What outlook for the USD/VND by year- end?

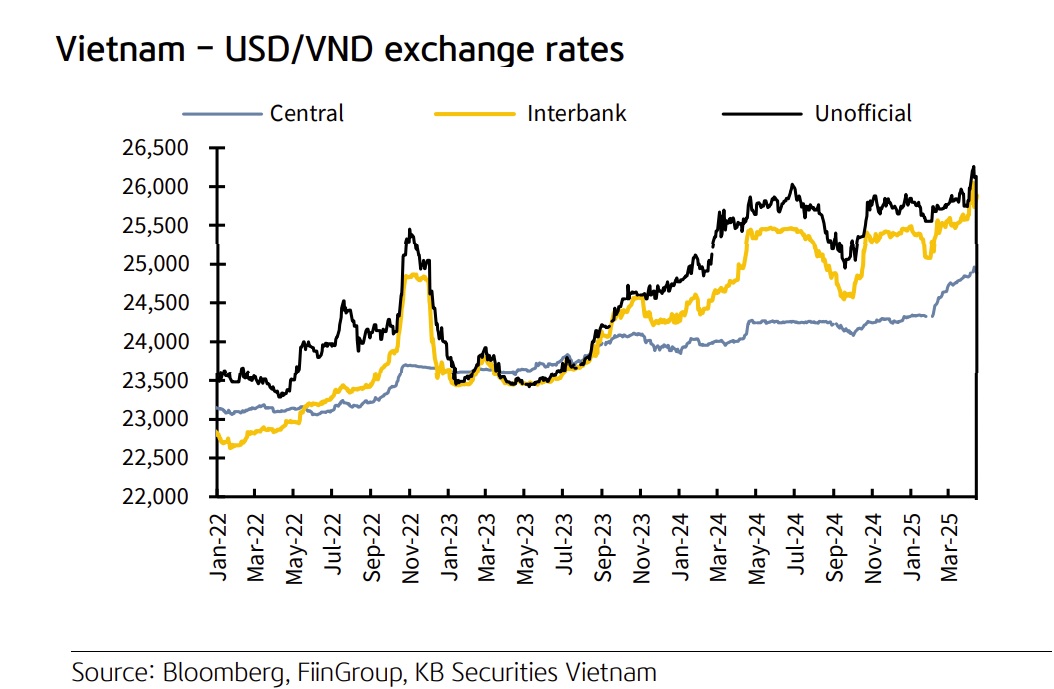

KBS has elevated the USD/VND exchange rate forecast amid a volatile global economic outlook.

Exchange rate dynamics in 2025 are anticipated to continue exhibiting complexity, shaped by a range of external uncertainties. US trade policies are likely to exert a dampening effect on global economic growth and trade activity. As a result, KBS has revised its exchange rate forecast upward, projecting that the USD/VND rate could expand by 4% compared to end-2024. Exchange rate movements in the coming period will largely be influenced by two key factors: (i) foreign currency supply-demand, particularly driven by FDI inflows, the trade balance, and remittances; and (ii) the global performance of the USD, as reflected in the DXY index.

“A weakening USD following a period of strong gains would help ease exchange rate pressures in the short term. However, if prolonged trade tensions continue to curtail foreign currency inflows into Vietnam, the exchange rate may still face upward pressure in the remaining quarters of the year”, said KBS.

As highlighted in KBS's macro note Vietnam amid Trade War 2.0, tariff policies are likely to intensify pressure on the USD/VND exchange rate. New tariff measures could indirectly constrain foreign currency inflows into Vietnam through their adverse effects on exports and FDI. In the short term, the US decision to temporarily suspend retaliatory tariffs for 90 days is likely to bring forward the export peak season to the second quarter of 2025. Anticipating future policy uncertainty, US importers may accelerate purchases, thereby bolstering USD supply and helping to ease exchange rate pressures. However, KBS said, in 2H2025, a slowdown in export activity and weaker FDI disbursement would be expected to weigh more heavily on the exchange rate.

Two key factors will require close monitoring once a final decision on tariffs is made: (i) the effective tariff rate imposed on Vietnamese goods, which will shape the extent of export disruption to the U.S. market; and (ii) how Vietnam’s tariff level compares with that of peer countries, which will influence long-term FDI relocation strategies.

Exchange rate pressure remains a key risk to monitor in the coming months, particularly amid persistent global market volatility. Based on currently available official information, in a worst-case scenario where Vietnam is subjected to tariffs exceeding 30%, long-term exchange rate pressure would likely persist. This would stem from: (i) an estimated 10–15% YoY decline in 2025 export turnover, primarily due to reduced exports to the US, and (ii) a temporary halt in new FDI capital disbursements, as investors reassess and potentially redirect capital toward lower-tariff destinations. However, KBS believes the likelihood of this adverse scenario is relatively low, as Vietnam is actively negotiating with the US to secure a more favorable tariff outcome, potentially in the 15–20% range under an optimistic scenario.

The DXY is typically a key driver of the USD/VND exchange rate. However, under current conditions, its influence is expected to be more subdued than in 2024. As of April 15, the DXY had declined by 8.2% YTD, compared to a 4.8% drop during the same period last year. This trend reflects growing concerns over escalating global trade tensions, particularly following the introduction of new US tariff measures, which have weighed on the USD as international capital flows increasingly shift toward safe-haven assets.

In KBS’s base-case scenario, it anticipates the US Federal Reserve will implement two interest rate cuts in 2025, each by 25 basis points, with the first cut likely occurring in June. However, it does not rule out the possibility of a more accommodative stance should trade-related disruptions to US supply chains dampen economic growth. In such a case, the Fed may opt to accelerate rate cuts, even if inflation remains elevated. A softer USD under this scenario would help ease pressure on the USD/VND exchange rate.

Although US tariff policies are expected to exert some pressure on the exchange rate, the SBV has signaled a continued commitment to maintaining a low-interest rate environment and expanding credit limits to support economic growth. This implies a willingness to tolerate a moderate depreciation of the VND within a controlled range to bolster exports and stimulate domestic production. However, should the exchange rate rise too sharply, exceeding a 4% increase from the beginning of the year, it could pose macroeconomic stability risks and undermine foreign investor confidence in Vietnam.

In such a scenario, the SBV may intervene to curb further depreciation through: (i) selling foreign exchange reserves, (ii) issuing T-bills to absorb excess VND liquidity from the banking system, or (iii) potentially raising policy interest rates in more extreme cases. Overall, KBS expects the SBV to maintain a growth-oriented monetary policy stance, while preserving sufficient flexibility and readiness to respond swiftly to external shocks.