Credit growth will leverage bank earnings

Several banks have begun to announce extraordinarily remarkable profit growth figures, against a backdrop of roughly 10% credit growth across the banking sector.

NIM recovery

According to Mr. Nguyễn Thanh Tùng, Chairman of the Board at Vietcombank (VCB), in the first half of 2025, the bank made considerable efforts to implement effective credit growth solutions while ensuring safety and sustainability.

As of June 30, 2025, Vietcombank's total credit reached VND 1.6 quadrillion, up 11.1% compared to the end of 2024. Excluding over VND 50 trillion in loans supporting VCB Neo, the growth stood at 7.5%. Credit quality remained under control, with the non-performing loan (NPL) ratio kept below 1%.

Banks are expected to continue achieving positive credit and profit growth, but competitive interest rate strategies have narrowed profit margins. VietinBank (CTG) Chairman Trần Minh Bình earlier revealed that the bank's credit had increased by more than 9% as of June 10 and was estimated to surpass 10% in the first half of 2025.

Summarizing MB Bank’s (MBB) first-half 2025 performance, CEO Phạm Như Ánh stated that the bank met all its targets, remained among the top five in growth, and added 2.2 million new customers. MB posted a profit of VND 15.4 trillion, a 16.9% increase, fulfilling 50.8% of its annual plan, while maintaining efficiency and safety. Green credit accounted for around 8% of the bank’s portfolio, and total credit rose 12.5%.

Robust credit growth is expected to be a recurring theme as banks release their second-quarter and semi-annual financial statements. According to the State Bank of Vietnam, the industry-wide credit growth stood at 9.9% — the highest since 2023 — and will be reflected in each bank’s performance.

Ms. Trần Thị Khánh Hiền, Head of Research at MB Securities (MBS), noted that system-wide credit started accelerating from February 2025, supported by improved sentiment and GDP growth targets of 8% coupled with loosened monetary policy. She observed that private commercial banks saw better credit growth than state-owned ones. Banks such as MSB, Eximbank (EIB), VPBank (VPB), SHB, and VietinBank, which recorded strong credit growth in Q1, continued their momentum into Q2, driven primarily by corporate lending.

The list of listed banks monitored by MBS is projected to grow profits by approximately 14.7% year-on-year in Q2, an improvement over the 11% growth in Q1. VPBank, VietinBank, and Eximbank are forecasted to post profit growth rates of around 12%, 10%, and 13%, respectively, thanks to better-than-average credit expansion.

Given the strong credit and profit growth in the first half of 2025, analysts at SSI Research predict that in the latter half of the year, domestic drivers will be crucial for Vietnam’s growth amid global uncertainties — especially those related to retaliatory tariffs and ongoing geopolitical tensions. Credit growth may increasingly stem from real estate and infrastructure projects, both of which are receiving greater policy focus as the government looks to stimulate domestic demand and maintain economic momentum.

SSI also commented that a combination of abundant new housing supply, rising home prices, and low mortgage interest rates — particularly preferential rates of 5.5%–7% for the first two to three years — is expected to continue boosting buyer sentiment and short-term market liquidity. Moreover, major public investment projects are anticipated to drive credit growth not only in the latter half of 2025 but also into the medium term.

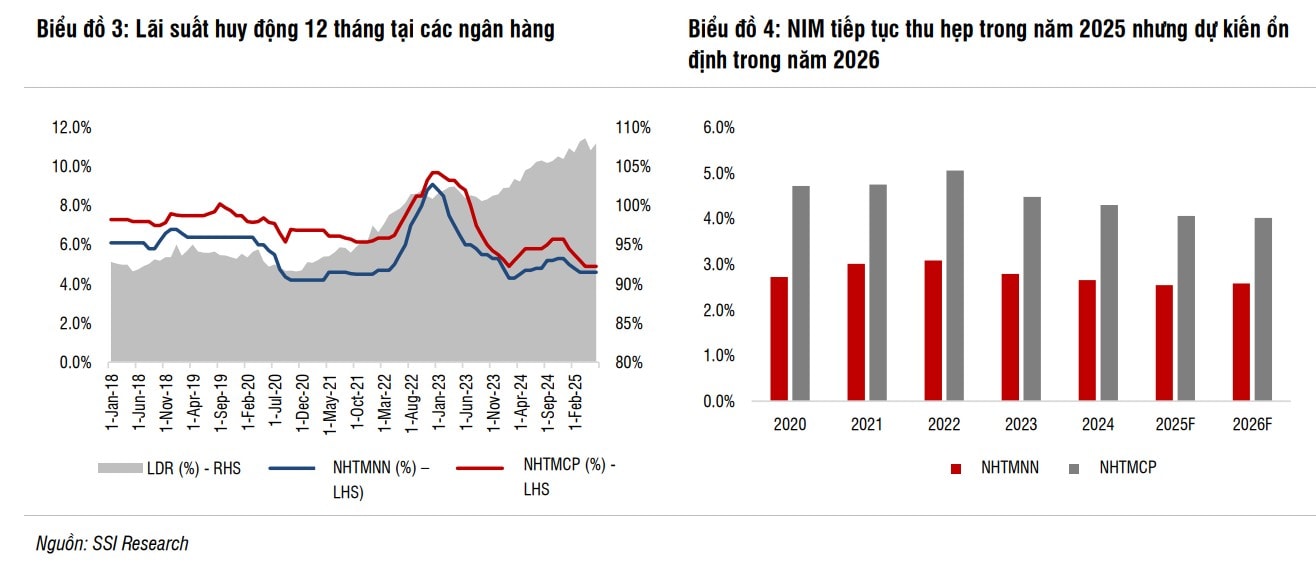

Analysts expect the low interest rate environment to persist into late 2025, supported by ample Treasury deposits and liquidity injections from the State Bank. However, they caution that should credit grow more aggressively, interest rates may fluctuate in the second half of the year due to seasonal factors, increased public investment disbursement, and exchange rate pressures. Additionally, net interest margins (NIM) could remain compressed due to reliance on credit demand and competition for funding.

