What prospects for FMC?

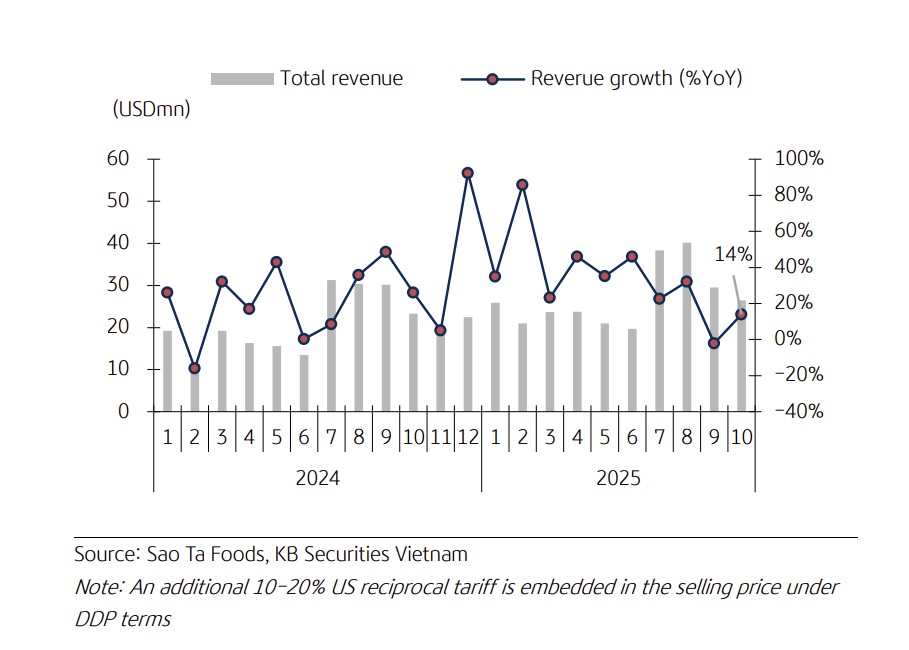

For 9M2025, Sao Ta Foods JSC (HoSE: FMC)’s consolidated revenue rose 23% YoY, while its NPAT-MI grew a modest 6% YoY.

FMC's production

Since 2Q2025, tariff-driven frontloading by US importers has fueled a surge in FMC’s overall shrimp sales volume. Given tariff-related uncertainties, FMC primarily exports to the US under the Delivered Duty Paid (DDP) term, under which it is responsible for customs clearance, transportation, and all related fees. Therefore, FMC’s average selling price has risen sharply, reflecting an additional 10–20% US reciprocal tariff component during the period.

Each year, the DOC conducts periodic administrative reviews (POR – Period of Review) on the two largest exporters by export value from each trading partner to determine the extent of dumping, based on actual production cost calculations. However, since the US has yet to recognize Vietnam as a market economy, the DOC typically uses data from third countries—mainly Thailand or Indonesia—as surrogate benchmarks for cost calculations, which often distort the results. In June 2025, the DOC announced a preliminary ADD rate of 35.29% for Stapimex (the mandatory respondent) under the 19th review period (Jan 2023–Dec 2024) and stated that the same rate would apply to 22 other non-mandatory exporters, including FMC.

Before the final determination expected in December 2025 or early 2026, concerned parties may submit rebuttal comments, participate in hearings, or pursue litigation in US courts if they disagree with the decision. During the 20th review period (2016–2018), the DOC had similarly imposed a preliminary ADD rate of 25.76% on FMC, which was later revised down to 4.58% in the final ruling due to calculation errors. In the worst-case scenario, the duty rate could reach as high as 25.79%, potentially eroding FMC’s market share and driving its selling expenses.

Over the past four years, FMC has set aside provisions equivalent to a 4.58% anti-dumping duty on its export value to the US, adopting a conservative approach based on the most recent rate imposed under POR 12, as noted earlier. In practice, the final determinations for 2020–2023 consistently confirmed that the company did not engage in dumping, allowing it to maintain a 0% duty rate thanks to its comprehensive and well-prepared documentation demonstrating reasonable production costs. As a result, FMC fully reversed its previous provisions. With more than 20 years of experience in handling antidumping cases, KBSV expects FMC to once again prove its non-dumping status and maintain the 0% duty rate.

KBSV estimates this could enable the company to reverse approximately VND172 billion in provisions in 2026, contributing around 40% of its PBT for the year. In addition, management indicated that FMC is likely to become a mandatory respondent in the upcoming POR 20 review (covering Jan 2024–Dec 2025), given its stronger export volume to the US. This forms part of the company’s proactive strategy to directly demonstrate compliance to the DOC. FMC remains confident that its thorough cost documentation will support its non-dumping claim and help sustain the 0% duty rate in the US market.

FMC – Revenue & growth (USDmn, %YoY)

In previous periods, the imposition of US reciprocal tariffs on shrimp imports from various countries has created both competitive risks and opportunities. India, which accounts for roughly 35% of the US shrimp import market, is currently subject to a combined duty burden of up to 50% or more—including a newly added 25% reciprocal tariff. This has prompted US importers to diversify their sourcing toward other countries, benefiting Vietnam’s exporters. In contrast, competitors such as Ecuador, Indonesia, and Thailand face lower tariff rates of 15–19% versus Vietnam’s 20%. Among them, Ecuador stands to gain the most, with a 15% tariff and strong potential to expand sales volume by over 10% in 2026, according to industry estimates. However, as about 80% of Ecuador’s exports are head-on shell-on (HOSO) shrimp primarily destined for China, FMC’s competitive position remains relatively resilient.

FMC’s management noted that the company would only consider exiting the US market if the tariff gaps with competitors were to widen to around 20%. Under current conditions, FMC expects to maintain export growth of 5–10% in 2026. In a worst-case scenario, the company could further diversify into other key markets—particularly Europe and Japan, its traditional strongholds with long-established partners. KBSV expects these markets to become an increasing strategic focus once FMC completes its plan to participate as a mandatory respondent in the upcoming POR review.

FMC’s share price has fallen 20% since the announcement of the US reciprocal tariffs and about 7% following the release of the preliminary ADD results. This pullback has brought the stock to an attractive valuation, with P/E and P/B multiples of 7.7x and 1.09x, respectively—20% and 30% below their five-year averages. In a worst-case scenario where FMC is subject to an ADD rate above 5%, KBSV expects US revenue to be offset by market diversification efforts, supported by steady global shrimp demand. Conversely, FMC has a strong opportunity to demonstrate non-dumping compliance, potentially qualifying for a 0% ADD rate by end-2026. Using a P/B valuation approach based on the ROE–cost of equity framework, KBSV estimates FMC’s 2026 P/B multiple at 1.34x, implying a fair value of VND46,800 per share—representing an upside potential of 28%.