Vietnam emerged as a regional outperformer

Vietnam saw an 11-year-high growth rate of 7.7% y-o-y in 2Q22, largely reaping the benefits of re-opening tailwinds.

Vietnam saw an 11-year-high growth rate of 7.7% y-o-y in 2Q22

>> What industries are on the verge of a significant comeback?

Impressive pace

After two quarters of sustainable re-openings, Vietnam’s recovery continues to be a regional outperformer. Its 2Q22 GDP growth hit 7.7% y-o-y, easily beating market expectations (HSBC: 5.8%; Bloomberg: 5.9%). This represents the highest growth Vietnam has seen in a quarterly GDP print since 2011, thanks to a strong broad-based recovery across sectors. That said, when dissecting the breakdown closely, another hidden message is also emerging. Despite rosy headlines, the energy crunch has started to take a toll on Vietnam’s growth.

At first glance, it is encouraging to see a significant improvement in services. Thanks to the removal of major local curbs and border restrictions in mid-March, travel-related sectors, particularly transportation and accommodation, have started to see meaningful revivals. Meanwhile, retail sales overshot 17% y-o-y in 2Q22, signalling a rebound in household consumption. Indeed, part of the success was attributed to a gradual recovery in its labor market. The unemployment rate dropped to 2.3% in 2Q22, while employment continued to expand at close to its pre-pandemic levels.

Tourism is also making headway as the summer season approaches. Take Hanoi’s Noi Bai airport as an example: parking lots are reportedly at full capacity, prompting airport authorities to respond with measures, such as opening all exit lanes to ticket control, to reduce traffic congestion. Scheduled flights in the Noi Bai airport have doubled since the start of 2022, exceeding those at the outset of the pandemic. This translated to daily passenger traffic of over 100k, a 40% increase from the same period in 2019, also exceeding the designed capacity of 100k at its T1 terminal.

Indeed, following the border re-opening on March 15, Vietnam has seen a substantial pick-up in tourist arrivals. In 2Q22, Vietnam welcomed 0.5 million visitors, almost five times more than in 1Q22, taking total tourists to 0.6 million in 1H22. Prior to the pandemic, 80% of tourists came from Asia, topped by those from mainland China (32%) and Korea (24%). Only 65% of tourists are from the region: European (16%) and US (11%) tourists have accounted for a large chunk of tourists post-pandemic, right after Korea (18%). The Vietnam National Administration of Tourism (VNAT) set an ambitious target of 5 million foreign tourists in 2022, a little shy of 30% of 2019’s level. However, the recovery in tourism is likely to be gradual, particularly given the lack of Chinese tourists.

That said, Vietnam has exceeded the VNAT’s annual target of receiving 60 million domestic tourists. To put this into context, take the resort island of Phu Quoc as an example: roughly 1.4 million visitors visited the island in 1H22, of which over 95% were local tourists. However, despite the high number of domestic tourists, tourism receipts were worth USD11bn, only hitting 66% of the year’s target.

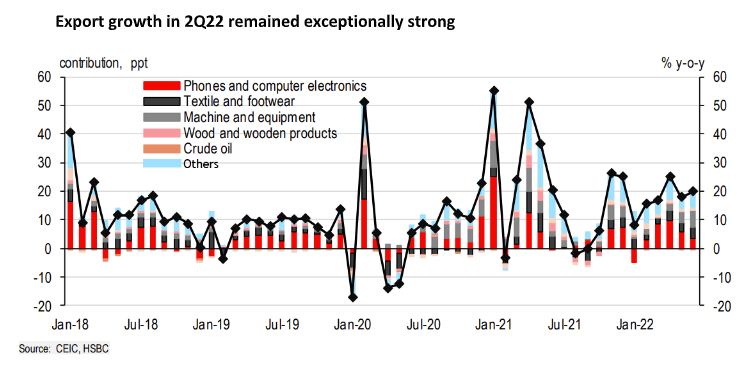

Aside from recovering domestic demand, Vietnam’s manufacturing has proved to be in a league of its own. All signs are pointing in the same direction of firm manufacturing growth. Although partly due to favourable base effects, industrial production (IP) growth accelerated to over 25% y-o-y in 2Q22. Undoubtedly, a large part of the success was attributed to firm electronics shipments, evidently shown in trade numbers. Export growth hit an impressive pace of over 20% y-o-y in 2Q22, a third of which came from firm computer and smartphone shipments. However, it is more than that: textiles and footwear, as well as machinery, all registered decent growth, indicating that Vietnam’s external engine is roaring again.

