Interest rates edged up, the SBV rolled out new liquidity support

The interbank and deposit rates inched up. In such context, the State Bank of Vietnam (SBV) rolled out new liquidity support.

Among the 18 banks MBS monitored, 11 banks raised deposit rates in November.

DXY cooled in November

The DXY came under downward pressure as the odds of a December Fed rate cut rose to around 90% Starting the month at 99.8, the DXY surged to a 6-month peak of 100.18 on November 21 after the September jobs report showed the U.S. economy added 119,000 jobs—more than double the forecast. This reinforced the Fed’s view that the labor market was cooling but remained solid, significantly reducing expectations for a December rate cut. Post-release, markets priced in only a 39% chance of a Fed rate cut in December.

However, the DXY quickly reversed, dropping to 99.4 by end-November (-0.4% mom, -9.1% ytd) after September retail sales rose a modest 0.2% (down sharply from August’s 0.6%) amid tariff-driven price pressures.

Meanwhile, the unemployment rate climbed to a 4-year high of 4.4%, and the University of Michigan’s November consumer sentiment index fell near record lows, signaling that inflation was eroding real incomes. Adding further downward pressure on the USD, the yen strengthened after the Fed cut rates at its December meeting.

USD/VND appreciation remained modest

By end-November, both the central rate and interbank rate rose a modest 0.2% mom, reaching 25,155 VND/USD (3.3% ytd) and 26,365 VND/USD (3.6% ytd), respectively. Upward pressure came partly from higher USD demand as the State Treasury resumed USD purchases from commercial banks for the first time since late June.

Specifically, in November, the Treasury announced plans to purchase USD from commercial banks, with a maximum total value of USD 250mn, thereby raising the total USD purchased since the beginning of the year to USD 2.14 billion (surpassing the full-year 2024 total of USD 2.08 billion).

Nevertheless, USD/VND appreciation remained modest, supported by a persistently positive VND-USD interest rate gap. This occurred as the VND interbank rates stayed elevated above 4% throughout November and even hit a 3-year high of 7.5% in early December. A further 25 bps Fed rate cut in December—bringing the total reduction this year to 75 bps—will help ease exchange rate pressure toward year-end. Additionally, domestic USD supply is expected to improve in Q4, as this is the peak export season and year-end remittance inflows typically surge.

The interest rates continued to rise

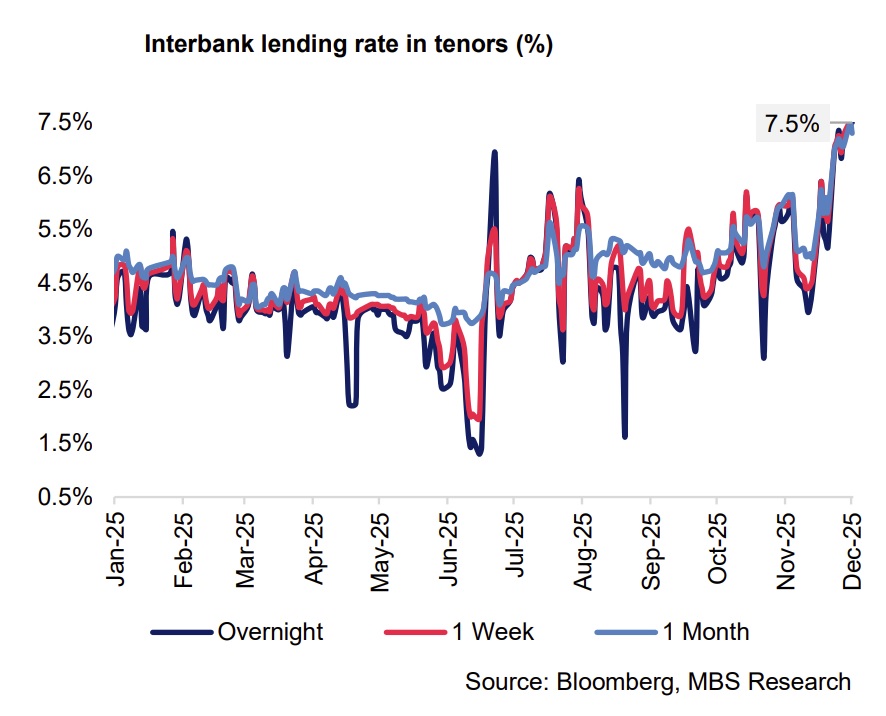

Credit growth strengthened sharply toward year-end, reaching 16.56% ytd as of 27 November—significantly higher than the 11.5% recorded in the same period last year. Against this backdrop, interbank overnight rates rose steadily from 5.4% at the start of November to 6.4% by month-end, then spiked to 7.5% in early December—the highest level in over three years. Meanwhile, rates for 1-week to 1-month tenors anchored at 7.2-7.4%, with 6-month rates hovering at 7.2%. In response, the SBV has raised the OMO interest rate by 50 basis points to 4.5%, marking the first rate hike in 19 months.

Among the 18 banks MBS monitored, 11 banks raised deposit rates in November. Notably, state-owned banks have also begun lifting rates on short-term tenors. Thus, the highest rate for tenors under 12 months now stands at 5.4% (20 bps ytd). By month-end, the average 3-month deposit rate at state-owned banks rose 13 bps mom to 2.03%, while private banks saw a larger 28 bps increase to 4.2%.

By end-November, VIB offered the highest 12-month deposit rate at 6% per annum. The upward movement in deposit rates at the start of 4Q was mainly due to seasonal factors, as banks increase capital mobilization to meet the typically sharp year-end surge in credit demand.

Accordingly, the average 12-month deposit rate for private banks climbed 27 bps ytd to 5.32%, while the rate for state-owned banks still held steady at 4.7%. Consequently, the average 12-month deposit rate of commercial banks increased by 14 bps since the beginning of the year, reaching 5% as of the end of November.

The SBV continued injecting liquidity

The SBV continued injecting liquidity via open market operations. In November, the SBV injected over VND 365.3 trillion through the OMO channel at a 4% interest rate for tenors ranging from 7 to 105 days, while the total matured OMO capital was nearly VND 258.9 trillion.

Cumulatively, the SBV injected a net amount of over VND 106.4 trillion—the highest monthly net liquidity injection since April 2024. On December 19, 2025, the SBV continued to inject VND 20,375 via OMO to support short-term liquidity for the Vietnam banking system.

In addition, on December 5, the SBV also rolled out a new liquidity support instrument—FX Swap. In which the central bank purchased USD on the spot from credit institutions at 23,945 VND/USD and will sell the same amount back under a 14-day forward contract at 23,955 VND/USD. MBS believes this tool will help improve short-term liquidity conditions.