Vietnam’s investment appeal rises as EuroCham confidence index hits three-year high

Renewed optimism is lifting European investors’ confidence in Vietnam, with the latest Business Confidence Index (BCI) highlighting strong growth, administrative progress, and resilience amid global trade challenges.

Vietnam continues to strengthen its position as one of Asia’s most attractive destinations for European investors, according to the Q3/2025 Business Confidence Index (BCI) released by the European Chamber of Commerce in Vietnam (EuroCham).

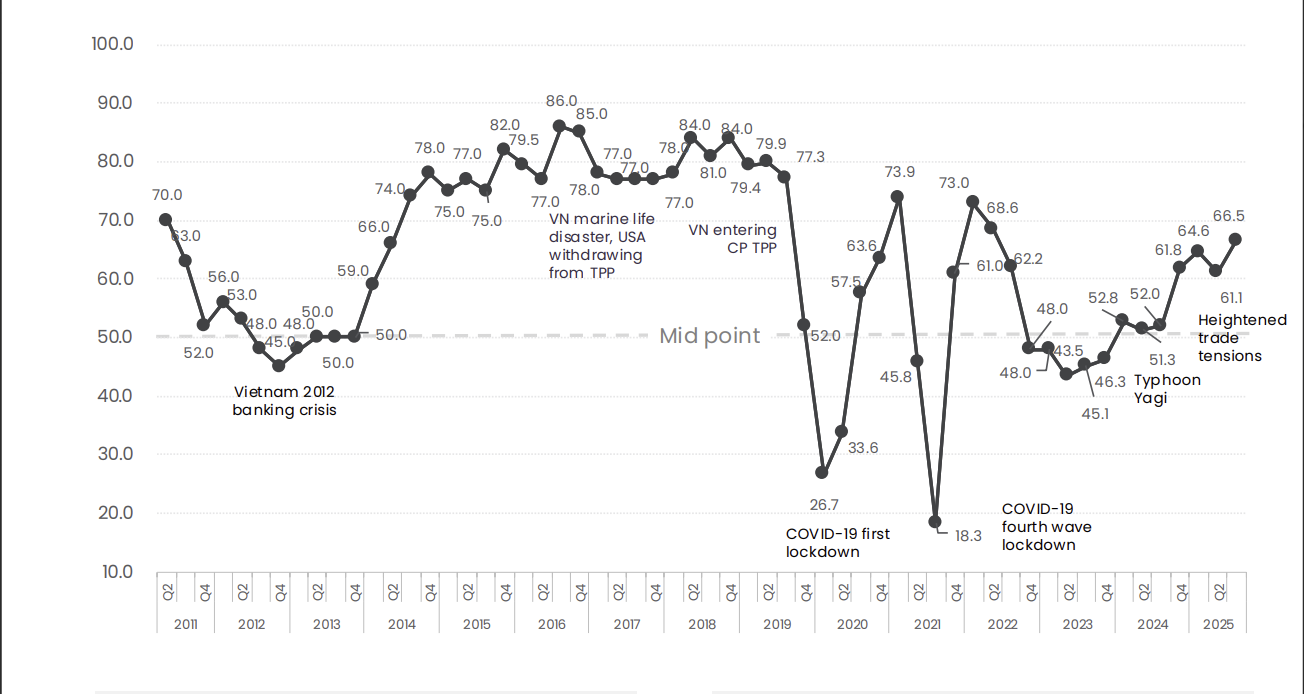

The BCI rose to 66.5 points, the highest in three years and above pre-tariff levels. The survey, conducted by Decision Lab, shows growing optimism among European businesses despite global trade frictions and new US tariff pressures.

EuroCham's Business Confidence Index (BCI) for the third quarter. Source: Q3 2025 BCI

About 80% of respondents expressed confidence in their business outlook for the next five years and 76% said they would recommend Vietnam as an investment destination. These results reflect growing trust in Vietnam’s stability, reforms and deeper integration into global supply chains.

Resilience amid shifting global trade

The global trade environment is changing and its effects are now more visible. As the US introduced new tariff measures, 31% of European firms in Vietnam reported negative financial impacts in Q3, double the previous quarter’s figure.

However, the share of companies seeing a positive impact increased from 5% to 9%, showing that some businesses are adapting and capturing new opportunities within shifting supply chains.

Relocation trends remain limited. Only 3% of surveyed firms plan to relocate operations out of Vietnam, while another 3% are considering domestic expansion. This stability reinforces Vietnam’s reputation as a resilient and dependable production base.

Although some companies face challenges from stricter “transshipment” rules and new trade policies, most are maintaining their investment plans. Compliance and sourcing have become slightly more complex, but not enough to change their strategic commitment.

EuroCham Chairman Bruno Jaspaert said: “The pressures are now materializing, but they remain within expectations. Vietnam’s fundamentals remain strong.”

He added: “The upgrade of Vietnam’s stock market classification by FTSE Russell from Frontier to Secondary Emerging Market status shows growing investor confidence and Vietnam’s rising role in the region.”

Two-fifths of surveyed businesses believe Vietnam will reach its 2025 GDP growth target of 8.3%-8.5%, while 23% remain neutral and 35% are mildly skeptical.

According to the General Statistics Office, Vietnam’s GDP grew 8.23% year-on-year in Q3, signaling continued momentum in key industries.

“While neutrality still dominates short-term views, optimism grows when firms talk about the future,” said Thue Quist Thomsen, CEO of Decision Lab.

About 68% expect better economic conditions in the next quarter, up 18 percentage points from Q2. Businesses want to finish 2025 on stronger ground.”

Administrative reform: progress and remaining frictions

European business leaders at a recent event organized by EuroCham Vietnam. Photo: EuroCham Vietnam

Despite solid growth, administrative hurdles still frustrate many European investors.

Nearly 65% cited procedural complexity as a main obstacle, especially in tax issues such as VAT refunds. Different interpretations of work permit rules across provinces also cause uncertainty.

Still, Vietnam has made notable progress. In August 2025, the government introduced three key decrees improving visa and work permit procedures, welcomed by the European business community.

Almost half of respondents (48%) said these reforms already improve their business operations, while 42% noted that changes are still taking time to take full effect.

EuroCham described the new decrees as a “significant leap” toward a more efficient and predictable environment.

“Talent mobility and knowledge transfer must drive Vietnam’s path to a high-income economy,” said Jaspaert.

These reforms help international experts work where they are needed most, fueling innovation and strengthening the private sector.”

As Vietnam continues its modernization efforts, alignment between European investors and national goals grows stronger.

“Growth today does not ensure success tomorrow unless businesses and nations prepare for the future,” Jaspaert added.

This is where the EU and Vietnam agree — both aim to build stronger, more innovative and more resilient partnerships.”

With the highest BCI in three years, ongoing reform and solid economic foundations, Vietnam’s partnership with European investors enters a new phase focused on shared innovation, sustainable growth and mutual trust.