Watch out for the rising of banks' bad debts

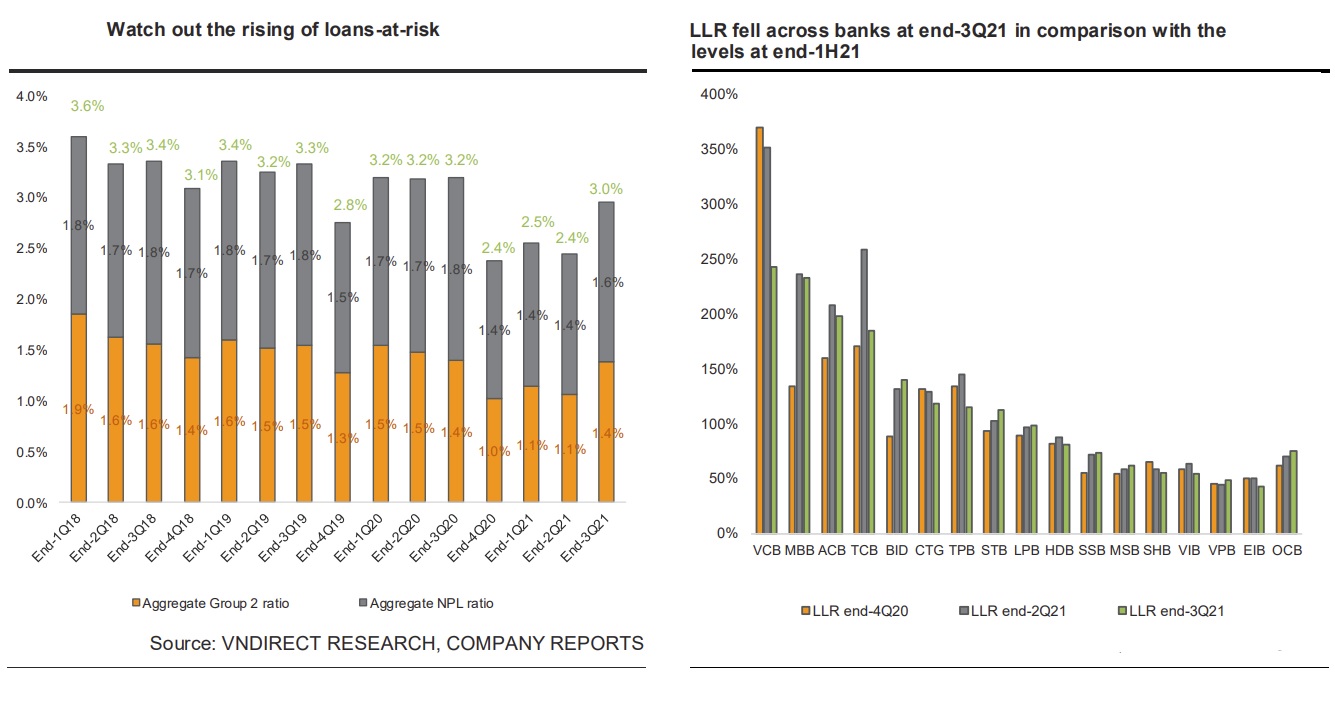

9M21 average annualized credit cost and write-off rate were higher than the levels seen in 1H21. However, the average non-performing loan (NPL) ratio rose while the average loan loss reserve (LLR) fell at end-3Q21 vs. end-2Q21.

Saigonbank's non-performing loan ratio increased from 1.44% at the end of last year to 2.05% at the end of September 2021.

The average non-performing loan (NPL) ratio increased to 1.64% at end-3Q21 from the levels of 1.49% at end-2Q21 or 1.54% at end-2020. Nationwide lockdown in 3Q21 not only restrained credit growth but also accelerated bad debt hikes. Particularly, while the total loan book of 17 listed banks grew 1.4% QoQ, their total non-performing loans rose 15.8% QoQ in 3Q21.

However, the positive point was the ongoing improvement of group 5 bad debt ratio at end-3Q21. Group 5 bad debt ratio slightly fell to 0.75% at end-3Q21 from 0.78% at end-2Q21. Top 5 lowest NPL ratio banks remained unchanged at end-3Q21, including TCB (0.6%), ACB (0.8%), MBB (0.9%), TPB (1%), and VCB (1.2%).

The restructured loan also rose across banks at the end of 9M21, increasing its proportion in the banks’ loan book. At end-3Q21, the total restructured loan of 10 banks, including 3 State-owned commercial banks (VCB, CTG, BID) and top 7 private listed banks (TCB, ACB, MBB, VPB, VIB, TPB, HDB), increased to VND82,441bn, making up from 0.7% to 5% their loan books, from VND43,031bn at end-2Q21.

Credit costs continued to surge in 3Q21. The average annualized credit cost of 17 listed banks grew to 1.6% in 9M21 from the level of 1.5% in 1H21 or 1.4% in 2020. However, their average provision expense/pre-provision operating profit slightly fell to 31.9% in 9M21 from 32.3% in 9M20, thanks to banks’ stronger topline growth and lower CIR.

Top banks that posted heavy provisioning include BID (68.4%), VPB (53.7%), CTG (50.2%). Meanwhile, the average loan loss reserve (LLR) dropped to 113.8% at end-3Q21 from 127.3% at end-2Q21, but higher than that of 108.6% at end-2020. Top 5 highest LLR banks were VCB (242.9%), MBB (232.8%), ACB (197.7%), TCB (184.4%), and BID (140.2%).

The State Bank of Vietnam (SBV) has officially proposed a Law on handling NPL of credit institutions, when the Covid-19 pandemic may increase bad debts and Resolution No. 42 of the National Assembly on the pilot of bad debt settlement is about to expire. This is expected to speed up the bad debt settlement.

VNDirect expected that under the economic recovery, businesses would resume operations and pay for their obligations, cushioning banks’ bad debt increase. Meanwhile, it also observed that banks proactively increased provisions for bad debt to maintain their asset quality under control which uplifted their credit cost in 9M21. Banks with a low-risk appetite as well as less customer concentration or a more diversified customer base are expected to face fewer asset risks. “We prefer TCB, ACB, and MBB that continuously recorded lowest NPL ratio and colossal provision buffer”, VNDirect said.