What is the outlook for Vietnam's textile and garment industry?

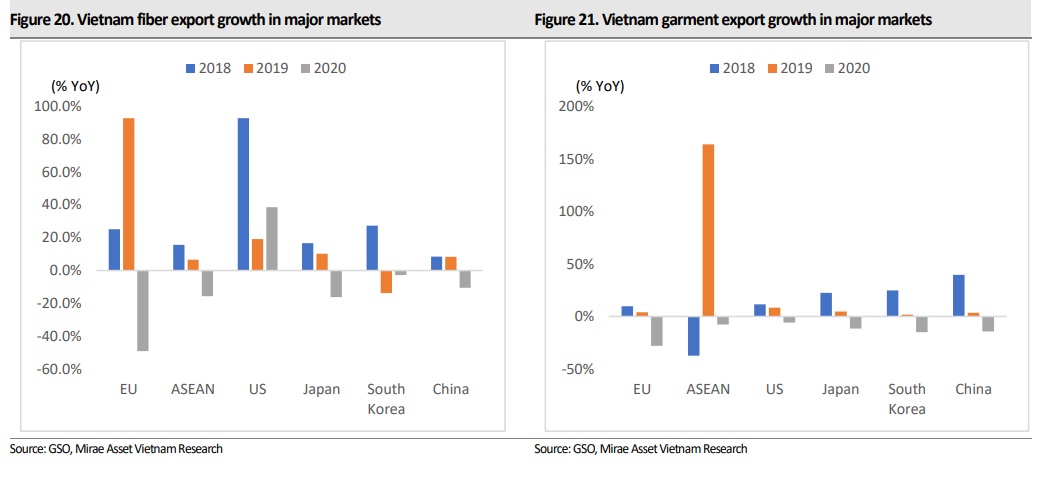

In 2021, by maintaining market share in major export markets, Vietnam's textile industry is expected to continue benefiting from newly implemented free trade agreements.

In 2020, most listed textile and garment companies saw negative net profit growth. In particular, Binh Thanh Import Export Production and Trade JSC (GIL) with production contracts lasting to 2023 and separate product lines for key customers IKEA and Amazon Robotics, along with income subsidiaries in many fields- still recorded strong growth, despite the pandemic.

However, in terms of cash flow, textile companies continue to maintain positive cash flow operating activities (CFO). Century Synthetic Fiber Corp (STK), Garmex SaiGon (GMC), Song Hong Garment JSC (MSH), Thanh Cong Garment, Investment, Trading JSC (TCM), and Viet Thang Corporation (TVT) all recorded positive CFO in the period 2016–2020.

In the US market, Vietnam's textile and apparel market share in 2020 continued to increase, reaching 14.9% (versus 13% in 2019), with a total value of nearly US$13.4bn (-7.2% YoY). Vietnam's main rivals, India and Bangladesh, also recorded market share growth, at 7.6% and 6%, respectively. Meanwhile, China continued to account for the highest market share, at 28.2%, despite a sharp decline 32.8% in 2019. In 2020, the total value of imports of textiles into the US plummeted 19.3% YoY to US$89.6 billion. Of the top five textile suppliers, Vietnam recorded the lowest rate of decline, at -7.2% YoY, while key competitors China (-30.6%), India (-15.3%), Bangladesh (-11.4%), and Indonesia (-19.1%) recorded double-digit decreases.

For the garment segment, Vietnam's import value into the US reached nearly US$12.6bn (-7.3% YoY) in 2020, equivalent to a 19.6% market share (a sharp increase the 16.2% in 2019). Among the top five suppliers, Vietnam recorded the strongest growth in market share, followed by Bangladesh and Indonesia, while China and India recorded market share declines. Also, Vietnamese garments recorded the lowest rate of decline (-7.3% YoY) of the top five, while China (-39.2%), Bangladesh (-11.7%), Indonesia (-20.1%), and India (-25.6%) all saw double-digit rates of decline in 2020.

In the EU market, Vietnamese garments account for only 6.5% of the top-seven suppliers, with a value of EUR 2.7 billion (-9% YoY). Although below those of China, Bangladesh, and India, the market share of Vietnamese garments has continued to increase steadily since 2016. In addition, although general demand for apparel products has declined since 2016, Vietnam has recorded the lowest cumulative decrease (-1.2% YoY) among the top suppliers, China, Bangladesh, India, Pakistan, Indonesia, and Thailand.

In the South Korean market, Vietnamese garments continue to dominate, with the largest market share (33.7%, down slightly 34.4% in 2019), followed by China (31.6%). In 2020, the value of Vietnam's garment imports reached US$3bn (-14.2% YoY), followed by China, with a value of nearly US$2.9 billion (-17.7% YoY).

For fiber products, the export value of Vietnamese filament and staple fibers to the Korean market in 2020 reached US$93 million and US$69.7 million, respectively, with market share maintained at 11% and 11.7%, respectively. China is still the leading country in the Korean import fiber market, with its share of filament and staple fibers at 57.3% and 36.8%, respectively. In general, in the low average price group, the market share of Vietnamese fiber products remained stable in the 2016–2020 period.

In 2021, with the strong deployment of COVID-19 vaccinations, Mirae Asset Securities (Vietnam) expects the pandemic to be under control and economic activity in major export markets to continue recovering to pre-pandemic levels 3Q21. Expected 2021 GDP growth in major markets, including the US (3.5%), the EU (3.6%), Japan (2.5%), and China (7.9%), will lead to consumer demand for garments at year-end. Consumer confidence indices in major export markets have also shown recoveries, indicating a resumption of consumer spending.

The yarn segment is expected to improve alongside the recovery of textile production, especially in China- the main export market for Vietnamese yarn. Polyester yarn is expected to continue to dominate global yarn production, with output growth exceeding the overall growth rate, and to continue to benefit the low base of crude oil prices in 2020. Meanwhile, cotton yarn demand is expected to recover, thanks to the recovery of textile production in Chinese garment manufacturing 4Q20, said Mirae Asset Securities (Vietnam).

As of end-January, 2021, Vietnam garment market share remained stable in major export markets South Korea (33.4%), the US (19.4%), and Japan (14.9%). Mirae Asset Securities (Vietnam) expects Vietnamese textile products, especially garment products, to maintain market share growth in Japan and the EU, thanks to duty/tariff advantages and customs incentives the CPTPP and EVFTA agreements. Vietnamese garments will continue to dominate the South Korean market, and fiber products to maintain their market share, thanks to price advantages.

In the US market, Mirae Asset Securities (Vietnam) expects Vietnamese garments’ market share to remain unchanged, thanks to the maintaining of US import duties on Chinese products under President Biden.