What industries are on the verge of a significant comeback?

In 2022, Vietnam's economic recovery will have spillover impacts across a number of industries.

KB Securities forecasts Vietnam's GDP in FY22 to grow by 6.3%.

Vietnam's economy is expected to continue its recovery from the 2021 low under the impact of COVID-19, because (1) Vietnam has injected more than 200 million doses of the COVID-19 vaccine, with 82.8% of the population receiving at least one shot until April 21, 2022; (2) Vietnam has resumed production and business activities and fully reopened international trade and tourism since March 15, following the "living with COVID-19" campaign; and (3) the government approved an economic stimulus package worth VND350,000 billion to speed up post-pandemic recovery. It thus forecasts Vietnam's GDP in FY22 to grow by 6.3%.

Businesses in five following industries will benefit the most from the specified macroeconomic conditions, according to KB Securities.

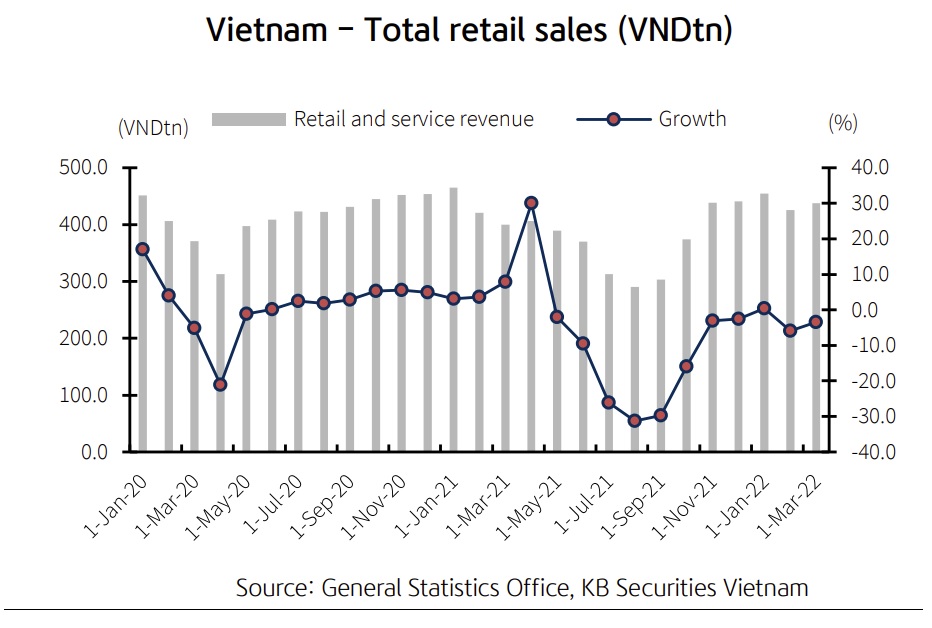

First, the relaxation of COVID-19 restrictions and rising consumer demand will support the retail business, particularly retailers of non-essential items, with 2022F EPS growth estimated to be 25% YoY. According to data from the General Statistics Office and Google Mobility, total retail sales of goods and mobility to shopping malls and amusement parks rebounded quickly following the lockdowns. Mobileworld (MWG) has a high potential for expanding smartphone market share due to the new store model, the Bach Hoa Xanh (BHX) chain's rebound in average sales/store, and Phu Nhuan Jewelry (PNJ) has a high potential for retail sales recovery due to growing demand and new store opening, according to KB Securities.

Second, thanks to the government's recommendations to fully reopen tourism by mid-March, lower entry criteria, and promote tourism, the tourism and aviation industries would rebound after two years of shutdown. With 17.6 million domestic arrivals in the first two months of the year, the tourist industry has demonstrated tremendous development, causing total income to increase by more than 300 percent year on year. Vietnam Airlines (HVN), Vietjet Aviation (VJC), Taseco Air Services (AST), and SCSC Cargo Service (SCS) all saw their stock prices rise. Given the recent significant rises in the prices of these stocks, KB Securities advises investors to only consider raising volume from declines for superior upside compared to target prices.

Third, Vietcombank (VCB), BIDV (BID), Vietinbank (CTG), Techcombank (TCB), Military Commercial Bank (MBB), and Sacombank (STB) are predicted to rebound this year with credit growth of around 14%. Banks have made higher-than-required provisions in 2021, owing mostly to the State Bank's supportive policies and recovered bad debts as firms' financial condition improves. Credit growth reached 2.52 percent YTD in the first two months of the year, compared to 0.66 percent YTD in the same period a year ago. Furthermore, in 2022, capital raising may improve profitability.

Fourth, industrial real estate would benefit from the industrial sector's recovery in 2022, as large industrial zones gradually resume production with workers returning to work and foreign experts entering Vietnam to research and sign contracts following the lifting of the lockdown and the resumption of international flights, combined with recent supply chain shifts. Businesses like Kinh Bac City Development (KBC), Long Hau Corporation (LHG), and IDICO Corporation (IDC) who have substantial leasable landbanks still have plenty of potential to expand.

Fifth, resumption of production and regaining demand from major trade partners would boost export processing firms in the textiles and garments and seafood industries. Export values increased by 10.2 percent YoY to $53.8 billion in the first two months of the year, aided by the restart of foreign commerce. Traditional exports such as seafood (50.7 percent YoY), textile fibers (30 percent YoY), textiles and garments (25.7 percent YoY), and wood and wood products (6.4 percent YoY) also saw positive increase in 2M22.

“We like firms with competitive advantages and capacity expansion in the textiles and garments industry, such as Song Hong Garment (MSH) and Century Synthetic Fiber (STK). Vinh Hoan Corporation (VHC), Sao Ta Foods (FMC), and Nam Viet Corporation (ANV) are all expected to grow strongly in the seafood business”, KB Securities said.