Vietnam’s monetary policy could remain accommodative

Vietnam’s monetary policy was relaxed to support the economy in 2021. This policy is expected to continue this year as well.

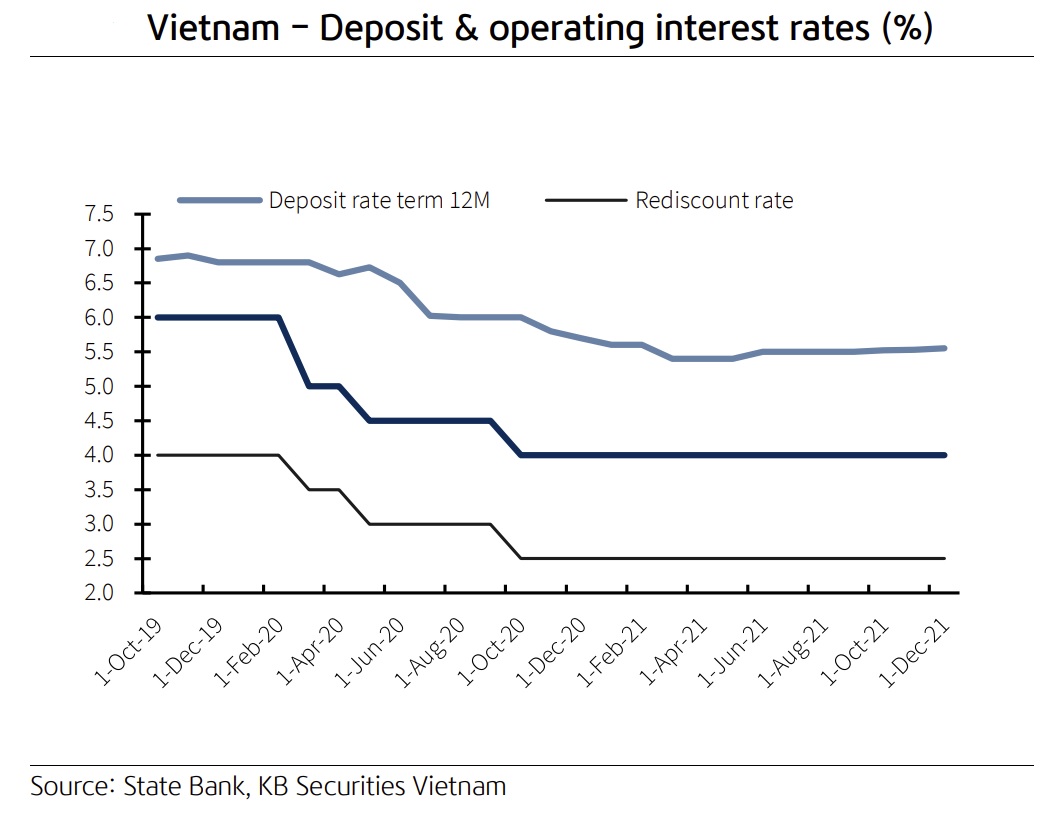

Deposit interest rates remained stable throughout 2021, fluctuating within a narrow range of less than 0.4%.

Deposit rates remained stable

The 2021 monetary policy was consistent with the cautious dovish policy of the State Bank of Vietnam (SBV) throughout the COVID-19 pandemic. Specifically, the SBV has cut policy rates three times up to now, all in 2020, by less than in other regional economies.

Apart from requiring commercial banks to cut lending rates to support businesses struggling, the SBV issued Circular No. 14/2021 amending Circular 01 on debt structure, debt rescheduling, interest rate exemption and reduction for customers affected by COVID-19. Besides, it also raised credit caps for commercial banks in the third and fourth quarters of 2021 to help credit growth reach 12.68% YTD.

For the whole year of 2021, interbank interest rates climbed to a higher base but remained low thanks to abundant liquidity. In particular, in 4Q21, interbank interest rates increased sharply, with overnight, 1-week, and 1-month interest rates increasing by 66bps, 73bps, and 81bps, respectively, compared to the end of 3Q21. This reflects the liquidity shortage across the banking system in the peak season.

Deposit interest rates remained stable throughout 2021, fluctuating within a narrow range of less than 0.4%. In 4Q21 alone, deposit interest rates moved sideways, increasing marginally for short terms (less than 12 months of maturity).

2022F interest rate

KB Securities expects the SBV's monetary policy to continue to take a supportive stance in 2022. However, the SBV could keep policy rates unchanged and set a target for credit growth to reach 14%, equivalent to 2021’s amid the presence of inflationary pressure (at 3.8% in the base case scenario).

However, deposit interest rates are likely to inch up in 2022 from the current low because: (1) inflation may bounce back, prompting banks to raise deposit rates to keep real rates attractive enough to gain competitive advantage; (2) credit demand may grow after the economic reopening; and (3) more prudent monetary policy of the SBV may make deposit interest rates inch up by 0.5%, equivalent to a 3.8% upturn in inflation.

"The lending rates should be kept unchanged or decreased slightly for some priority industries given the government's interest rate support package. The National Assembly approved the 2% interest rate support package worth a maximum of VND40,000 billion for some priority industries since banks need to maintain high net interest incomes (corresponding to high NIM at present), to make room for provisioning given rising pandemic-induced bad debts", KB Securities said.