Vietnam’s stock market: What is the key trend?

Trading in Vietnam’s stock market after the holiday period has become increasingly unpredictable. Still, short-term forecasts suggest that adjustment and volatility are the main characteristics shaping September’s outlook.

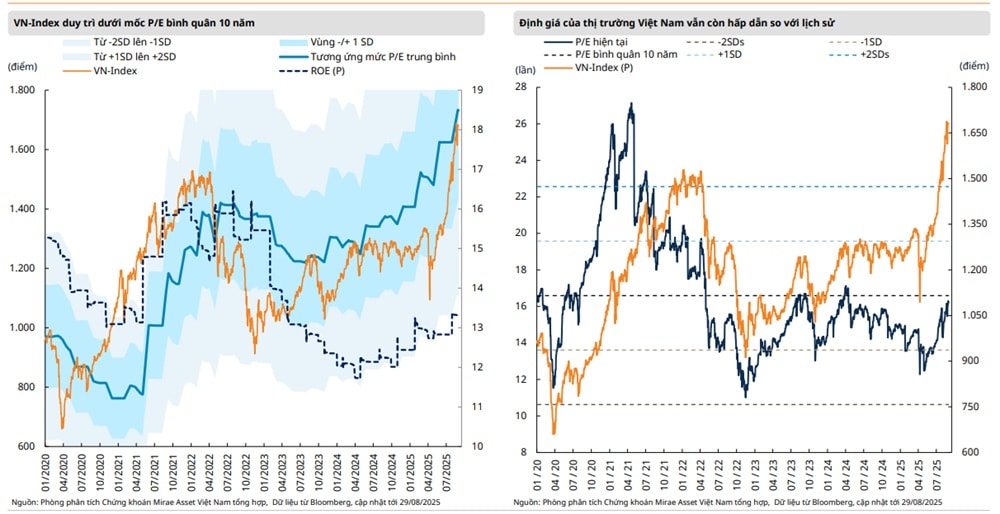

Vietnam’s stock market remains attractive in terms of valuation.

According to SSI Research, the market this month could find support from expectations that the US Federal Reserve will cut interest rates on September 17 and from the possibility that Vietnam may be upgraded to emerging-market status in early October. However, analysts caution that pressure may rise significantly in the coming weeks after the benchmark index posted strong gains over the past two months.

In a more cautious scenario, a sharper correction could occur between September and early October, with a potentially larger amplitude than previous pullbacks since the April bottom. In recent sessions, major stocks such as Vingroup (VIC) and Vinhomes (VHM) have regained their leading role in supporting the market, joined by positive contributions from LPB, MWG, VNM and STB. Meanwhile, shares in the banking and securities groups—including BID, VPB, TCB, ACB, MBB, VCB, MSB, OCB, VIX and VND—have declined.

Looking at historical cycles, SSI Research notes that the VN-Index has often performed well in September, rising in seven of the past 10 years. Yet the last four years show a clear departure from that trend. Since 2021, when the four-day national holiday was introduced in September, the market has either moved sideways or fallen sharply—dropping 6% and 11.6% in 2022 and 2023, and gaining less than 1% in 2021 and 2024.

Experts identify several factors that may drive adjustment. Exchange rate pressure has been intensifying, with the dong depreciating an average of 3% during September–October from 2022 to 2024. The third-quarter earnings season is typically lackluster. In addition, profit-taking often follows strong rebounds, as seen in August when the market has consistently risen in the past four years, averaging gains of 2.6%.

The effect of the long holiday and the exchange rate’s influence on investor sentiment were also acknowledged by Tran Hoang Son of VPBankS. He noted that while trading volumes were strong during the rally through late August, liquidity slowed markedly after the holiday period, signaling greater caution among investors awaiting important September events. According to him, this pause in liquidity, combined with exchange rate concerns, has created a psychological effect of hesitation and expectation.

Nguyen The Minh of Yuanta Securities Vietnam highlighted another dimension: uncertainty. “What investors fear most is not bad news, but ambiguity. Bad news, if specific, can be priced in; ambiguity cannot. Therefore, pointing out risks early is also a sign of courage,” he emphasized.

SSI Research statistics show that markets often experience corrections of more than 7% within an uptrend, particularly after a rapid 20% gain over three months. The VN-Index has already surged 50% in the past quarter without any pullback greater than 4.5% since April, suggesting that a correction may be inevitable.

Analysis of stock performance by market capitalization over the past 14 years reveals no significant difference in average monthly growth between large-, mid- and small-cap stocks. However, in the past five years, mid- and small-cap stocks have frequently outperformed in the first half of September, only to lag in the second half. This rotation indicates temporary shifts in capital flows and may be useful for short-term trading strategies.

Vietnam’s stock market remains attractive in terms of valuation. The current earnings yield stands at 7.7%, well above the main investment alternatives such as bank deposits with interest rates around 5–6%, real estate with rental yields of 3–4%, and gold, which has already seen strong price surges. As a result, analysts say a significant correction could present buying opportunities for long-term investors.

SSI Research supports this view, citing four reinforcing factors: expectations of double-digit GDP growth over the next five to ten years driven by institutional reforms and private-sector expansion; solid earnings growth of over 14% annually projected for 2025–2026; the prospect of an upgrade to emerging-market status attracting global capital inflows; and supportive monetary policy that sustains a favorable interest rate environment.

Mirae Asset Securities Vietnam (MASVN) also pointed to “adjustment” and “volatility” as the market’s keywords, noting that larger swings have become a “new normal” since late August and are likely to continue into September as investors await the realization of anticipated catalysts. Chief among these are FTSE Russell’s September review on Vietnam’s market classification and the Fed’s upcoming rate decision.

Yet MASVN cautioned that these stories are already well-known, and any changes could trigger profit-taking. In terms of market upgrade prospects, the firm emphasized that foreign inflows following such a decision would be long-term in nature, given the scale of capital and the need for gradual allocation. Current foreign investor activity remains relatively cautious. Regarding the Fed, MASVN expressed skepticism that a rate cut is imminent, noting that widespread trade tensions are still exerting upward pressure on inflation, limiting room for easing in 2026 and keeping exchange-rate risks alive for Vietnam.

Looking ahead to September and the remainder of 2025, MASVN maintained an optimistic outlook. It believes the VN-Index still has room to advance toward new historic highs of 1,800–2,000 points if current momentum is sustained and exchange rate pressures remain within the State Bank’s control. The firm laid out two scenarios. In the base case, the VN-Index is expected to establish short-term support at 1,650 points before climbing to 1,800. In a less favorable case, the index may find medium-term support around 1,550 points.