronics doldrums.

“Despite weakness in goods trade, services continue to provide some much-needed support. International tourist arrivals moved closer to 1 million in April, driven by a 70% m-o-m pick-up in Chinese tourists. The positive recovery is thanks to easing flight constraints and China’s inclusion of Vietnam as a destination for its group tour resumption in mid-March. However, as a major tourist source with 30% share prior to the pandemic, the recovery pace of Chinese tourists remains gradual, with only 25% recovered to the same period in 2019. For example, Korean tourists, another major source, have recovered to 77%”, said HSBC.

>> Vietnam needs radical solutions to revive growth

While tourism can provide some partial support, its recovery will only be a slow process, and will not be enough to offset this year’s challenges. Indeed, growth headwinds can be seen through the lens of an extremely sluggish credit growth. Despite an annual credit growth target of 14-15% and the SBV’s two moves to cut its key interest rates in March, loans only grew around 2% by mid-April, half of that growth in the same period in 2022, reflecting ongoing concerns of economic difficulties.

As a result, the authorities have introduced a series of policy support recently, including a VND120trn credit package for social housing, a 2ppt cut of VAT until end-2023 and plans to restructure some loans. In particular, there are initial signs of a relaxation in the policy stance against the property sector, which has been facing liquidity crunch since last October.

Despite slowing growth, inflation has been better behaved, offering some relief to policymakers. Headline inflation fell 0.3% m-o-m, translating into a benign y-o-y print of sub-3%, moving further away from the State Bank of Vietnam’s (SBV) 4.5% inflation ceiling. For one, food inflation momentum continued to ease, thanks to a decline of 1.6% m-o-m in pork prices (recall pork inflation has a sizeable impact on overall food inflation). Meanwhile, energy prices saw a mixed picture. While transport costs rose marginally, due to higher oil prices, other energy inflation, such as electricity and gas fell. That said, caution is still warranted on the supply-side of inflation. After all, OPEC’s decision to cut oil production and Vietnam Electricity Group’s (EVN) proposed electricity price hike have not materialised.

“All in all, Vietnam continues to face challenges in 2Q23 after a tough 1Q23 economic performance. While we will likely see weak growth in 1H23, we expect the services sector to receive a punchier boost and the trade tide to turn in 2H23, lifting whole-year growth to 5.2% in 2023”, said HSBC.