Vietnam manufacturing maintains strong momentum despite storms disrupting supply chains

Vietnam’s manufacturing sector continued to expand in November, marking the fifth straight month of improvement, even as severe storms caused supply-chain delays and slowed production, according to S&P Global.

Vietnam’s manufacturing sector continued to record strong growth in November despite severe storms disrupting supply chains and slowing production timelines, according to the latest S&P Global report.

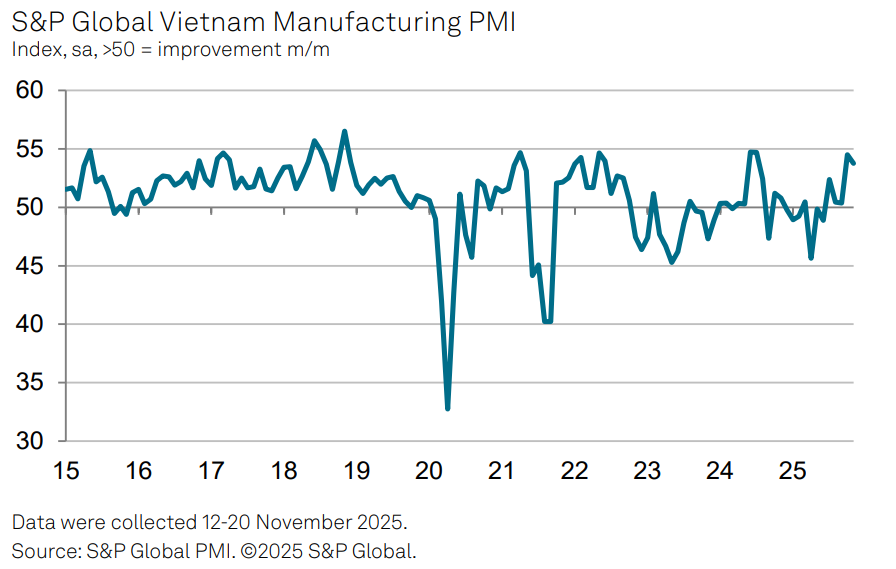

The S&P Global chart shows the development of Vietnam's Manufacturing PMI.

Operating conditions strengthened for the fifth consecutive month. A reading above 50 signals expansion, while a figure below that threshold indicates stability or contraction.

“The pick-up in growth seen in October was largely sustained through November as the Vietnamese manufacturing sector enjoys a positive end to the year,” said Andrew Harker, Economics Director at S&P Global Market Intelligence.

“While rates of expansion in output and new orders eased, firms added staff at a faster pace to meet workloads.”

He noted that growth persisted even as storms disrupted supply chains and production lines in recent weeks.

Andrew added that firms may see continued growth in the months ahead as they catch up with delayed projects.

A third straight monthly rise in new orders supported further production growth in November, although both expanded more slowly than in October.

Export orders grew at a stronger pace, reaching a 15-month high due to rising demand from mainland China and India.

Some firms reported that storm conditions limited production, but overall output still increased for the seventh straight month.

Production activities at Quang Minh Industrial Park in Hanoi. Photo: Pham Hung/The Hanoi Times

Severe weather mainly affected supply chains and reduced manufacturers’ ability to complete orders on time.

Supplier delivery times lengthened sharply, marking the biggest deterioration since May 2022.

Backlogs of work also rose for a second month and at the fastest rate since March 2022.

Staffing levels continued to grow as firms responded to rising workloads. Employment increased modestly but at the strongest pace in almost 18 months, with many firms hiring full-time staff.

Some manufacturers relied on existing inventories to meet orders, causing a sharper decline in finished goods stocks compared to October.

Storm-related disruptions also pushed input costs higher as raw-material supplies tightened.

Input prices rose sharply, marking the second-fastest increase since July 2024, although inflation eased slightly from October.

Output price inflation softened but remained solid as firms passed higher costs to customers.

Purchasing activity increased for the fifth month in a row, with the expansion rate hitting a four-month high.

Input inventories also rose slightly for a second month, although many firms used purchased goods immediately in production.

Expectations of stronger new orders and more stable weather supported a more upbeat year-ahead outlook.

Nearly half of surveyed firms expected higher output, raising overall business confidence to a 17-month high.