VOS struggles to reduce losses

Due to challenging business conditions, Vietnam Ocean Shipping JSC (HOSE: VOS) is still struggling to reduce its losses.

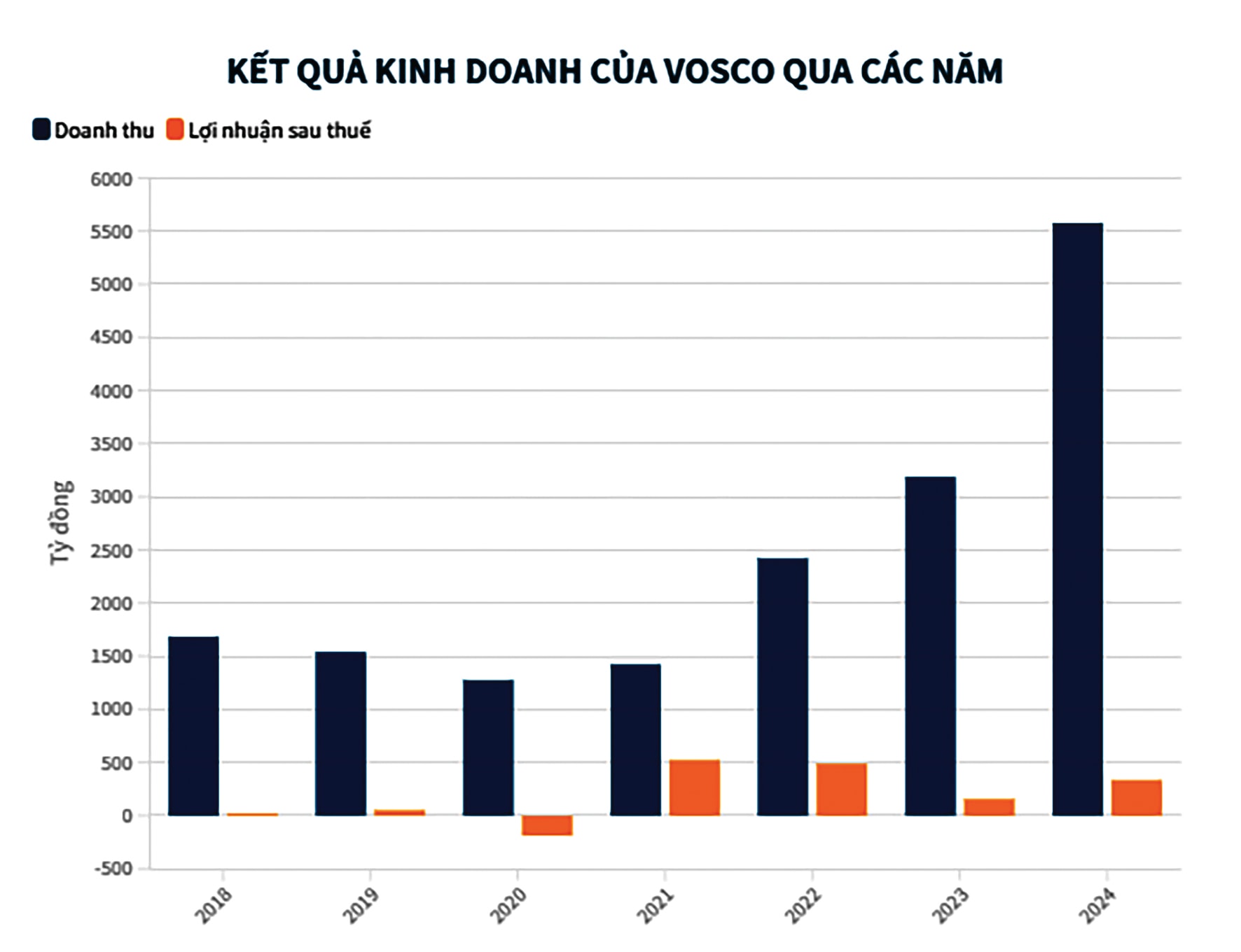

VOS's net revenue and net profit over the years

Despite the difficulties, VOS is planning to expand its fleet, primarily funded through bank loans.

