Stock Market Daily Forecast: What market sectors to invest in?

Investors could consider increasing the proportion/disbursement of new purchases in stocks that have consolidated convincing support zones and are attracting strong demand.

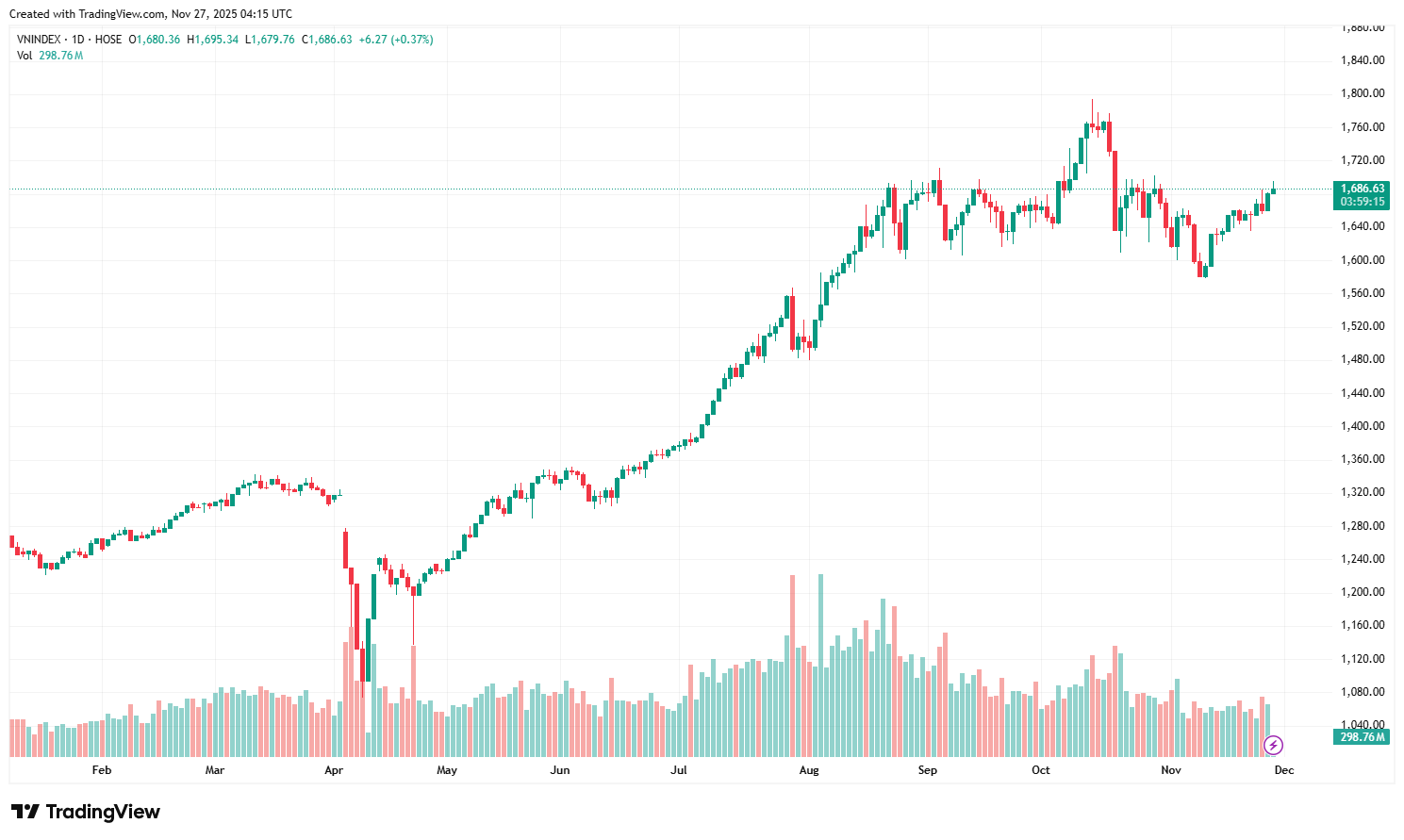

This morning, VN-Index rose to 1,685 points

The Vietnam stock market recovered yesterday thanks to increased demand at the beginning of the session. VN-Index mainly fluctuated around 1,670 points with liquidity improving compared to the same time yesterday. The bright spot in the session belonged to stocks GEE, VIX, and GEX with strong increases, including GEE and VIX hitting the ceiling. Supply has cooled down somewhat as green spread again with 198 green codes and 93 red codes.

However, the correction in some large-cap stocks that have increased well in recent times, such as VIC, VHM, and VJC, slowed down the growth of the VN-Index and it ended the morning session at 1,667.64.

The VN-Index's performance in the afternoon session was similar to the morning session, with tug-of-wars around 1,670 for most of the trading time. Leading the group of gainers was the purple color of VPL. In addition, the green reversal of VIC stocks and the green color of banking stocks (CTG, MBB, VPB) helped the VN-Index consolidate the increase and gradually widen the increase range past the 1,680 mark in the last 30 minutes of the session.

Active buying money flow was more active, typically in some groups such as real estate, public investment, and banking. Foreign investors returned to net buying with a total net value of VND 622.95 billion, focusing on buying SHB, VPB, and VIX. At the end of the session, the VN-Index closed at 1,680.36, up 20 points, equivalent to 1.20%.

The VN-Index closed yesterday's session with a white Marubozu candle and closed above the 1,680 mark thanks to increased demand in the afternoon session.

On the daily chart, the RSI and CMF indicators pointed up, showing a signal of active buying and money returning to the market. The /-DI lines are tending to intersect, so the alternating ups and downs during the session will continue in the short term. The VN-Index is approaching the thin Ichimoku cloud waist around the 1,690-1,700 points, so it is necessary to pay attention to the possibility of fluctuations when the VN-Index moves up to this score area.

On the hourly chart, the VN-Index surpassed the Tenkan line of the Ichimoku cloud, while the DI and ADX lines agree above the 25 mark, further strengthening the uptrend to the 1,700 mark in the coming sessions.

The cash flow is showing signs of returning to the stock market as the upward trend gradually regains its dominance over red in today's session. Many stocks/industry groups are recording the attention of buying power after a period of accumulation at attractive discount prices. Accordingly, VCBS recommends that investors consider increasing the proportion/disbursement of new purchases in stocks that have consolidated convincing support zones and are attracting strong demand in some market sectors such as real estate and banking sectors.