Vietnam's inflation would be under control in 2H23

Due to poor domestic aggregate demand and low economic growth, inflationary pressures may be kept under control.

According to Kis Vietnam, the CPI would climb by 2.82% in 3Q23 compared to the same time in 2022.

>> Việt Nam likely to keep inflation below 4.5% in 2023: Economists

In Vietnam, inflation has slowed dramatically, rising 2.0% year on year in June 2023, the lowest increase in the previous 16 months. Vietnam's CPI averaged 3.3% year on year in 6M23. The dramatic decline in domestic gasoline prices is the primary element aiding in the reduction of inflationary pressures in 6M23.

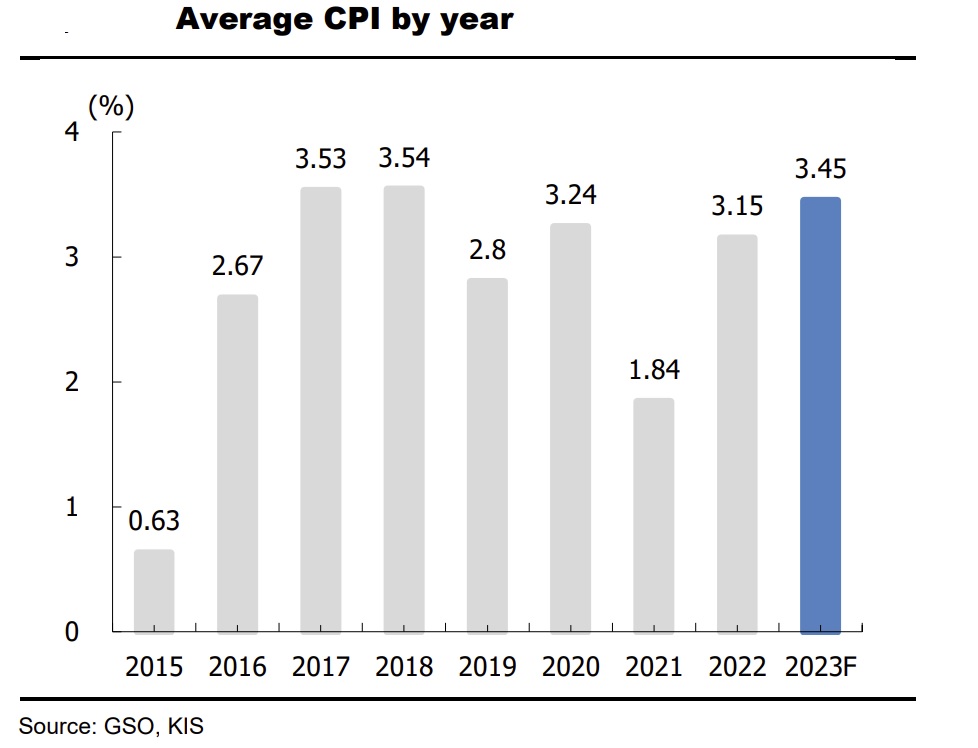

According to Kis Vietnam, the CPI would climb by 2.82% in 3Q23 compared to the same time in 2022. Furthermore, due to weak domestic demand as a result of economic issues, this firm has lowered its prediction of average CPI from 4.3% in the previous forecast to 3.45%. Furthermore, the regulatory authority's diligent monitoring and encouraging developments in the worldwide market contributed as supplementary variables driving inflation toward the aim of less than 4.5%.

According to KIS, the FFS index (food and foodstuff), which has the most weight in the CPI basket (33.56%), is predicted to rise further in 3Q23, despite the fact that this period is traditionally marked by lower activity levels and is not associated with vacations. As stated in the last report, the rise in live hog prices can be ascribed to the development of African swine flu in specific locations beginning in March 2023, resulting in a limit ed decline in output. Furthermore, family pig output has declined sharply, while large-scale pig farming enterprises, both local and foreign, continue to dominate. In order to reduce their losses, these firms may deliberately boost their pricing.

However, the growth in pig prices will be limit ed by the market's present low purchasing power and customers' financial troubles, causing them to pick more economical food alternatives instead of pork. Furthermore, this year's decline in seafood and aquatic product exports, as well as the forthcoming flood season in the Mekong Delta and some customers' selection of vegetarian diets during the Vu Lan season, operate as impediments to a major increase in hog prices.

>> Consumer price index rises 3.29% in H1

According to KIS, oil prices will cease to be a key factor influencing the traffic index and inflation in the second half of 2023. According to the most recent Energy Information Administration (EIA) report, the prediction for oil prices has been reduced downward from USD 85 per barrel to around USD79.50 per barrel by the end of 2023. Furthermore, the projected economic comeback of China (the world's largest oil importer), which had been highly anticipated following the lifting of COVID-19 limit ations, appears to be failing, adding to the negative prognosis for oil prices.

Furthermore, when students return to school in 3Q23, the education index will rise significantly. This is mostly due to increased expenditures for school fees, stationery, and study supplies. Furthermore, the National Assembly passed Resolution 69/2022/QH15 on State budget projections for 2023, which raises the base pay for private and governmental employees by 20.8% compared to 2H23. This will influence inflation in the following quarter.

Mr. Dinh Quang Hinh, analyst at VNDirect, identified a number of variables that might increase domestic inflationary pressures in 2H23: (1) The difference in gasoline prices between 2H23 and 2H22 will be substantially lower than the difference between 1H23 and 1H22. (2) The government raising the minimum wage for state officials and workers on July 1, 2023 may put pressure on inflation.

However, Mr. Dinh Quang Hinh believes that inflationary pressures would be held in check due to poor domestic aggregate demand and low economic development. "Overall, we lower our average inflation forecast for Vietnam in 2023 to 3.3% (/-0.2% pts), meeting the government's target of keeping inflation below 4.5%," Mr. Hinh added.