What will drive BWE's prospects?

Water supply revenue of the Binh Duong Water - Enviroment Corporation (HoSE: BWE) is forecast to rise 2% YoY in 2025, supported by recovering consumption in Binh Duong as trade tensions ease

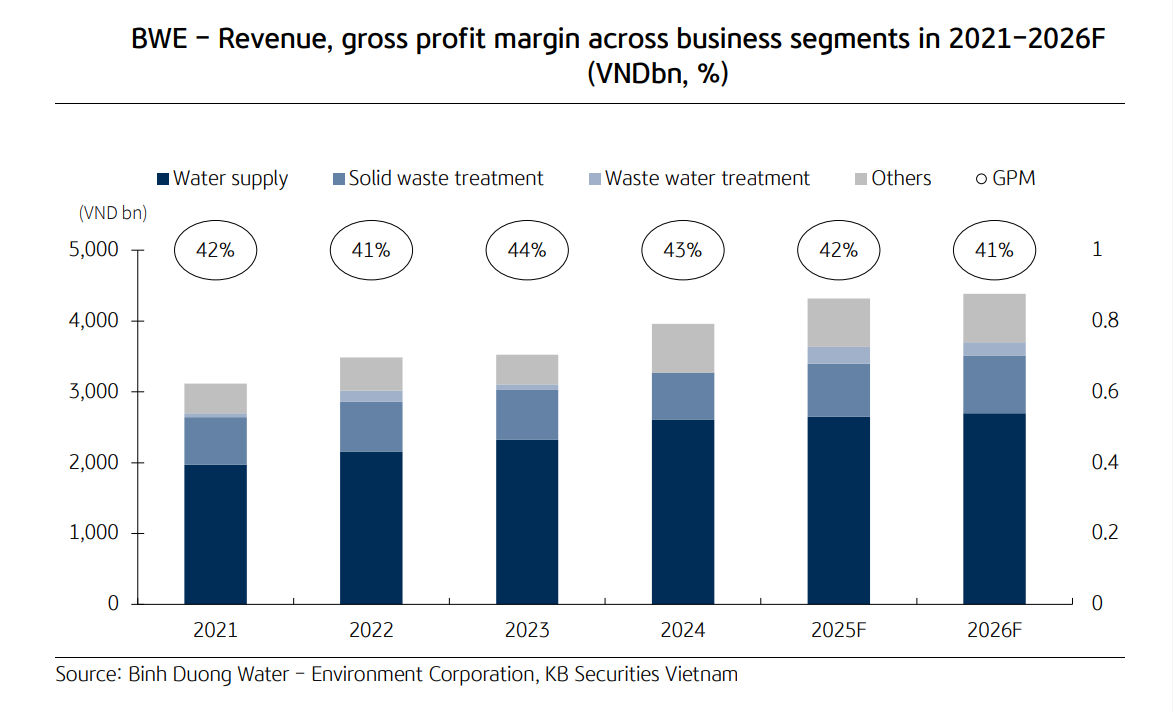

Following the announcement of US President Donald Trump’s decision to suspend import tariffs on goods from trade partners (April 9-July 9), including Vietnam, companies in Binh Duong accelerated shipments of key exports such as wood and wood products, textiles & garments, and electronic components ahead of the tariff deadline. However, local clean water consumption recorded negative growth for two consecutive quarters—falling below even Covid-19 levels—due to: (i) limited remaining growth potential in Binh Duong’s water market, (ii) the Nhi Thanh water plant (Phase 1&2) already running at full capacity, and (iii) an export mix shifting toward electronic components, which consume less water than wood processing and textile & garment industries, both of which have showed. That said, KBSV expects easing trade tensions to stabilize manufacturing activity, supporting a recovery in water consumption in Binh Duong. This underpins a slight upward revision to our water supply revenue forecast to VND2,649 billion / VND2,699 billion (2% / 2% YoY) for 2025/2026, up VND11 billion / VND14 billion from our previous estimates.

At end-August 2025, Phase 3 of the Nhi Thanh water plant officially commenced operations, raising total capacity to 120,000 m³/day. With a total investment of over VND1,100 billion, the project will timely meet rising clean water demand for residents in Ben Luc, Can Giuoc, Can Duoc, Thu Thua, and several major industrial zones. KBSV forecasts Nhi Thanh to deliver water supply revenue of VND205 billion (23% YoY) in 2025 and VND238 billion in 2026 (16% YoY).

Despite setbacks from the Covid-19 pandemic and management team challenges, BWE consolidated resources and successfully launched Phase 1 of the Can Tho 3 water plant (50,000 m³/day) at half of its designed capacity, boosting BWE’s water supply capacity by an additional 7%. As of 2Q2025, the project had recorded work-in-progress of around VND110 billion (30% of planned total investment) and will proceed with Phase 2 after raising charter capital to above VND100 billion. KBSV has not yet factored this project into its valuation model, pending further information on its operations and performance.

Following the successful operation of its first 5MW waste-to-energy plant in January 2024, BWE has broken ground on its second waste-to-energy project amid rising waste treatment demand in Binh Duong. The new facility will be developed in two phases, with Phase 1 involving a total investment of USD45 million (VND1,150 billion), designed to process 500 tons of waste per day and generate 12MW of electricity. Equipment deliveries are scheduled between July 2025 and March 2026, with completion targeted for 2025–2026. Applying the 2025 regulated tariff for solid waste power (VND2,575/kWh), KBSV expects the project to reach full generation capacity from 2027, lifting waste treatment revenue to VND923 billion (14% YoY) and supporting a 6% revenue CAGR through 2030.

On June 27, 2025, the Binh Duong People’s Committee announced a new tariff cap for municipal solid waste treatment services in the province. Based on the technical–economic norms for solid waste treatment published by the Ministry of Agriculture and Environment, the ceiling was set at VND567,116/ton for food waste composting and VND229,929/ton for other waste. With a leading market share in municipal solid waste treatment in Binh Duong, KBSV believes BWE stands to benefit from this upward revision, as the company currently operates composting capacity of up to 920,000 tons per year—sufficient to process 100% of local waste volume.

Meanwhile, as no tariff has yet been issued for waste-to-energy treatment, BWE has proposed applying an allowed profit margin of 5–10% based on actual costs. Under KBSV's conservative scenario, it incorporates only the new composting tariff into its valuation model, which results in forecast waste treatment revenue of VND750 billion in 2025 (14% YoY) and VND811 billion in 2026 (8% YoY), with gross profit of VND109 billion and VND121 billion (70% / 11% YoY), respectively.

Following a sharp de-rating from 2SD above its 5-year average EV/EBITDA— driven by weak short-term prospects in the water supply segment—BWE now trades around 1SD of its 5-year average. KBSV believes the long-term growth outlook of the environmental segment (wastewater collection and treatment and solid waste treatment) combined with the company’s strategy to diversify its water supply footprint will offset the near-term slowdown in water supply, supporting our investment thesis on BWE.

Using a combination of FCFF and EV/EBITDA, KBSV upgraded BWE to BUY with a target price of VND56,000/share, implying 15.5% upside versus the closing price on September 19, 2025. Our target EV/EBITDA multiple of 8.5x— equivalent to the company’s 5-year average—reflects stronger earnings contribution from the environmental segment, offsetting near-term deceleration in water supply. KBSV's target price implies 1.8x/1.6x P/B for 2025/2026, consistent with ROE improving to 12–13%.