Risk of Being Put Under Surveillance

Following heavy losses in Q1/2025, VOS faced another tough quarter in Q2/2025. The financial report shows that the company generated only VND 836 billion in Q2 revenue — a sharp 55% drop compared to the same period last year — as it no longer recorded coal trading activities like the previous year. Without extraordinary income such as the VND 393 billion from selling the Dai Minh vessel, VOS ended Q2/2025 with just over VND 10 billion in net profit, a steep 96% decline year-on-year.

In 2024, VOS had earned over VND 3,400 billion and made a profit of VND 28 billion from the trading segment through a contract to import 1.7 million tons of coal from Indonesia to Vietnam. Experts regarded this model as more efficient than outsourcing transportation. However, in the first half of 2025, revenue from this segment plummeted. For the first six months of 2025, VOS posted nearly VND 1,300 billion in revenue — a 56% decrease year-on-year — and a net loss exceeding VND 43 billion.

Compared to its full-year pre-tax profit target of VND 376 billion, VOS has already posted a net loss of over VND 43 billion and accumulated losses of more than VND 26 billion. If it cannot reverse the situation, VOS shares risk being classified under a warning status. As of the July 29 trading session, VOS stock was trading at just VND 14,900 per share.

Explaining the revenue drop, VOS stated that it had returned the Dai An oil tanker and the Dai Hung chemical tanker in March 2024. Meanwhile, the dry bulk shipping market faced severe fluctuations due to unstable tax policies under President Donald Trump. Supramax charter rates dropped to just USD 2,500–3,000 per day, leaving many ships in the Atlantic and Asia-Pacific regions idle and awaiting cargo.

Not only the dry cargo market, but VOS’s product tanker segment also experienced sluggish periods, especially during holidays and the transition between Q1 and Q2/2025. Additionally, many of VOS’s ships — including Vosco Sky, Vosco Unity, Vosco Starlight, and Dai Thanh — were undergoing scheduled maintenance, generating no revenue while still incurring significant costs. Given this trend, VOS is likely to continue posting net losses in 2025 due to high expenses and the lack of a profitable revenue stream to turn its business around.

Sharp increase in company debt at the end of Q2/2025

Challenges in Fleet Expansion

Despite its struggling operations and idle ships, VOS is moving forward with plans to expand its fleet. For 2025, the company proposed the acquisition of 1–2 used container ships, each with a capacity of about 1,000 TEUs, at a cost of under USD 20 million per ship.

By the end of Q2/2025, VOS's total assets reached VND 3,470 billion, an increase of VND 581 billion from the beginning of the year. At the same time, the company’s debt rose significantly, with interest expenses in the first half of the year surging to nearly VND 10 billion. This may be related to the completion of the purchase of one of two MR product tankers approved by VOS’s Board of Directors in June, with each tanker costing over VND 900 billion — 70% of which was financed by bank loans.

Regarding projects carried over from 2024 to 2025, VOS stated that it has revised its investment plan to acquire two used Supramax dry bulk vessels (56,000–62,000 DWT) at a price of under USD 23 million each. These investments will be funded through a mix of loans and equity, depending on the specific project. Additionally, VOS proposed adjusting its investment strategy to either build four new ships or acquire used product tankers under 8 years old, around 50,000 DWT each, priced below USD 52 million per vessel. The funding sources would again come from a combination of loans and company capital.

As of now, VOS manages and operates a fleet of 13 ships with a total capacity of 421,699 DWT, consisting of 7 dry bulk vessels, 4 product/chemical tankers, and 2 container ships. With ongoing losses, idle ships, and unresolved tariff negotiations, VOS’s continued fleet expansion — largely financed by bank loans — presents a significant challenge for the company moving forward.