VN-Index may keep trading in a narrow range

In March 2023, the VN-INDEX climbed 2.7% month to date and 4.5% year to date. What will happen in April?

Long-term investors may consider buying part of the portfolio when interest rates are falling. Photo Quoc Tuan

>> VN-INDEX’s downward trend may continue

In March, the VN-INDEX increased to 1,052.3 points (2.7% mtd., 4.5% ytd.). The rise might be due to the following factors: First, in the midst of global banking upheaval, the Fed has issued a less aggressive stance on monetary policy. Second, in March, SBV reduced certain important policy rates. Third, substantial inflows by overseas investors, with net purchases of VND3,065 billion in March (vs. net sales of VND264bn in February 2023).

On March 23, Vietnam (VN-INDEX, 2.7% mtd.) beat all of its South East Asian regional rivals, including the Philippines (PCHOMP Index, 0.6% mtd. ), Singapore (STI Index, -0.7% mtd. ), Thailand (SET Index, -1.8% mtd. ), Indonesia (JCI Index, -2.0% mtd. ), and Malaysia (FPMKLCI, -4.0% It might be the result of investors' cash flow gradually returning amid signals of lowering interest rates.

Similarly, the VN-INDEX has outperformed rivals in South East Asia by 4.5% since the beginning of 2023, owing to a low base, a 32.8% decrease in 2022, and more favorable monetary policy.

Following a 12.9% m/t drop the previous month, the tourism and entertainment industry increased by 6.3% m/t in Mar-23, owing to Vietnam's inclusion on China's tourist pilot program. Retail, on the other hand, became the poorest sector, falling 3.7% m/t in Mar-23 due to disappointing 2Q22 performance and cautious 2023 projection.

The oil industry recorded the largest year-on-year gain of 14.1% in 1Q23, owing to (1) increased extraction and transportation activities amid high oil prices and (2) the recovery of the Vietnam petroleum distribution sector. In contrast, retail (-8.1% year on year) and food producers (-6.1% year on year) also had lower demand as personal income fell.

The three bourses' average trade value declined 12.4% mom (-67.9% yoy) to VND10,147bn (HOSE: VND8,983bn/trading day, -11.3% mom; HNX: VND900bn/trading day, -17.0% mom; UPCOM: VND332bn/trading day, -24.6% mom).

In 1Q23, the average trade value of three bourses fell 19.2% qoq (-63.1% yoy) to VND11,332 billion (HOSE: VND9,925 billion per trading day, -20.2% qoq; HNX: VND996 billion per trading day, -8.3% qoq; UPCOM: VND412 billion per trading day, -17.9% qoq).

Foreign investors net bought VND3,345 billion in Mar-23 (vs net sold VND264 billion in Feb-23), owing to (1) Fubon ETF successfully increasing its capital by VND3,800 billion, and (2) VanEck Vietnam ETF changing the tracked index from MVIS Vietnam Index (80% Vietnam stocks) to MVIS Vietnam Local Index (100% Vietnam stocks).

>> VN-Index struggles to begin a strong upswing

Foreign investors have purchased VND7,277 billion in total net purchases in 2023, accounting for 25.1% of total net purchases in 2022.The share of foreign investors in daily trading value increased from 12.8% to 13.8% of overall trading value on March 2023.

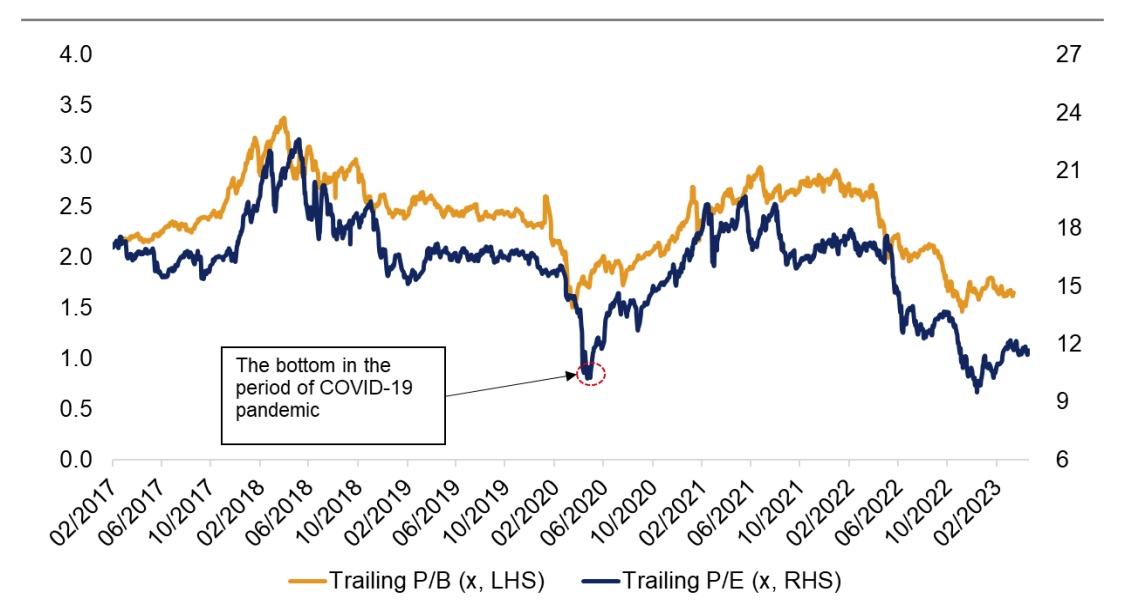

VN-INDEX is trading 30% below its 5-year average valuation.

The stock market in Vietnam is now trading at 0.7x the 5-year P/E average, and the TTM P/B is similarly trading at 0.7x the 5-year P/B normal.

The average deposit interest rate for 12-month periods declined to 7.5%/year on March 2023 (from 7.8% on February 2023).Meanwhile, the VN-INDEX's current earnings-to-price ratio has risen to 8.6% (from 8.5% on December 2022). The market profits yield is anticipated to be around 10.6% when the dividend yield of 2.0% is included. As a consequence, the disparity (between market earnings yield and deposit rate) increased to 3.1% (0.8% points from the previous day). The disparity may decrease after the 1Q23 earnings season, however, because market profits growth may stay negative due to (1) decreasing global economic growth and (2) a high interest rate environment.

The VN-INDEX was buoyed in April by (1) dropping domestic interest rates and (2) capital inflows from international ETFs. However, the expectation for 1Q23 profits is rather unfavorable due to slowing economic development, which is impeding the market's upward momentum. VNDirect anticipates the VN-Index will trade in a narrow band of 1,030 to 1,100 points in April 2023 due to a mix of catalysts.

“Long-term investors may consider buying a portion of their portfolio when interest rates decrease, however short-term investors should be patient until the market creates a definite trend”, said VNDirect.

Upside triggers, according to VNDirect, include (1) more dovish monetary policy from the FED and (2) more government economic assistance. Lower-than-expected market profits growth in 1Q23F and global financial crisis concerns are among the downside threats.