Watch out for exchange rate risks

The State Bank of Vietnam (SBV) keeps the USD/VND exchange rate within a "acceptable" range despite the decrease in the USD index (DXY) in order to accomplish several objectives at once.

In order to be more proactive in their operations and reduce risks when making payments and borrowing in foreign currencies, businesses might create scenarios for exchange rate variations, as the USD/VND rate is still high and expected to rise further.

USD "plummets"

The DXY was trading at 99.59 on April 14, 2025, after a series of steep declines. As a result, since the Trump administration imposed reciprocal tariffs with 180 nations on April 2, 2025, the DXY has lost almost 4.2%.

In addition to reflecting the Dot Plot's indication of the FED's potential for two more rate cuts at the most recent meeting, the USD's depreciation also reflects investors' misgivings about tariffs driving the US economy into recession and their lack of faith in the USD, which is a symbol of the country's economic might.

From a two-year high of 109.53 in early January 2025 to 103.79 in mid-March 2025, the DXY previously experienced a declining trend.

Prior to that, the DXY had been declining, having peaked in early January 2025 at 109.53, its highest level in more than two years, and then dropped to 103.79 in mid-March 2025. Despite this, foreign investors are currently gravitating toward JPY and CHF as safe havens, avoiding the possibility that significant creditors will sell USD or U.S. Treasury bonds to hold other currencies. The market is still anticipating big tariff deals that will have an immediate effect on creditors and the US economy.

Reason for the stable exchange rate

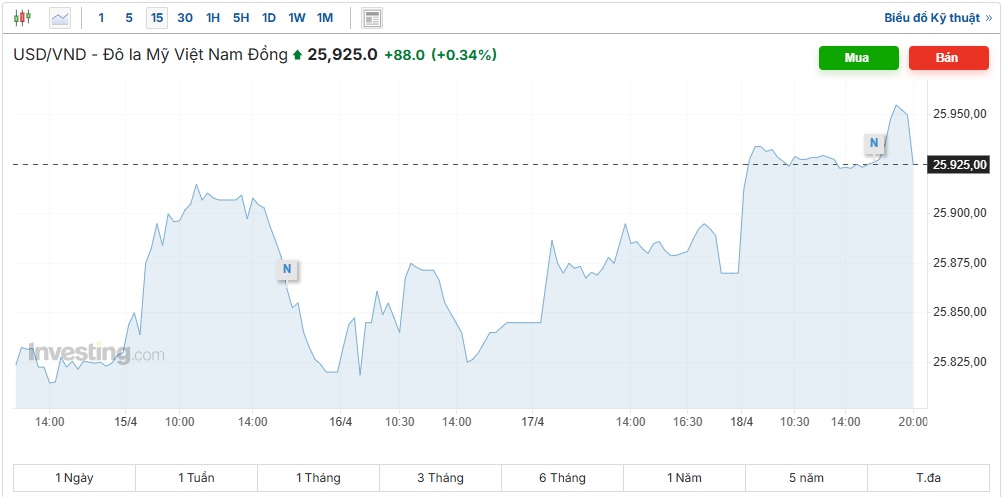

At the SBV's Operation Center, the central exchange rate is still adjustable in the interim. As a result, the selling exchange rate that commercial banks quote is still higher than 26,000 VND/USD. In order to encourage economic growth, stabilize the exchange rate, limit inflation, and preserve safe foreign exchange reserves, it is evident that a high exchange rate range is being maintained in order to sustain interest rates.

The flexible central exchange rate system of the SBV, which closely monitors global market movements (particularly the USD Index, FED, and PBoC), is expected to remain effective in the future due to a number of internal and external factors.

First, analysts observe that the benefits of tariff exemptions for US trading partners in the technology electronics industry (phones, laptops, semiconductors, etc.) have only been felt initially. Furthermore, one of Trump's "MAGA" statements highlights the USD's strength. Therefore, these could alter the strength of the USD in terms of outlook, impact, and perhaps even the possibility that the US's high inflation will cause the FED's rate drop to go against expectations. Dao Minh Tu, the SBV's deputy governor, asserts that the organization's position to adopt a proactive but adaptable foreign exchange policy is entirely suitable.

Second, the SBV will always keep market expectations stable notwithstanding the strong expectations for export prospects (and FDI prospects) and the dangers involved. The SBV might think about reducing policy rates to encourage economic growth if the FED makes additional rate cuts. The chief economist for the Maybank Group, Mr. Chua Hak Bink, anticipates that, under favorable circumstances, the SBV will lower the policy rate by 25 basis points. This opinion is also supported by UOB's experts, who predict that the USD/VND exchange rate will climb further in the second and third quarters of this year before progressively decreasing and settling back into a trading range of /-5% by the end of the year.

"Shock absorber" for the future

According to numerous projections, officials will need to "weigh and measure" the space for rate cuts in order to maintain a favorable VND-USD interest rate differential and draw in investment inflows. The SBV Deputy Governor Đào Minh Tú stated that various measures have been taken to reduce loan rates, including cutting operating costs at four state-owned commercial banks. At the same time, the SBV requires that loan interest rates be openly disclosed at all times.

UOB specialists also underlined that the SBV will not purposefully lower VND but will instead maintain a stable USD/VND exchange rate in light of global financial integration and pressure to avoid being accused of currency manipulation by the US.

In order to minimize psychological effects, lessen exchange rate shocks, and stop "dollarization," the SBV only selectively intervenes in the FX market when there is significant market volatility. In addition, it will aggressively boost foreign exchange reserves to act as a "shock absorber" in the event that the USD gains value or capital leaves the country.