Guarding against external risks

However, import growth has been strong too, hitting over 15% y-o-y in 2Q22. Granted, part of it was due to the import-intensive nature of Vietnam’s manufacturing base. For example, electronics materials accounted for almost 40% of imports in 2Q22. That said, as a net energy importer, it is increasingly clear that soaring energy prices have raised Vietnam’s energy bills.

Therefore, on a net basis, Vietnam saw a trade deficit of USD 0.6 billion in 2Q22, down from a surplus of USD 1.5 billion in 1Q22, likely dragging its current account into a larger deficit. Indeed, Vietnam’s current account advantage has been eroding since 2H21, as smaller trade surpluses were unable to offset deficits in services and primary income. After seeing a current deficit of 1% of GDP in 2021, HSBC expects Vietnam to run another deficit for the second consecutive year, though the magnitude should be smaller than that of 2021, likely hitting 0.3% of GDP. This will likely put more downward pressure on VND.

That said, one bright spot in Vietnam’s capability to guard against external risks lies in its consistent FDI inflows, which provide an anchor to its core balance. On a rolling basis, strong FDI inflows have been able to offset current account deficits in the past quarters. In particular, FDI inflows to its manufacturing sector continued to rise, reflecting investors’ unwavering interest and confidence in Vietnam’s sound fundamentals.

What about inflation?

Even though price pressures are not as acute as in regional peers for now, inflation momentum is rising rapidly. Headline inflation rose 0.7% m-o-m, translating into 3.4% y-o-y, exceeding HSBC and market expectations (HSBC: 3.2%; Bloomberg: 3.2%; Prior: 2.9%). Similar to previous months, high transport inflation remains the primary driver, rising 3.6% m-o-m. Indeed, domestic petrol prices continue to be adjusted upwards, jumping to record high levels.

>> Inflation not a domestic problem in Vietnam

In response, the government sought to cut taxes on petrol to alleviate some of the pressure, as taxes and fees account for around 35% of gasoline prices. Since 1 April, the environmental tax has been cut to VND2,000 for gasoline and VND700-1,000 for other fuels, which is expected to run through 2022. In early June, the Ministry of Finance (MoF) proposed a further cut to VND500- 1,000, which is expected to take effect in early August. But this may not be the end. The MoF also signalled that it is considering reducing special consumption tax (8-10%), and VAT (10%), but this requires approval from the National Assembly, whose upcoming session is scheduled for October.

While high energy prices are largely expected, the main upside surprise to our forecast is food inflation, up 0.8% m-o-m. Based on data from the General Statistics Office, it largely reflects the strong pass-through of elevated energy costs on food inflation, as there is a broad-based price increase across items including meat, eggs, and vegetables. Moreover, there are signs that inflation has started to broaden. As domestic demand gains traction, core inflation has recovered to 2.0% year on year for the first time in nearly two years.

Given elevated global oil prices, HSBC expects upward pressures on inflation to persist. While it expects 2022 inflation to average 3.5% – still below the State Bank of Vietnam’s (SBV) 4% inflation ceiling – price pressures will become stronger in 2H22. Based on HSBC’s inflation forecasts, inflation will likely overshoot 4% from 4Q22 to 2Q23, increasing the call for the SBV to start its monetary normalisation. It expects the SBV to start with a 50bp rate hike in 3Q22, and continue with a 50bp rate hike in each subsequent quarter until 3Q23. This will likely take the policy rate to 6.50% by the end of 2023.

In short, Vietnam has benefited from a meaningful economic re-opening. Domestic demand is getting back on track, while its external engine continues to impress. That said, HSBC also needs to be mindful of rising risks to growth, particularly from surging energy prices. All things considered, HSBC is raising its 2022 growth forecast to 6.9% (prev: 6.6%) and cutting its 2023 growth forecast to 6.3% (prev: 6.7%).