What outlook for HAH?

Hai An Transport & Stevedoring JSC (HSX: HAH)’s net profit is projected to grow by 57%, 23% and 9% yoy in 2024, 2025 and 2026 respectively, driven by high charter rate as new contracts are secured combine with fleet expansion and the enhancement of vessels and port throughput.

HAH’s charter revenue increases significantly as charter rates remain high. The combination of increased imports in the US and prolonged tensions in the Red Sea has driven up global freight rates, keeping charter rates at elevated levels. This, coupled with the company's plan to sign new leasing contracts for 8 vessels in 2025-2026, is expected to boost charter rates by 5-10% and lead to a 74%, 61%, and 14% year-on-year increase in HAH's charter revenue in 2024, 2025, and 2026, respectively.

Besides, HAH’s strong rebound in fleet operation is fuelled by improved trade activities. MBS expects the strong recovery of trade activities to be prolonged in the last months of 2024, aligned with the trend of inventory replenishment in major economies like the US, and to continue growing in 2025-2026. With 8 self-operated vessels with a total capacity of nearly 11,000 TEU, HAH is well-positioned to meet the growing demand for transportation, thereby driving a 35%, 10%, and 5% yoy increase in output and a 38%, 11%, and 6% yoy increase in self-operation fleet revenue in 2024, 2025, and 2026, respectively.

MBS forecasts HAH’s total revenue to surge by 46.1% YoY in 2024 and grow by 23.7% and 9.1% YoY in 2025 and 2026, respectively. While financing costs are expected to soar by 102% YoY in 2024 due to the company's debt-funded fleet expansion, they are projected to moderate, increasing by only 4.6% and 9.2% YoY in 2025 and 2026. Overall, HAH's net profit is expected to increase by 57.4%, 23.2%, and 8.7% YoY in 2024, 2025, and 2026, respectively.

HAH’s growth will be boosted by the following key points: First, the surge in demand for container shipping, driven by the early stockpiling trend in the US combined with geopolitical tensions in the Red Sea and the looming threat of a US port strike, has resulted in elevated freight rates and higher charter rates.

Second, to meet the increasing transportation demand and expand its service network, the company plans to continue expanding its capacity and fleet size in 2025-2026. With the addition of two vessels by 2026, the company's fleet will grow to 18 ships and its capacity will reach approximately 30,100 TEU, marking a 13.6% year-on-year increase.

Third, trade activities in Vietnam continue to improve significantly as US retailers and manufacturers shift their production chains to Vietnam due to higher tariffs imposed on goods from China under the new US administration, thereby sustaining the growth in revenue from vessels and port operations.

Fourth, with additional revenue from new vessels in November and December at charter rates 29% higher than the average rate and expectations that charter rates will remain elevated as new leasing contracts are secured by the end of the year, we believe this is the right time to invest HAH.

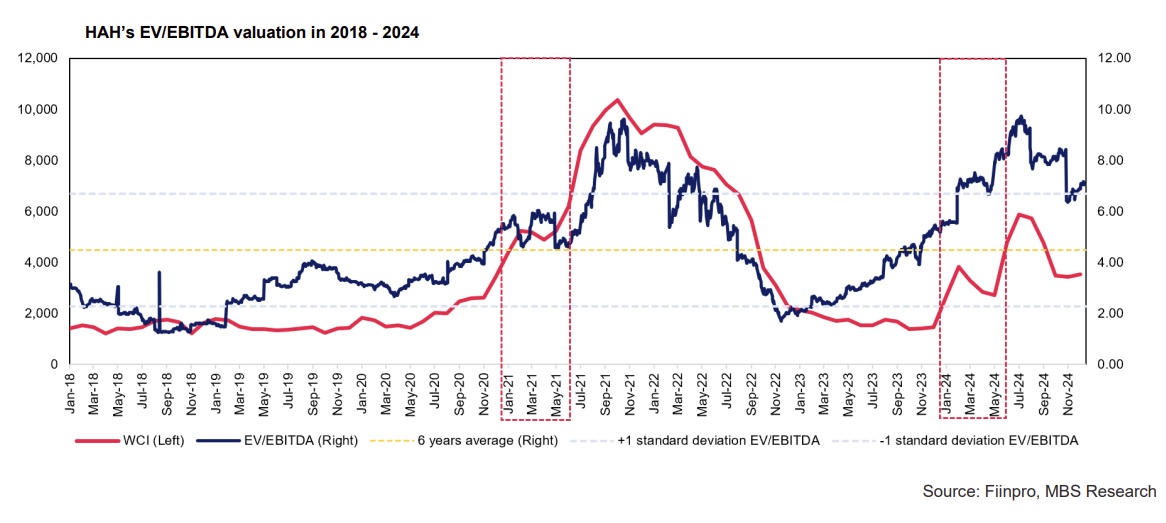

“We have employed both the FCFF and EV/EBITDA methods to determine a fair value for HAH of VND 58,000 per share within one year from the recommendation date, representing a potential upside of 15.9% compared to the closing price on December 24, 2024. Our target EV/EBITDA multiple of 5.7x is based on the expectation that the WCI will continue its upward trend and return to its previous peak before moderating, similar to the periods of 01/2021 – 06/2021 (when HAH's average EV/EBITDA was 4.4x) and 01/2024 – 07/2024 (when HAH's average EV/EBITDA was 6.8x), combined with the benefits of high charter rates from new lease agreements signed at the end of this year that have not yet been fully reflected in the stock price”, said MBS.