What will happen to the USD/VND rate?

VND would slightly depreciate against USD in the short term, and keep its view for 2022F, said VNDirect.

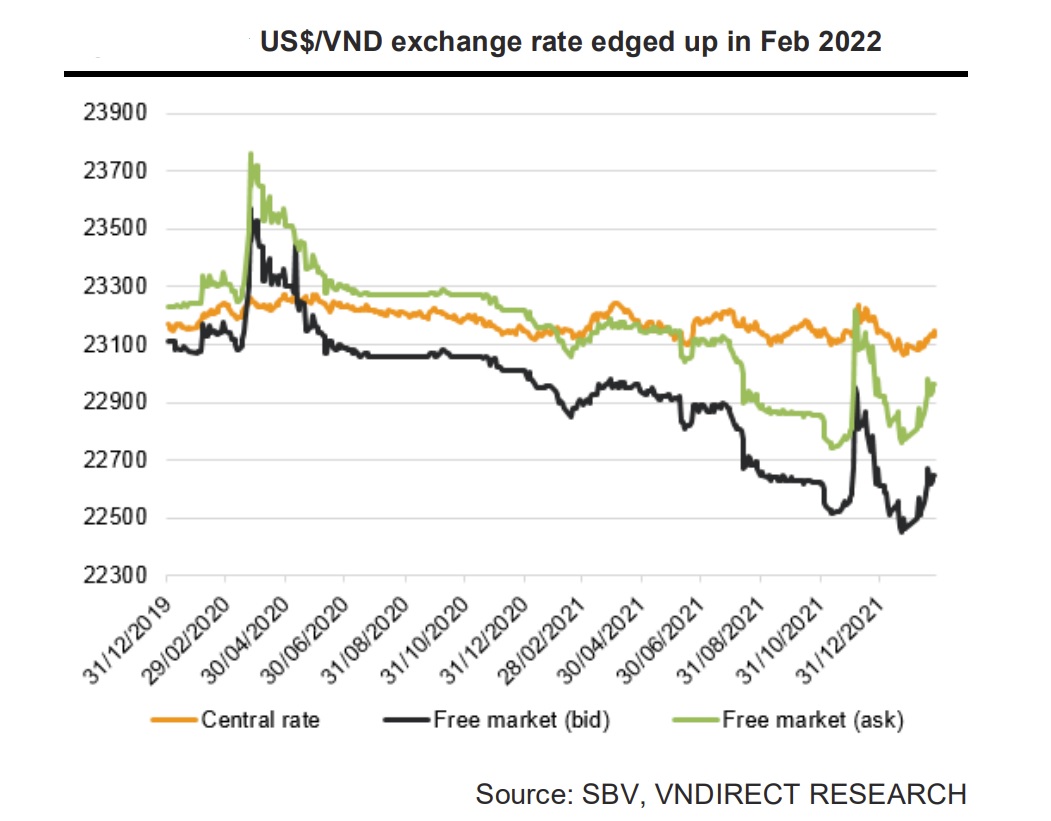

The USD/VND exchange rate also edged up in February 2022.

The U.S. Dollar index, which measures the currency against a basket of currencies, reached 96.7 on February 28, 2022, its highest level since early June 2020. The Russia-Ukraine crisis has had an impact on investor mood. On March 1, the CBOE Volatility Index (VIX), a real-time market index that measures market expectations for volatility over the next 30 days, reached 33.3 points, the highest level since October 2020.

As a result, investors are scrambling for assets that are perceived to be safer, such as gold, US government bonds, and the US dollar. Because of its status as the world's reserve currency, the US dollar is sometimes seen as a safe haven asset. Furthermore, the assumption of increased interest rates in the United States will help the dollar, as higher yields make the currency more appealing to investors.

In the context of the US dollar's appreciation in the global market, the USD/VND exchange rate also edged up in February 2022. Specifically, the central bank-set USD/VND exchange rate stood at 23,140 on February 28, inching up 0.2% MoM, while the interbank exchange rate for the US dollar and VND also increased by 0.7% MoM.

The USD/VND exchange rate increased 0.8 percent month over month in the free market. The USD/VND exchange rate remained relatively constant in the first two months of 2022. The central bank-set exchange rate and interbank exchange rate stayed steady from the end of 2021, while the free market exchange rate rose barely 0.1 percent.

VNDirect's analyst, Mr. Dinh Quang Hinh, confirmed that VNDirect's positive perspective of VND has shifted to neutral for 2022 for the following reasons: First, the US dollar may retake the upper hand in 2022, as the Federal Reserve (FED) has been gradually reducing the amount of its bond-purchasing program (QE tapering) since November 2021 and has raised interest rates since mid-March. The market anticipates the FED to hike policy rates by 100-175 basis points in 2022, starting in March, according to a CME Group study. Second, inflationary pressures in Vietnam will rise in 2022.

However, Mr. Dinh Quang Hinh said that the fundamental factors that kept the Vietnam Dong stable in recent years would still remain, including the current account surplus and higher foreign exchange reserves (FX reserves).

"From a projected deficit of 0.3 percent of GDP in 2021, we expect the current account surplus to grow to 2.0 percent of GDP in 2022F. From a present level of US $105.8 billion, we expect Vietnam's foreign exchange reserves to reach USD 122.5 billion by the end of 2022 (equal to 4 months of imports). As a result, in 2022F, we expect the US dollar/VND (interbank rate) to remain constant at 22,600–23,050, and the Vietnamese dong to fluctuate in a reasonably limit ed range compared to the US dollar", Mr. Dinh Quang Hinh said.