VN-Index moves sideways, which stocks to pick?

VCBSs recommended investors to pick stocks with positive Q3 business results expectations.

In this morning’s trading session, the VN-Index continued to fall 0.65% to 1,642 points with many stocks in downtrend, such as AAA, ADG, BHV, CTG, HDG, GMD…

In the yesterday’s trading session, the VN-Index opened in green and quickly widened its increase, approaching the 1,680 mark - also the highest level of the session in the first hour of trading. Creating momentum for the VN-Index were large-cap stocks with VIC stocks and some banking stocks (MBB, LPB, VPB).

However, the supply increased in the second half of the morning session along with good stocks narrowing the range, even some stocks reversed to red, causing the VN Index to lose steam and hover around the 1,670 mark until the end of the session. Foreign investors sold strongly with a total net value of VND 1,230.49 billion, focusing on selling FPT, STB, and VPB.

In the afternoon session, VN-Index moved sideways in a narrow range around 1,665 in the first hour before swinging back to 1,650 for the rest of the session. Selling pressure continued to be a negative point in the market when it dominated with 243 red stocks and 84 green ones. The large-cap group also recorded widespread red, with only a few codes such as VIC, MBB and LPB increasing slightly, helping to balance the general index. Foreign investors increased net selling in the afternoon session with a total net value of VND 2,354.72 billion, focusing on selling VHM, FPT, and VPB.

At the end of the session, the VN Index closed at 1,652.71, down 12.34 points, equivalent to 0.74%.

In the today’s trading session, the VN-Index continued to fall 0.65% to 1,642 points with many stocks in downtrend, such as AAA, ADG, BHV, CTG, HDG, GMD…

The VN-Index closed yesterday with a red candlestick, decreasing in points, showing that supply pressure dominated the market.

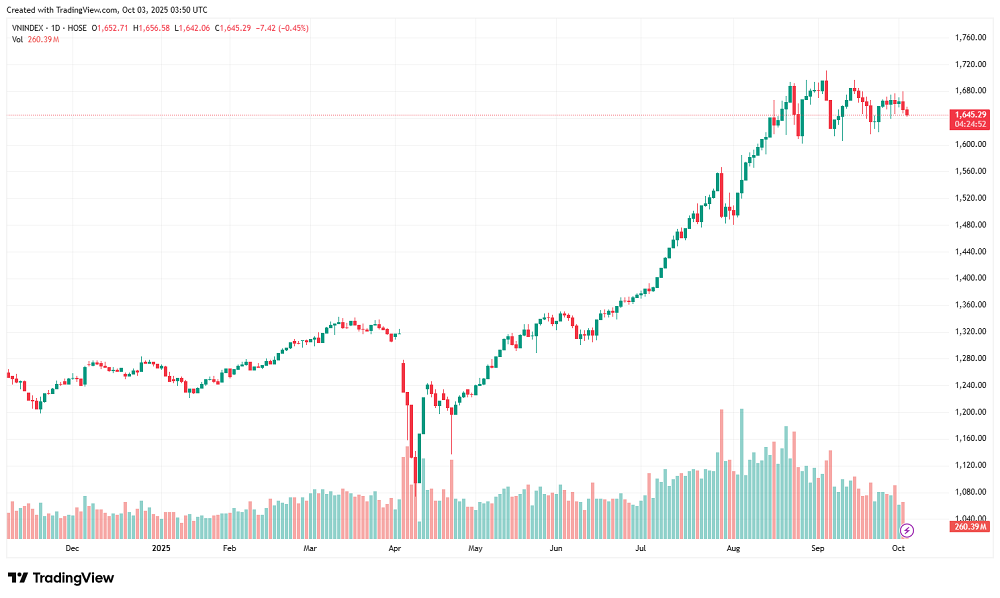

On the daily chart, the VN-Index is struggling in the MA20 area, showing that the market is still in the supply-demand testing phase around the 1,650-1,670 range. The MACD is moving sideways in the low zone and the Bollinger band is showing signs of narrowing, further reinforcing the sideways movement with a fluctuation range of 20-30 points of the VN- Index at present before recording more notable fluctuations.

On the hourly chart, the VN-Index ended the session with a black Marubozu candle along with the MACD and RSI indicators both pointing down, showing the weakening of the VN-Index in the short term. The -DI line is pointing up above the 25 mark, so the possibility of struggling will continue in the next session.

The VN-Index has recorded a sideways movement since the end of August and the fluctuation range has gradually narrowed along with lower liquidity, showing the movement of testing supply-demand at the market's peak. Along with the movement of VN-Index, many stocks also have sideways accumulation movements after adjusting to long-term support zones.

VCBS recommended investors select stocks with positive Q3 business results expectations that are in the accumulation trend at the price base or have convincing supply-demand testing signals with increased demand to disburse part of the market fluctuations in the coming sessions. Some notable industry groups include banking and retail sales.