What industrial real estate stocks to pick in 2026?

A new, long-term, and sustainable growth cycle for the industrial real estate sector is being fostered by the favorable macroeconomic climate and the industry's natural capabilities.

Nam Dinh Vu industrial zone

Vietnam is becoming a crucial destination amid significant shifts in global supply chains, especially due to the strong growth of its industrial real estate sector.

An attractive destination for FDI

According to a study by KB Securities Vietnam (KBSV), multinational firms have progressively moved some of their manufacturing from China to Southeast Asian nations, including Vietnam, to reduce the risk of being dependent on a single market.

Committed FDI flows into Vietnam continue to show a positive trend, indicating foreign investors' confidence in the country's long-term potential, even though the world economy is still at risk of recession and short-term declining aggregate demand. With industrial real estate playing a key role, this capital flow is creating the groundwork for a new boom cycle in the infrastructure and industrial sectors.

Three key elements are what make Vietnam appealing to international investors, according to Ms. Nguyen Thi Trang, an analyst at KBSV. First, long-term investment decisions are assured amid a stable macroeconomic climate with a strong political base and steady economic development.

The competitive cost advantage comes in second. Vietnam has a distinct edge in the region since its average industrial park land lease price is now about US$120/m²/lease cycle, which is much less than Malaysia's (about US$140/m²) and Indonesia's (about US$160/m²) and comparable to Thailand's.

Thirdly, it is anticipated that the 15% worldwide minimum tax rate will reduce the disparity in tax benefits between nations, emphasizing Vietnam's core advantages.

Center of benefits

Industrial real estate is directly benefiting from the need for manufacturing infrastructure, which is translating into actual pressure on the supply of industrial land due to the convergence of macroeconomic forces and competitive costs.

In actuality, the industry that best illustrates the spillover impacts of FDI is industrial real estate. The demand for industrial property, ready-built factories, and high-quality warehouses rises dramatically as international businesses look for places to locate plants, creating a new boom cycle for the whole sector.

Additionally, KBSV predicts that throughout 2024–2027, industrial park land leasing costs in Vietnam will increase by an average of 9–11% every year. Limited supply in important industrial provinces in Northern Vietnam, the ongoing "China 1" wave, the tendency of moving production from Southern to Northern Vietnam in order to improve logistics, and the completion of many major transportation infrastructure projects are the main drivers of this expansion.

Not only has the amount of new foreign direct investment (FDI) grown, but its quality has also greatly improved. With well-known companies like Foxconn, Goertek, and LG Innotek in the electronics industry; Amkor Technology in the semiconductor industry; and Jinko Solar in the energy industry, high-tech projects are starting to stand out.

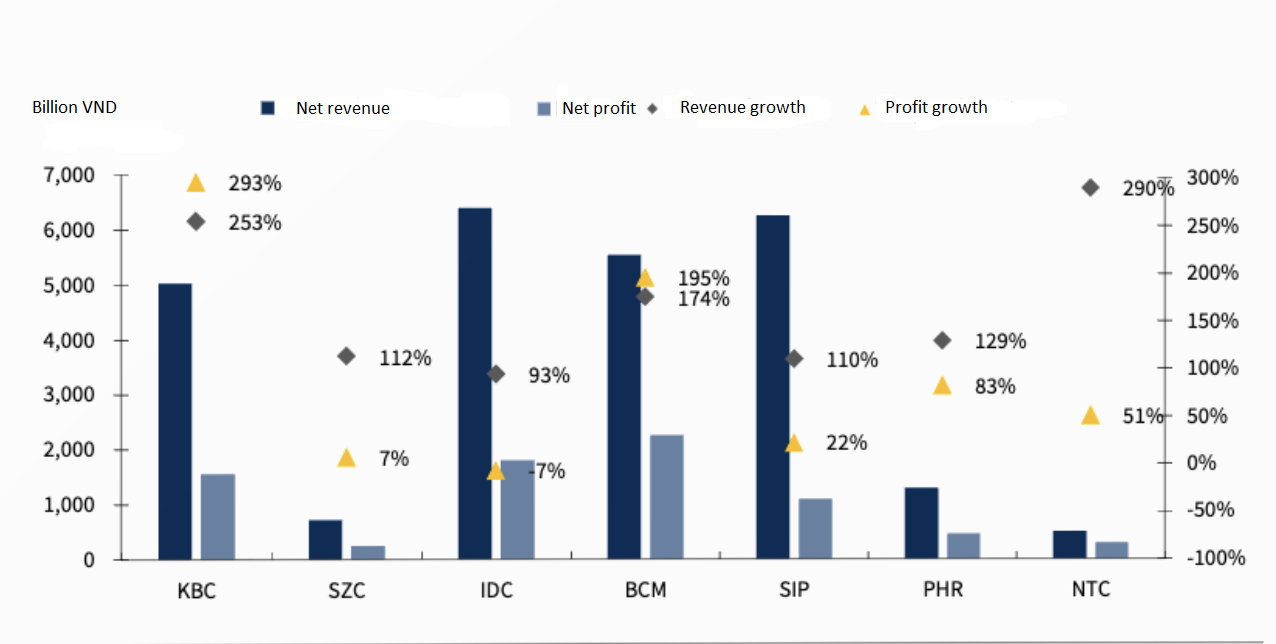

Net revenue and profit of some firms in the industrial property sector.

What stocks to watch?

Ms. Nguyen Thi Trang also highlighted certain investment prospects from the industrial environment, which are exemplified by typical listed firms. First, the main justification for Vietnam Rubber Group (GVR) is its extensive rubber land availability, which is seen as a strategic asset with the potential to be developed into an industrial park.

According to GVR's predictions, it will lease 80 hectares of new industrial parks in 2026, bringing in VND 1,465 billion (up 29.7%). Due to a one-time income recognition, the NTU3 industrial park is anticipated to contribute more than half of this total.

Second, Kinh Bac Urban Development Corporation (KBC) centers on its potential to build industrial parks in key regions and draw in sizable FDI clients. According to projections for 2025–2026, industrial park land would be turned over on 110 hectares and 80 hectares, respectively, worth VND 4,223 billion and VND 3,335 billion. Of this, 65 hectares under earlier Memorandums of Understanding (MoUs) would be contributed to KBC's land handover in 2025–2026, including 25 hectares under the MoU inked with Luxshare (2024) and 40 hectares under the MoU signed with AIC and Invest Group in November 2025.

Third, Saigon VRG Investment Company (SIP) is thought to have a more solid base because of its sizable clean land availability in important industrial parks like Phuoc Dong. To increase land leasing in two industrial parks in Dong Nai (LA-BS Industrial Park and Long Duc 2 Industrial Park), SIP is anticipated to utilize the Long Thanh airport, which is set to open in the first half of 2026.