Nonetheless, SSI believes that accelerated public investment and provincial mergers could stimulate economic activity in neighboring regions, expanding credit demand beyond just real estate. As broader recovery in credit demand unfolds, NIM recovery could become more evident.

"Preferred Banks" Forecast

Amid expectations of strong bank profitability, the sector’s valuations remain attractive. According to SSI, banks under their coverage are trading at a 12-month forward price-to-book (P/B) ratio of 1.1x — significantly lower than the historical average of 1.68x since 2017. Stocks such as VCB, BID, ACB, VPB, and several smaller banks remain undervalued.

As of late April, the unofficial market exchange rate had risen to VND 26,470/USD, while the central rate was listed at VND 24,956/USD, marking increases of 2.8% and 2.5% respectively since the start of 2025.

Investment strategies and preferences may vary, yielding different lists of “chosen banks,” yet most securities firms agree that bank valuations remain low. In contrast, some stocks such as TCB, MBB, CTG, and STB have surpassed historical peaks, highlighting growing differentiation within the sector.

SSI attributes this divergence to investors' expectations regarding policy changes and business strategies amid intensifying competition, especially as U.S. retaliatory tariffs reshape export-related credit demand and the strategic positioning of each bank within the sector.

Analysts continue to favor banks with low capital costs, as these institutions are better positioned to expand market share and maintain stronger NIM in a fiercely competitive environment. They also believe that as legal bottlenecks ease and the primary real estate market begins recovering, banks with sizable real estate loan portfolios will have opportunities to boost credit growth.

SSI RS also places high expectations on banks with clear recovery stories, where profit growth may stem from reduced provisioning and significant income from bad debt recovery. As a result, CTG, MBB, TCB, STB, and VPB are the preferred picks for the second half of 2025 and into 2026.

Meanwhile, VCBS forecasts that the banking sector’s 2025 pre-tax profit could grow 18% compared to 2024. Small-sized banks are expected to lead in growth (up 35%) due to aggressive real estate credit expansion from a low base and improved bad debt handling, possibly featuring notable exchange listings. Dynamic private banks are projected to grow profits by 20%, while state-owned banks are expected to see around 12% growth.

VCBS notes that dynamic private banks are benefiting from policies supporting private sector development and improving asset quality. This group is also involved in high-profile activities such as IPOs, restructurings, and debt recovery.

In VCBS’s 2H2025 strategy report, credit growth is projected to reach 16% by year-end, with NIM hitting a bottom and NPLs gradually declining amid improved debt recovery efforts. Overall, the banking sector's valuation is seen as attractive amid strong growth.

Notable 2025 Outlooks for Selected Banks

Asia Commercial Bank (ACB): Credit is expected to continue growing steadily in 2025, driven by a clear recovery in individual lending and stable corporate demand supported by favorable economic conditions. Profitability remains high, underpinned by effective cost and asset quality management. NIM is anticipated to recover slightly from H2 2025, thanks to improved funding costs and slower reductions in lending rates.

BIDV (BID): Credit growth is expected to match the industry average at 16%, with NIM declining slightly to 2.3%. The bank maintains one of the highest asset quality levels with low provisioning pressure. Its charter capital increased by VND 21.656 trillion to nearly VND 91.870 trillion through reserve capital, a 19.9% stock dividend, and a 3.84% private placement.

VietinBank (CTG): Credit growth is projected at 16.9% in 2025, in line with the industry average. NIM is set to recover in H2 2025, supported by both deposit and lending operations. Asset quality remains well-controlled, with some restructured customers being reclassified to lower-risk categories and provisioning reversals expected in Q2 2025.

MBBank (MBB): Among the fastest-growing in terms of credit, MBB is expected to reach 28% credit growth in 2025, fueled by both wholesale and retail segments. NIM is projected to recover in H2 2025 thanks to a rising CASA ratio (currently the highest in the industry at 35%) and a greater focus on retail lending. Fee income is also favorable, and asset quality is expected to improve.

Maritime Bank (MSB): Credit demand remains strong, with expected credit growth of 21.2% in 2025. NIM improvement is likely from H2 2025. Asset quality is also improving, with the NPL ratio falling to 2% thanks to strong credit growth and increased bad debt recovery. MSB is completing its financial ecosystem with plans to divest from TNEX Finance and invest in a securities firm and an asset management company.

Techcombank (TCB): Credit growth is supported by the recovery in real estate and construction sectors. CASA remains high, giving the bank an edge in funding costs and easing NIM pressure. Diversified non-interest income continues to contribute to profit growth. The planned IPO of subsidiary TCBS is expected to raise capital, revalue investments, and strengthen Techcombank's position in the financial market.