Vietnam's pangasius exports are expected to increase significantly in 2024

The aquaculture business is expected to profit from a recovery in exports as demand recovers in major export markets such as the United States, China, and the European Union.

Vietnam's pangasius exports are forecasted to experience strong growth in 2024.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam's pangasius exports in January 2024 were 165 million USD, a 97% increase over the same period last year. All key markets, including the United States, China, the European Union, and nations in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), had good growth. The major pangasius product remains frozen fillet, with a value of more than 131 million USD, up 87% from the same time in 2023.

China is the top importer of pangasius from Vietnam. Specifically, the export value of pangasius to this market in the first month of 2024 was 52 million USD, approximately four times the amount in the same period of 2023. Meanwhile, exports to the US market were 18 million USD, representing an 83% rise over the previous year and an increase in most product categories.

Vietnam's pangasius imports to the EU market were approximately 13 million USD, representing a 20% rise over the previous year. Among EU nations, the Netherlands remains the leading importer, with approximately 4 million USD, a 16% rise over the same time. Furthermore, other markets inside the bloc had excellent development, with Hungary gaining fourfold, Spain, France, and Slovenia growing around 2.5 times...

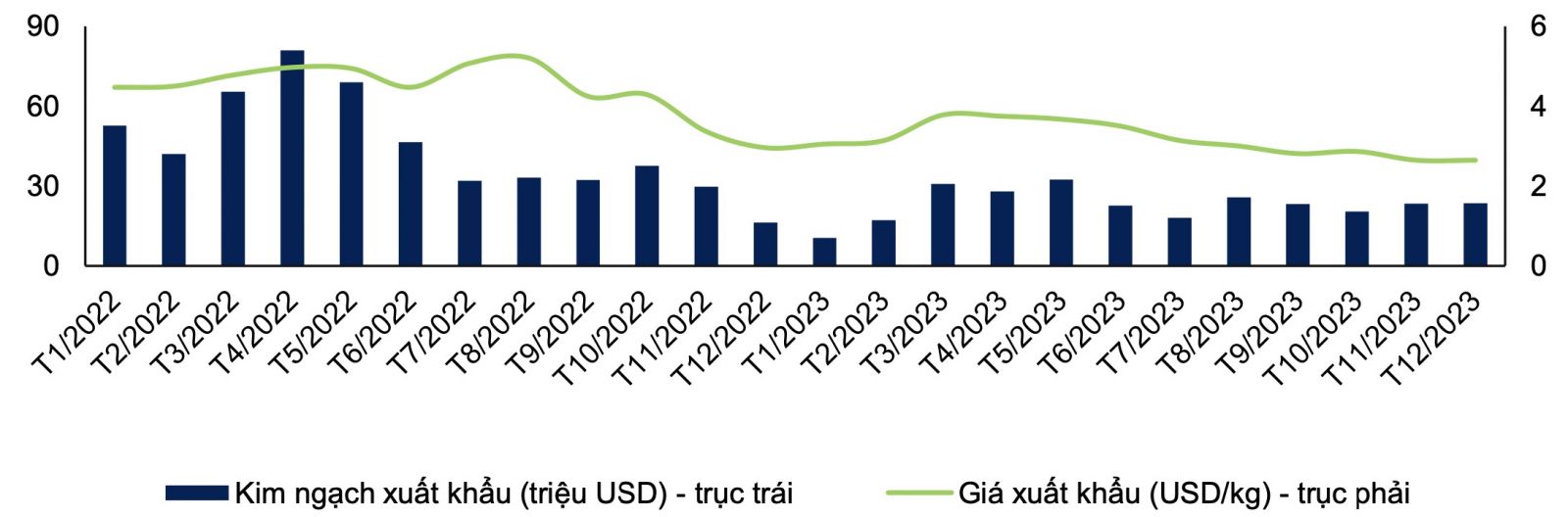

According to a VASEP spokesperson, orders improved in January and February 2024, and raw pangasius prices rose from 25,000 - 26,000 VND/kg in 2023 to 28,000 - 29,000 VND/kg at the start of 2024. Although pangasius exports only reached 224 million USD in the first two months of the year, a 0.7% reduction from the same period last year, there is still a chance that pangasius can meet its export target of 2 billion USD, a more than 10% increase from 1.8 billion USD in 2023.

The US and Chinese markets continue to show signs of recovery in 2024, mainly to lower inflation and an expected increase in US spending capacity. The pangasius market in China is predicted to grow because to government measures that promote the real estate sector and stimulate spending in the first half of 2024.

Analysts at FPT Securities (FPTS) predict that demand for pangasius would recover significantly starting in the second half of this year. Meanwhile, pangasius supplies in Vietnam are projected to run low. These variables are predicted to boost pangasius export prices in the future. Pangasius exports from Vietnam are expected to grow again, benefiting the aquaculture industry.

In the US market, FPTS forecasts pangasius consumption to recover positively in Q4 2024. As a result, pangasius inventory in the United States has declined dramatically starting Q4 2023, owing to seafood retailers' promotional activity for the year-end festivals. Pangasius exports from Vietnam are likely to profit from future increases in consumer demand and market expansion in the United States.

For the Chinese market, FPTS predicts that demand for pangasius will improve. According to projections, Chinese consumer expenditure will increase in the first half of 2024 as a result of government initiatives that support the real estate market and encourage consumption. This bodes well for pangasius exports from Vietnam to the Chinese market, as consumer demand is projected to rise.

However, this Securities Company remains cautiously hopeful, expecting that demand for pangasius in China would revive considerably by the second half of 2024, one quarter later than prior projections. The rationale is that weak consumer spending mood might linger in the first half of the year. Furthermore, pangasius' competitive potential when compared to other seafood is deemed "not high," necessitating a lengthier recovery period for eating. Despite this, pangasius exports from Vietnam to China continue to seem promising in the future.