What benefits does VPB gain from FE Credit restructure?

VPB stock of Vietnam Prosperity Joint-shares Commercial Bank (VPBank) has received a new value due to the potential for credit expansion and FE Credit restructure.

.jpg)

VPB is valued at 24,500 VND per share by securities companies.

VPB reported consolidated pre-tax earnings for Q2/2024 of over VND 4,500 billion, a 72% increase. This good outcome is mostly due to FE Credit, which is expected to earn a minor profit of VND 145 billion in Q2, compared to a loss of VND 853 billion in Q1/2024 and over VND 2,000 billion in the same time the previous year.

Credit growth continues conservative, with a focus on asset quality management: VPB achieved a consolidated credit growth rate of 7.7%, with individual growth at 8.2%, VPBankS at 29.5%, and FE Credit expected at roughly 1%.

In its analysis on VPB, BSC Securities claimed that the bank continues to shrink its corporate bond portfolio by 33.5%, bringing the share of corporate bonds in total debt to 3.6%, the lowest since 2020. By industry, the bank's lending concentrates on wholesale and retail (up 17.8%), real estate (up 22.1%), and lodging services (up 36.4%). As of the most recent report, VPB's outstanding debts to NVL have fallen to around VND 6,000 billion.

NIM has been consistent at 5.8% over the last four quarters, as expected. As a result, VPB's year-end NIM is likely to drop as asset quality improves and accrued interest is recovered. The improved Q2/2024 profit results of VPB suggest that the reorganization of FE Credit's risk portfolio is having a beneficial impact.

Regarding FE Credit, BVSC Securities predicts that this segment will recover and become profitable again in 2024 based on several factors: the company has restructured most of its loan portfolio; low interest rates have improved customers' ability to repay debt; credit growth is expected to return as consumer credit demand recovers, and new disbursements have increased since April 2024, with positive signs in debt recovery.

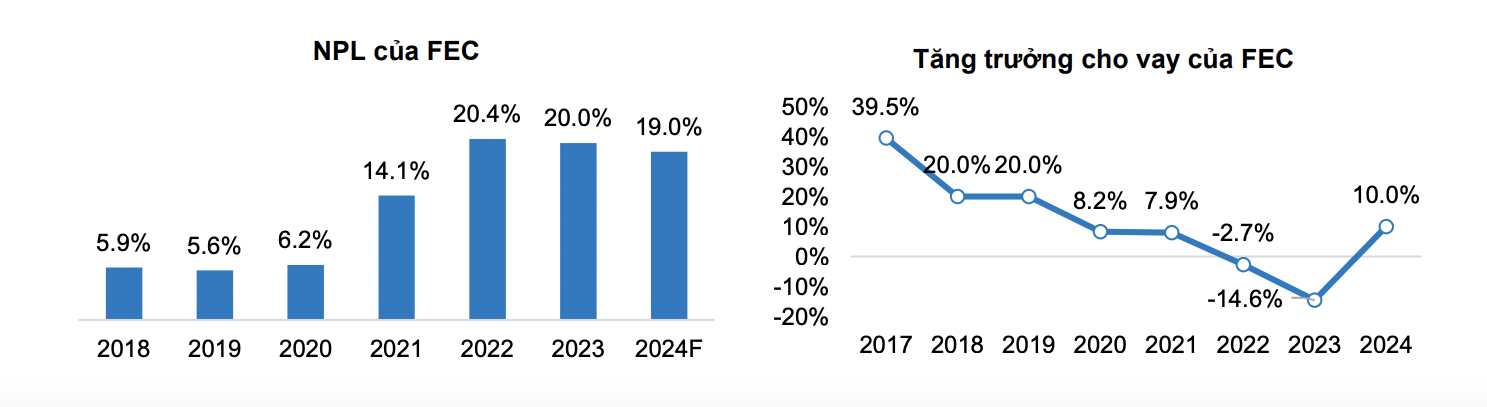

In 2024, FE Credit expects its risk provision expenditures to fall to VND 10,203 billion, an 18% decrease. The near-completion of the loan portfolio restructuring at FE Credit, which includes higher-quality loans and a lower NPL (non-performing loan) percentage, reduces the load on provisions. VPB's provisions have also lowered to VND 6,110 billion (a 23 percent decrease). BVSC predicts that FEC credit growth will reach 10% by 2024, as consumer financial demand is likely to revive.

FE Credit began restructuring its portfolio in May 2023 and had accomplished 70% by the end of the first quarter of 2024, with the intention of ending in 2024. Shifting to less risky loans and tougher lending requirements are among the most important restructuring initiatives. The emphasis is on growing a client base among workers in industrial zones while decreasing the quantity of cash loans.

FE Credit, a subsidiary of VPB, returned to profitability in 2024 thanks to portfolio restructuring. Source: BVSC.

BVSC sees further credit growth potential for VPB, stating that the bank may receive additional credit limit s as it takes on the mandatory transfer of a weak bank. The government is committed to completing the mandatory transfer of three out of four weak banks in 2024, having finished the valuation process and submitted the transfer plan for approval. VPB will receive significant financial support from strategic partner SMBC. Additionally, securing international loans will help supplement long-term capital and diversify funding sources for VPB.

BVSC expects VPB's operating income and post-tax profits to be VND 60,352 billion (up 21%) and VND 15,096 billion (up 51%), respectively. This growing momentum will contribute to an upward adjustment of VPB's stock value.

BVSC has established a target price of VND 23,869 - 24,500 per share for VPB and its subsidiaries based on the residual income method, the P/B comparison method, and the book value methodology. It advised investors to retain VPB shares for a medium-term aim till the end of the year.