Vietnam remains on track to better growth prospects

Yun Liu, ASEAN Economist, HSBC Global Research, believes Vietnam remains on track to see better growth prospects in 2024, but it will take time for the recovery to broaden out.

>> Vietnam seeing positive export signs in Q1

Despite the encouraging high frequency indicators, Vietnam started 2024 with a slightly disappointing GDP figure. Its GDP growth slowed to 5.7% y-o-y in 1Q24, undershooting HSBC and market expectations of 6.4% y-o-y. That said, this does not mean the recovery is not sustained. It is, but the recovery story is quite uneven.

The biggest downside surprise to us came from the services sector, which only expanded by 6.1% y-o-y in 1Q. There continues to be a divergence in the recovery, with domestic-oriented sectors lagging behind external-facing sectors. Indeed, ‘information & communication’, financial and professional services have slowed since 4Q23, whereas the real estate sector’s contribution continues to be minimal, reflecting ongoing weakness in the property cycle. Meanwhile, retail sales growth has not returned to the pre-pandemic trend, with a still sizeable 10% gap below what it would suggest. While Vietnam’s export cycle has started to see green shoots, it has not translated into a meaningful boost to its domestic sectors.

However, tourism-related services continued to enjoy positive momentum. For the first time since COVID-19, Vietnam’s monthly inbound tourists approached close to 1.6 million, exceeding pre-pandemic levels by 13%. While base effects partially played a role, a rally in mainland Chinese tourists’ returns also added some much-needed support.

After Singapore became the first ASEAN country to see an almost full return of Chinese tourists in February, Vietnam is racing closer, with the recovery rate hiking to 90% in March. This is partially thanks to Vietnam’s ongoing efforts to restore direct flights with mainland China, which have reached almost 80% of pre-pandemic levels. While Chinese outbound tourism to ASEAN has seen a positive pick-up lately, there is still room for further improvement. Encouragingly, an expansion in the visa exemption list is under consideration by the authorities.

Vietnam’s exports continue to benefit from an upturn in the tech cycle

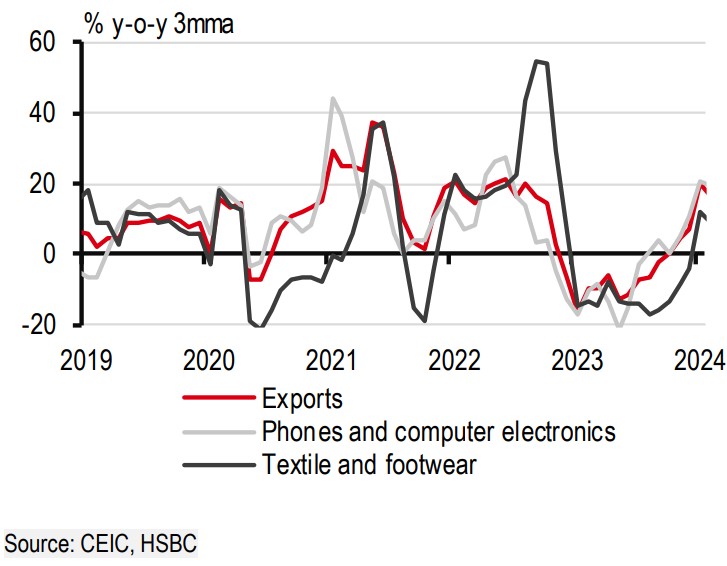

In Yun Liu’s view, despite an uneven recovery in services, the external-facing manufacturing sector continues to regain its past glory. Exports expanded by over 14% y-o-y in March, bringing quarterly growth to 17% y-o-y. This is largely driven by an upturn in the electronics cycle, benefiting from being a key production hub for Samsung’s smartphones. This is slightly different from regional peers, including Korea, Taiwan and Singapore, which have sizeable exposures to AI-powered chips. Aside from electronics, export rebound continues to broaden out to other shipments, including textiles and footwear, though their contributions are still minimal. In addition, while import growth also rebounded to double- digits in 1Q24, trade surplus widened to USD8bn, overshooting 2023’s monthly average by over 10%.

>> Growth engines rev up, fuelling recovery hopes

While near-term trade is about to take off again, long-term FDI prospects remain a bright spot. Greenfield FDI rose almost 60% y-o-y in 1Q24, 65% of which is concentrated in the pillar manufacturing sector and the rest in real estate. Looking at the source of investors, it is interesting to see that Singapore has regained the crown as Vietnam’s largest FDI provider, with an impressive share of 50%. Greater China, which accounted for half of Vietnam’s FDI in 2023, came in second with a share of 30%. Korea and Japan, who traditionally are Vietnam’s two largest investors, only accounted for a combined share of 15%.

Lastly, inflation. Headline inflation saw a 0.2% m-o-m fall in March from price corrections during the Tết holidays, translating into y-o-y inflation of 4.0%. While this was below HSBC and market expectations of 4.2%, it remained elevated. Details showed all segments fell, except for ‘housing and construction’ and ‘other goods and services’. While monthly food prices fell, rice inflation remains elevated at double-digits. “We continue to caution upside risks to food and energy inflation, though we do not believe inflation will likely overshoot the SBV’s 4.5% inflation ceiling this year. Therefore, we do not expect the SBV to ease anytime soon. We expect the SBV to hold its policy rate steady at 4.5% over our forecast horizon through 2025," said Yun Liu.

All in all, Yun Liu believes Vietnam remains on track to see better growth prospects in 2024, but it will take time for the recovery to broaden out. She maintained her GDP growth forecast at 6.0% this year, but has tweaked our quarterly forecasts, expecting the recovery to broaden out more in 2H24.