What is the scenario for coal-fired power in long-term?

Coal-fired plants could remain competitive until international coal price cools down as China is having stern actions to recover coal supply, said VNDirect.

Uong Bi Thermal Power Plant

A decline in output and business performance

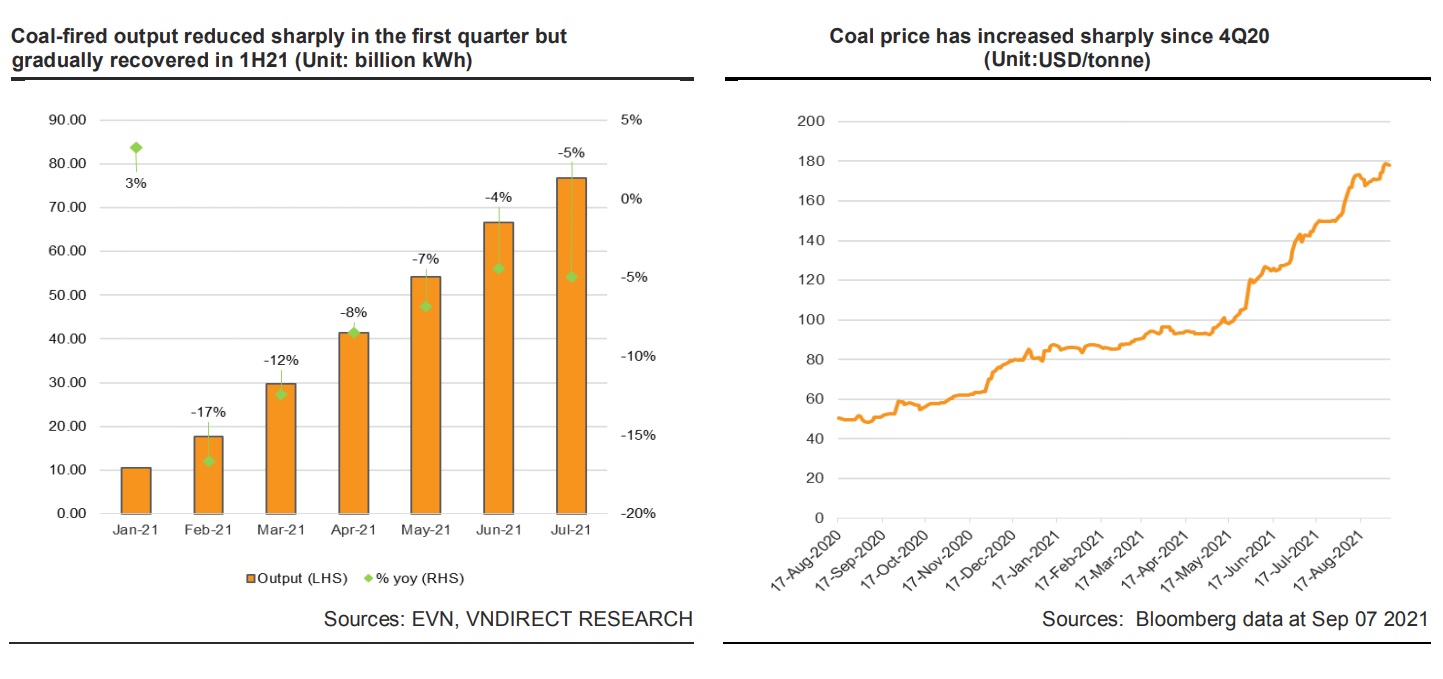

Coal-fired power output decreased 5% YoY to 76.8bn kWh in 7M21 due to (1) EVN prioritized to mobilize from renewable energy sources, (2) low electric load as Vietnam applied strict social distancing during the fourth wave of Covid-19, and (3) several thermal plants using imported coal was affected negatively by the rise of international coal price, especially in Indonesia and Australia - the major suppliers of Vietnam.

So, coal-fired power performed moderately with a slight decline in 1H21. Hence, most of the coal-fired companies recorded a decline in revenue and net profit. Notably, although QTP revenue decreased 15% YoY in 1H21, its net profit increased 14x YoY due to a sharp reduction in its COGS. Hence, its gross profit margin increased from 4.5% in 1H20 to 10.5% in 1H21, while financial expense reduced 63% YoY.

On the other hand, HND and PPC recorded a decline in 1H21’s revenue of 25% YoY and 45% YoY, respectively, due to a sharp reduction in power output, leading to a decrease in net profit 76% YoY and 38% YoY, respectively.

Coal-fired power potential

However, VNDirect sees the potential for coal-fired power plants from 2022F for the following reasons.

First, coal-fired power will be assigned a higher output target when electric load recovers from 4Q21, leading to higher power consumption.

Second, coal-fired power is the main pillar in Vietnam's power system, accounting for 50-55% of total output each year due to its stable nature and reasonable average selling price of around 1,400-1,500VND/kWh.

Third, the whole situation of increasing coal prices due to supply shortage has negatively affected several large consumers such as India and China. Besides, the uptrend momentum in coal price also harmed Vietnam coal-fired plants using imported coal, as EVN announced the price of imported coal had increased 250% YoY in 7M21. However, several coal-fired plants maintain their reasonable power price, such as Genco 3 and POW. In particular, Genco 3 announced its 6a mixed coal price on August 21 stayed at 1.529m VND/tonne, reduced 1.1% YoY. Besides, POW recorded its 8M21 ASP price for Vung Ang 1 to remain at a stable rate of around 1350VND/kWh.

VNDirect believed that being self-sufficient in domestic coal resources would be the main reason for Vietnam to be less affected by the world situation. With the total demand for domestic coal of 35m tonnes/year, it is achievable as TKV has produced 29.67m tonnes of coal in 9M21, reaching 77% of the company's annual plan.

Expectations from new plants

Although coal-fired power is raising concern in terms of environmental impact, this energy source still plays an essential role in the national electricity development plan as power consumption is expected to rise rapidly in the following years. Hence, coal-fired power capacity will grow at 6.2% CAGR in 2021-30F and account for 27% of the total capacity in 2030F. However, to maintain both objectives – electricity growth and environmental protection, the proposal stressed the importance of developing new coal plants with modern technology to reduce emissions and increase production efficiency.

Besides, Vietnam is importing bituminous coal and black lignite coal with low heating value; thus, the draft PDP8 suggests substituting high-value coal in the future. At the moment, the proposed domestic coal of 35m tonnes/year can only provide for 14GW of coal-fired plants, while the total capacity reached 20GW in 2020. Hence, the new plants will operate using imported coal or mixed coal, with the expected importing amount will increase from 12.4m tonnes/year in 2020 to 74.8m tonnes/year in 2045F.

The total capacity of domestic and imported coal-fired plants in 2020 is recorded at 14,281MW and 6,150MW, respectively, and will edge up to 16,851MW and 12,682MW in 2030F, respectively. Notably, the domestic coal-fired power growth rate will slow down from 2035F and start decreasing in 2040F which will give way to the growth of imported coal-fired plants according to the PDP8. VNDirect expected the listed plants would contribute significantly to the national electricity in the future.