What is the outlook for power stocks?

VNDirect expected country electricity consumption to recover since 2022F. So, power stocks would be attrative for investors.

In 7M21, although Vietnam still suffered from the pandemic and has been applied strict social distancing for many months, the power consumption growth rate has recovered by a higher level of 6.4% YoY.

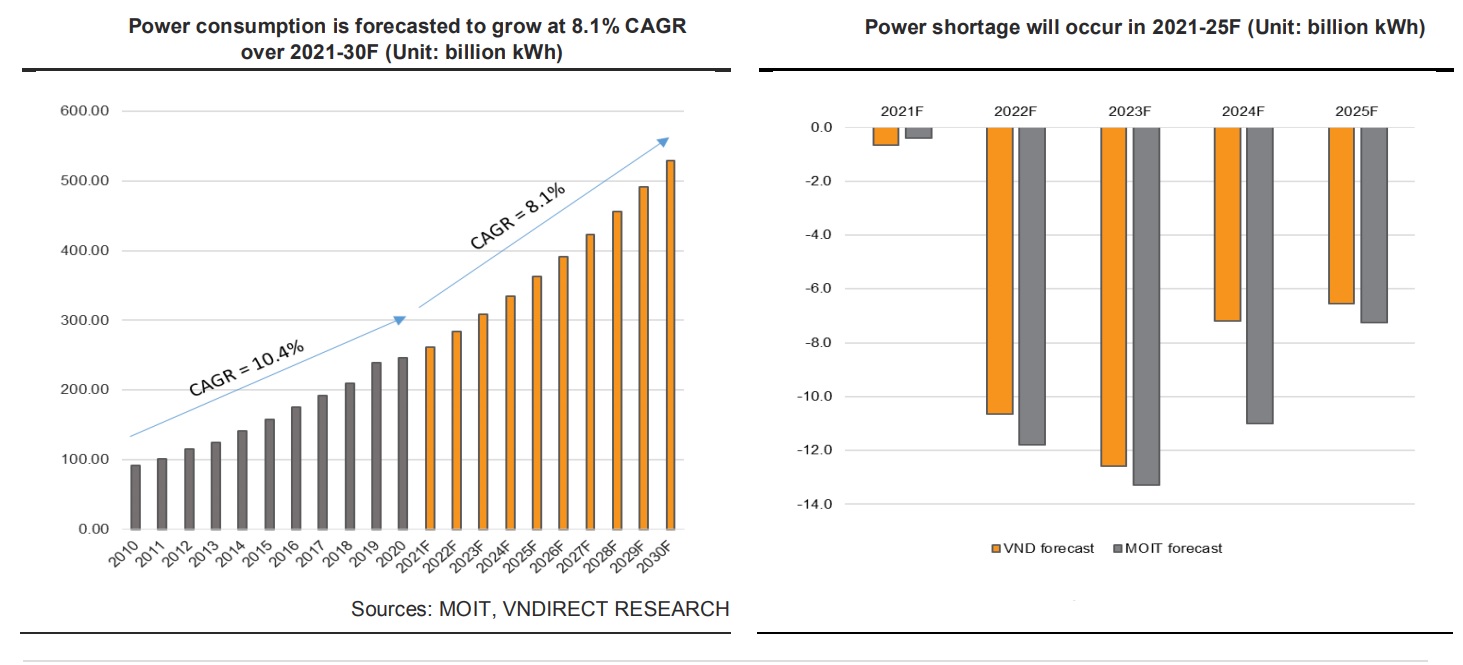

Vietnam’s power output grew at average 10% per year from 2010 to 2019, but is decelerating to only 2.4% YoY in 2020 due to Covid-19 pandemic, causing a decline in power consumption. In 7M21, although Vietnam still suffered from the pandemic and has been applied strict social distancing for many months, the power consumption growth rate has recovered by a higher level of 6.4% YoY, but still lower than the expected 8.5% according to the Power Development Plan 8 draft (PDP8).

VNDirect expected power consumption would recover from 2022F when Covid-19 is under control. According to the Ministry of Industry and Trade Vietnam (MOIT), Vietnam's power consumption will grow at 8.1% CAGR in the 2021-30F period. Besides, this stock company forecasted that power shortage might occur in the 2022-25F period due to the delay of several traditional power plants (Hydro, gas-fired, and coal-fired power) in the 2016-20 period with an estimated capacity is up to more than 7,000MW.

Meanwhile, the recent sharp rise in gas and coal-fired power appears to be a global issue, causing input shortages in several countries, especially China and European countries. It is generally because supplies could not rise fast enough to keep pace with the expected demand recovery. However, the power crisis seems even worse in China when the government oriented to cut down coal-fired power for the sake of carbon reduction. Hence, it put increasing pressure on businesses, and currently, several companies are forced to stop operating in peak hours or suspend operation for 2-3 days/week. The uncertainties related to energy in China have led many investors to look for alternatives, and Vietnam is said to be an expected option. Hence, VNDirect believed the stability in Vietnam's current power system would be the advantage, attracting FDI inflow to Vietnam, and furthermore, it could increase power consumption in the future.

Besides, the reduction in the capacity of several factories in China could allow Vietnam exports to rise as several manufacturing sectors in China recorded a decrease in output, such as steel and yellow phosphorus. Hence, VNDirect expected it would benefit Vietnam businesses to increase exporting output and indirectly increase power consumption when our factories operate in high capacity.

Vietnam's power sector is going through a major transition as government has priorities to maintain the balance between macro-economic growth and environmental sustainability. Given the size and the faster-than-expected progress of this energy transition, VNDirect believed power stocks that focused on cleaner alternatives would outperform for a few years to come. It also prefers energy infrastructure developers as it believes more investments in grid systems are needed to facilitate energy transition towards a lower-carbonnation. It observed that power stocks have recently charged up across global equity markets in response to ongoing E.U and China electricity outages. Thus, Vietnam power stocks will back to the center stage.

Gas-fired power output would bounce back since 2022F, trailing the recovery manufacturing activities. Additionally, due to the high possibility of El Nino phenomenon, the hydropower output will be subdued next year, triggering higher mobilization from gas-fired power. A series of megaprojects in the LNG-to-power value chain have been announced recently, making it the most promising segment in the next couple of years. Thus, POW, NT2, and gas infrastructure developers like GAS will ride on this trend, said VNDirect.

This stock company finds a substantial increase in ESG fund inflow in regional emerging markets. Even in Vietnam, ESG is expanding at the early stage of investment. It prefers companies with ongoing renewable energy (RE) projects that benefit from the attractive feeds-in-tariff and companies that enjoy RE infrastructure development. Some prominent names include BCG and FCN.